Journal of

eISSN: 2574-8114

Literature Review Volume 8 Issue 3

1Associate professor, Dept. of Fashion Management Studies, NIFT, Bhubaneswar, India

2Masters Student, Dept. of Fashion Management Studies, NIFT, Bhubaneswar, India

Correspondence: Dr. Santosh Kumar Tarai, Associate professor, Dept. of Fashion Management Studies, NIFT, Bhubaneswar, India

Received: May 08, 2022 | Published: June 3, 2022

Citation: Tarai SK, Soundarya M. A Study on the new business strategies for the Indian apparel industry post-covid-19 pandemic. J Textile Eng Fashion Technol. 2022;8(3):65-69. DOI: 10.15406/jteft.2022.08.00303

The covid-19 pandemic has disrupted enormous businesses across the globe to an extent none had ever imagined. There is no doubt about the slowdown of various businesses; however, covid was a boon to a few industries worldwide. The textile and apparel industry is one such industry where the covid-19 pandemic is both a boon and a bane. Many of these industries got shut down during the pandemic, but few managed to survive and grow during and after the post-covid-19 pandemic. The Indian apparel industry was also a victim of the pandemic, but not for a prolonged time. Few industries tried ways to overcome the struggle and successfully devised new strategies that kept them forward through the years. Thus, to understand and implement the new strategies, it is essential to get past the scenario that led to the formation of these strategies.

Objective: This study highlights the scenario of the Indian apparel industry Post- Multifibre Agreement (MFA) regime that led to its success along with the existing challenges and conditions at that time, which helped in formulating the strategies followed before the covid disruption. Insights from the past studies would help in understanding and implementing the new strategies that would fit aptly in this new post covid period. The study is mostly based on data gathered from secondary sources and industry inputs from various export firms at the management level.

Keywords: Covid-19, business strategies, supply chain, small and midsize enterprises, post-quota regime

A business strategy can be simply defined as a clear set of plans, actions, and goals that outlines how a business is supposed to perform in a competitive market with either products or services or both. It focuses on strengthening performance in order to achieve the desired goals and actions set for it. Strategic inputs and decisions have always paved the path to success for any industry, the apparel industry being one of them. The covid-19 pandemic has kindled the need for strategic movements and decisions, especially in the Indian apparel industry, as the market dynamics have changed since then. The shift of attention from China to the southeast Asian countries, namely India, Bangladesh, Vietnam, and Cambodia, has resurged the competition and the need to implement new business strategies in order to keep moving forward.

Business strategy will help us to understand the volatility in the fashion business, which was induced by unprecedented rapid developments in communication and information technology, trade liberalisation, and the globalized nature of the fashion business.1 Further, it is also observed that increasing consumers demand in the last two decades has made competitive strategies becoming more relevant to the firms. Moreover, with the advent of WTO, firms compete with their domestic and foreign rivals in the market. It is apparent for firms to adapt to the environment in order to survive and prosper in the market.2 Further, with the rapid adoption of the internet, physical boundaries and distance are becoming less critical as firms all over the world are now able to cater to larger markets more efficiently.3 All these developments have compelled exporting firms to step up the level of competitiveness against their competitors who are producing similar products in the same industry. Firms with the capability in all facets of competitive priorities may survive in a fast-changing marketplace. The SME sector cannot be an exception; it has been seriously affected by phenomena that pervade the large-scale sector. Previously, it was believed that SME firms were solely focused on the domestic market, but now, in order to survive and growth in the long run, they must be globally competitive.4 As gradually the market is changing very fast with the changes in the business environment and spirit of competition, keeping this fact in mind, the majority of the SME firms in developing countries have emphasized adopting core competitive strategies in order to survive in a globalized market.5

As apparel sector is majorly dominated by SME firms which play a potential role in improving the economy by increasing exports, generating employment, and raising the standard of living. To make this sector more competitive, sustainable, and with better export performance, it needs to adopt specific strategies to have the upper hand in the competitive market. Looking at the change in business and stiff competitive market, business strategy or competitive strategy can be more adaptable for SME firms to gain competitive advantages over their rivals (Porter, 1980). He offers a generic strategy that may be appropriate for small manufacturing firms under certain industry conditions; first, the differentiation strategy creates a unique product, service, customer loyalty, price-inelasticity, competitive barriers, and higher margins. Second, the low-cost strategy creates a sustainable competitive advantage by offering the lowest prices based on low-cost producer status in an industry segment. Third, pricing strategy adaptation refers to how the pricing strategies for a product differ across national boundaries. The business model is built on four types of competitive tactics that export firms in SMEs should use: marketing, segmentation, innovation, and product service. Others said that developing long-term goodwill ties with consumers or buyers would make it easier for SMEs to build client loyalty and, as a result, lower their operating costs. From a larger perspective, it is far cheaper to serve an existing (loyal) customer than to attract and serve a new one.6

Literature review

Indian apparel industry pre-covid-19 disruption – a perspective:

The Indian apparel industry is known for its reasonable export share in the world market during the quota regime. However, there were targeted markets comprising a limited number of products due to the existing quota system back then. From 1996 to 2009, an increase of slow growth in export was observed, implying underutilization of manufacturing units resulting in high costs. As a result, Indian industries faced challenges while competing worldwide despite having the advantage of forwarding and backward integration. In addition, factors like poor technology, lack of quality infrastructure, low productivity and efficiency, and poor-quality products led to operational challenges, resulting in slow growth in exports. The removal of the quota system also resulted in the participation of many developing countries in apparel exports that used to have better export policies and thus gained benefits through custom duties and tariffs. This became a challenge for India as the poor performance of India's export was primarily due to the shifting of production base to low-cost apparel producing countries, as mentioned above, which led to the massive competition among the developing countries.

It was estimated that post elimination of the quota system, the global textile and apparel base will be shifted to the south Asian countries, predominantly China, Vietnam, Cambodia, Bangladesh, and India. Many contemporary studies suggested that India and China would be the major gainers in the textile & apparel trade in the post-quota period due to the availability of cheap labour and raw materials.7,8 Before the covid-19 pandemic outbreak, the Indian apparel export industry was performing at a mediocre level as export suppliers particularly Bangladesh, Vietnam, Turkey, and Cambodia emerged successfully and grabbed Indian export share in the US and EU and other world's major apparel consuming markets as per ITC trade map data. Thus, it became pertinent to understand the competitors' approach and strategy in the apparel export business with their successive growth in export trade. This has become a harsh lesson for Indian apparel suppliers to consider the causes of failure in the apparel export market.

India's competitiveness and performance in the global market in the past two decades

Although India is among the top ten exporters in the world market, due to certain factors, India's performance is not up to the level as expected. The comparison of market shares generally measures competitiveness. It can also be measured by various input costs (input measure) corrected for labour productivity and quality factors. India's apparel exports in the world market, although registering growth, export performance is slow compared to others. Thus, to make the Indian apparel sector more competitive and efficient, the operational input factors are required for improvements. Besides, there is a need to improve non-price factors such as quick response, fabric quality and processing quality, etc., which are perceived as essential attributes at the international level.

However, in competitiveness, India's apparel exporting firms are found to lack these attributes compared to its immediate exporting apparel suppliers in the present export market scenario. There have been contesting opinions on the drawbacks of the Indian apparel industry that made it difficult to become the global leader.

India's declining apparel export can be further attributed to two dominant reasons. One is that India failed to get orders from export consumer markets, and the other is that India faces stiff competition from its neighbouring counterparts, including Turkey. The declining growth rate of Indian apparel exports is due to a lack of orders from apparel export consumers like Western Europe, the USA, Canada, etc., due to the economic slowdown in their own country. On the other hand, India faces stiff competition from apparel exporters from Vietnam and Bangladesh, who are vigorously competing for apparel export market shares. Similarly, Turkey has emerged as a barrier to the EU market for Indian exporters due to its geographical proximity and faster delivery of orders.

Another but more important reason is the highly fragmented character of the apparel market in India adds further worries about consolidation and the transportation costs. Moreover, increasing wage rates, hikes in oil prices, and inputs costs are other causes of worry, affecting exporter's profit.9 Furthermore, higher unit value realizations reveal a heavy hold in a different market segment rather than competitiveness in similar markets. As a result, higher unit value is critical in sustaining and improving competitiveness over time for Indian apparel exporters. Thereby, India's export share is also affected by these factors in the present context. Contemporary studies reveal that Indian apparel export is expected to perform better in export markets. This is evident from the world export data that China is losing market share in the present export market after the covid-19 outbreak, particularly from countries like Bangladesh, Vietnam, and Turkey. Therefore, the dominant arguments are that this could be an opportunity for Indian apparel exporters to focus on those markets and capture the export share where China is outperformed. The reflection of India's export will be further supported when all these input production factors are taken care of by the government and industry stakeholders. Besides, it is observed that India's export category dominates the world export market in certain areas. The apparel categories such as non-knit women's outerwear, non-knit undergarments, and knitted undergarments constitute the most significant shares and account for more than 70 percent of exports from India.10 Compared to the market shares of these and other product categories of India's exports against a few of its competitors, India's competitive edge is quite mixed. Thus, the comparison is restricted to apparel exports to the USA, the single largest market for Indian exports. In this category, China and Hong Kong pose the greatest threat to India in terms of market shares.

Table 1 explains the strengths, weaknesses, opportunities, and threats of the Indian apparel industry. Despite the minute flaws possessed by the apparel industry, the strengths and opportunities available cannot be undermined. Since the covid-19 pandemic, a clear shift in apparel business from China has been observed, and importers like the US and EU and many brands have taken command on humanitarian grounds and decided to source from other established competing manufacturing countries. This resulted in a boon for countries like India, Bangladesh, Cambodia, and Vietnam. However, the rise of neighbouring countries is a threat to the Indian apparel industry, but the forward and backward integration system of the Indian apparel industry keeps it marching forward. Moreover, the revised government's favourable policies and initiatives have not only helped the industry to take a step ahead in the global market but also cater to the observed weaknesses by pondering on new business strategies which may be helpful to the Indian exporters to produce competitive products to meet the buyer's expectations in volatile markets. Further, we have attempted to frame a perceptual mapping of Asia’s major apparel export countries based on their position in the market.

Strengths |

Weakness |

- The second largest industry in India |

- Export content has reduced |

- Vertically integrated Industry |

- High dependence on Accessories (trims-hard goods) in China |

- Comparatively better entrepreneurial skills |

- Technological dependence |

- Largest exporter to the EU and 2nd largest to the USA |

- Insufficient skilled workforce |

- Strong raw material base |

- Lack of one-stop building |

- Available of huge manpower and cheap workforce |

- High dependence on various stakeholders |

- Cost competitiveness |

- Lack of sufficient specialists in pattern making |

- Flexible textile manufacturing systems |

- Lack of sufficient chemicals for colour printing |

- The apparel industry is one of the largest contributors to foreign exchange |

|

Opportunity |

Threats |

- Can be leader in world apparel exports |

- Strong international competition particular China, Bangladesh and Vietnam |

- Capable of reducing the level of unemployment |

- Recession in foreign markets |

- Enormous export potential |

- Unpredictable of foreign currency exchange risks |

- Need to focus on new developed market |

- Improvement in quality |

- Need to focus on development on new product |

|

- Need to focus on quick response |

|

- Rising of domestic demand consumption |

|

Table 1 SWOT analysis of the Indian apparel industry

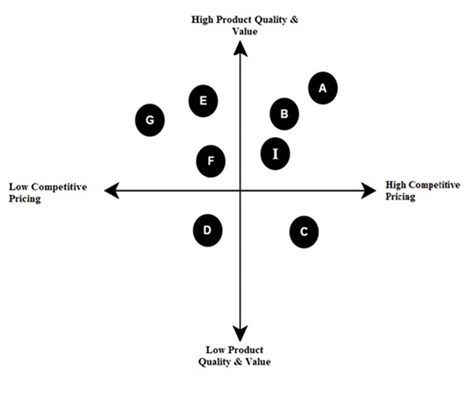

Figure 1 highlights the competitor mapping regarding compliance, pricing, product value, and quality. SME firms dominate the Indian apparel industry, so it has scattered supply chains created specifically by small informal firms. This segment has limitation with low product diversity, but have full capabilities for cotton production, lacking in processing synthetic fabrics, modern machinery, limited trim manufacturing units, and decreased duty drawback. But Bangladesh is a low-cost country due to low wages and other factors. Due to preferential access to European markets under the 'Everything but Arms (EBA) initiative and in Canada, Japan, and the USA under their respective GSP schemes,11 this country has established an integrated factory for which it has been capable of getting large bulk orders. This country is highly dependent on fabric sourcing from India and China, and its target markets are low to mid-market segments. To some extent, this country is seen as weak in terms of compliance, quality, and dependability.

Figure 1 India's competitors perceptual mapping.

A - China, B - Vietnam, C - Pakistan, D - Indonesia, E - Cambodia, F - Bangladesh,

G - Sri Lanka, I – India

.

Due to the participation of premium garment firms, Sri Lanka is positioned as a higher-priced, higher-value niche product and is heavily reliant on textile resources, especially imports from China and India. Cambodia's rising wages are affecting FOB prices, and the country produces poor unit values due to a lack of product diversity and mid-range quality.12 Indonesia, on the other hand, has a low to moderate product value. This country has a positive image among purchasers, as well as significant textile mills and a strong skills base. Vietnam has the ability to deliver on non-cost factors and has recorded strong growth despite higher unit values and invested heavily in backward linkages. China stands out among all and produces a vast range of goods and services, has increased productivity levels in short lead times and has the ability to deliver on non-cost factors. However, after the ban on using the cotton from their cotton-growing Xinjiang region, there is an impact on orders being shifted to India/Pakistan and other Asian countries. Pakistan has outperformed in apparel exports to both the European Union and USA compared to India and Bangladesh for 2021. At the same time, the lack of product diversity has led to low reliability in their products, despite their competitive prices and advantage in cotton-based products.12

Covid disruptions in the Indian apparel industry

The Covid-19 Pandemic has led to multiple disruptions and disorientation in the supply chain network, adversely affecting it. Being one of the essential parts of the business, the Supply Chain is under tremendous pressure and scrutiny. Disruptions at various levels have led to the closure of many businesses. The textile and apparel supply chain has also witnessed a slowdown in the business due to the pandemic, which resulted in the migration of labour forces, difficulty in sourcing and availability of raw materials, delay in delivery of finished product orders, and maintaining the warehouses, managing the inventory. The manufacturing units operating during the pandemic with reduced labour forces following the social distancing guidelines showed lower productivity and efficiency. A digital survey conducted by the ILO Siraye program to assess the impact of COVID-19 on factory operational activities highlighted that; the capacity utilization rate decreased by 30% in quarter 1 2020 compared to 2019 statistics. There will be a decrease in revenue by 20% in 54% of the factories surveyed in 2020. 58% of manufacturers want to re-purpose production towards Covid-19 response goods (face masks, towels, bed linen, and patient gowns). They will need support in sourcing machinery, raw materials, foreign exchange, and training workers (Dawit, 2020). Global consulting firm McKinsey in its report of immediate sourcing responses to Covid-19,2020 has stated that the sourcing executives have to focus on four priorities securing inventory and managing the ramp-down and ramp-up of supply chains; optimizing cash flow along the supply chain, and ensuring optimal trade-off between cash position, profit impact, and supplier stability; proactively managing financial risk across the entire supply chain, and finally adjusting internal costs, including open commitments and operating expenses of the sourcing function.13

With China being the first country to be hit by the Covid pandemic, it suspended the export of raw materials to the neighbouring and western countries, giving rise to disruptions and breakdowns in the supply chain. Due to the unavailability of raw materials and nationwide lockdowns, the manufacturing units had no choice but to shut down their businesses. The delay in the availability of raw materials, lack of transportation facilities, migration of labour, and cash flow constraints disturbed the supply chain management of various apparel export houses and textile businesses (Kumar, Luthra, Mangla, & Kazançoğlu, 2020). Global brands like H&M, Inditex, Mark & Spencer, PVH, VF Corporation, Kiabi, and Target have assured to fulfill the existing contractual obligations between the brands and the export houses situated in countries like India, Bangladesh, Vietnam, etc. for the orders placed pre-covid, but that is not enough to compensate the losses caused by the disruption of the supply chain.14

Due to the present global economic setback, socio-political turmoil, and pandemic challenges, the Indian economy faces macroeconomic risks. For the last two years, problems like slow growth in industrial contribution, lack of efficiency in industries, poor capital inflow, and competitive factors across the globe have attracted priority attention in the government agenda as well as for apparel manufacturing exporters. Therefore, the above-discussed situations and scenarios make it necessary for devising new business strategies that will help in overcoming and coping with the present market conditions and help in holding a substantial position in the market in the coming years.

Suggestions

New business strategies for the Indian apparel industries

The relevance of defining and framing strategies for Indian apparel firms is unavoidable in the present context. Post covid-19 pandemic, making strategic business decisions would help revamp the apparel market dynamics. Based on the understanding of the situation before covid disruption and the present market conditions, a few strategies are suggested that will bring about a substantial amount of change that would be significant in improving an industry's hold over the market.

Integrated growth strategy: The key focus of implementing an integrated growth strategy is to emphasize domestic and export markets. Since Indian apparel and textile industries are sufficient enough to come together and get involved in exploiting their growth potential by combining resources and competencies from their units and directing those units towards new business opportunities. This would also optimize the entire value and supply chain, thereby improving the lead time and efficiency.

Investment in advanced technology and machinery: In this era where science and technology have advanced massively, there is also a paradigm shift in the apparel industry. Artificial Intelligence and Machine Learning have changed the dynamics of this industry's operations, production, and retail segments. The government needs to increase the budget for investment across the entire value chain spectrum, which can meet the exporters' requirement of accessing the finance at a reasonable interest rate with a longer duration for up-gradation technology and types of machinery for better performance in products and non-product areas.

Apparel-driven growth and priority on the handloom sector: Indian economy is changing fast and growing gradually; apparel-making firms must focus on domestic rather than looking at the international market. Further, a large handloom base in India becomes an opportunity for Indian firms to meet the increasing demand for sustainable products in the world market. Thus, attention is sought both from the government and the weaving community.

HRD and flexible labour laws: To make the apparel industry attractive & preferred choice among the new generation, there should be flexibility in labour policy & standardized with other industries. Availability of a trained workforce will result in product quality/production efficiency and finishing areas through textile and apparel education. Division of work among unskilled vs skilled leads to the effectiveness of the organisation.

Identity and brand image creation: Branding over the years has become the most critical aspect for a business to be known and followed in the market. Consistency in product quality and development of new product trends. Providing quality products consistent with recent trends leads to brand building & image creation. Further, holistic marketing leads to solid branding. Especially post covid, customers want transparency in everything they see, including the products and services offered by any business company. Hence, it is essential for a company to focus on the brand-building strategy.

Cost competitiveness: For a business firm, it is important to understand how the competitors are pricing their products. Hence, adopting superior technology with new operational techniques, engaging a trained workforce & govt support, and incentives make the apparel products cost-competitive globally.

Cluster identity & organised structure: The responsibility, sharing, and collective working culture of each export firm may produce superior and different product categories that will create cluster identity. Further, marketing & promotional techniques using famous personalities will lead to the branding of the cluster. Firms are required to be organised in which they can access a lot of both financial and non-financial benefits; also, reasonable people may join the firms.

Emphasis on Direct buyer link & setting up own website: By implementing new technology, hiring the right people, and setting up their websites, firms may be connected with buyers directly, increase their visibility, and will be able to make good money. Having a website is the first step toward entering an e-commerce setup.

Vertical setup: Forgetting bigger volumes and decreasing lead time, vertical setup firms are necessary to compete and capture high volume orders from buyers. Post covid-19 pandemic, buyers are looking for faster accessibility; thus, having a vertical setup would decrease the lead time.

Setting up locally procured Fabric Hub and Training centre at apparel cluster centre: This may cater to the faster availability of yarn and raw materials at a reasonable price with good quality both developing, stitching and making finished products in a hassle-free. Also, reduce the lead time in supply chain activity and fulfil the market requirement by attending training regularly.

A sustainable approach to production: The industry has to focus on sustainable ways of production, specifically organic fabrics, to protect the environment. Since the pandemic broke out, customer demand for sustainable and organic products has increased. For this purpose, investment in superior technology and other infrastructure development is essential, considering the effect of apparel production and consumption on environmental issues. Sustainability may influence customers' minds in the future.

Collaboration with start-up firms: Collaboration will make the firms more visible for instance, inputs like design, materials, digital print, technological support, information, and service will bring a holistic impact on the newly set up businesses. Once the company is well established, it can always look for implementing an integrated growth strategy.15–19

The covid-19 pandemic undoubtedly slowed down the entire market dynamics, yet has also opened new channels and opportunities for businesses. The right strategic move by business firms would ultimately lead to profits. Also, the end of the quota regime has created an ample amount of employment strength, economic improvement, the scope for the development of industries, and the overall growth of developing countries. These were not visible to that extent in developing countries during the quota regime. Further, it has provided an opportunity for the developing countries to integrate the factors in business operation, restructure business practices, and improvement of the industry. The apparel industry-particular SME firms show promise of gainful employment and are considered a big money-spinner in any economy. This sector is the backbone of the Indian economy, considering the sector's contribution to growth in production, boosting exports, and generating employment. However, some issues jeopardized the export capabilities of this sector in the present context of a business slowdown, competitive global environment, and impact of the covid-19 pandemic.

There have been still a series of challenges and differences in the global market for the Indian apparel and textiles sector; nonetheless, it managed to take a step ahead and contribute to the share of the global export. It is observed that due to the superior business strategy and export policy of a few Asian countries, their export share has increased enormously. However, despite the immense potentiality of apparel firms in India failed to realize the required growth in export due to a plethora of reasons. Looking at the ups and downs of the Indian apparel exports in the world market, it is required to focus on a skilled workforce, superior technology and machinery, digitization of business process, strong supply chain, innovation in textile raw materials, market identification, qualitative competing factors, motivation, and decent pay, change in labour policy to attract skilled people and facilities to women workers as they are the major chunk workforce in the apparel industry.

To make the Indian apparel sector more competitive and efficient, both pricing and non-pricing factors are important, particularly improvements in specific areas namely lending rate, advanced technology, quick response, fabric, and processing quality. It is expected that the framework of this article may help shape the apparel exporting firms in harnessing the global opportunities that are being on offering and provide a strategic roadmap for Indian apparel firms for sustainable growth in their exports. Though the reasons for their failures to cope with the changing competitive world order are many but the article tries to put a sincere effort to provide broad suggestions from business perspectives. We may hope that suitable government schemes and policies along with industry insights in the best strategic direction could help this sector to be capable of managing to retain the buyers' requirements with competitive offers.

None.

None.

Authors declare that there is no conflict of interest.

©2022 Tarai, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.