eISSN: 2574-9927

Research Article Volume 4 Issue 3

Energy, Transport and Climate Directorate, Joint Research Centre, European Commission, Netherlands

Correspondence: Darina Blagoeva, Energy, Transport and Climate Directorate, Joint Research Centre, European Commission, Westerduinweg 3, 1755 LE, Petten, Netherlands

Received: May 31, 2020 | Published: June 30, 2020

Citation: Blagoeva D, Marmier A, Dias PA, et al. A new methodology to assess the EU resilience to materials supply along the value chain: case of lithium for lithium-ion batteries in electric vehicles. Material Sci & Eng. 2020;4(3):73-81. DOI: 10.15406/mseij.2020.04.00130

Implementation of recent EU policy measures to reduce greenhouse gas emissions in combination with a large adoption of low-carbon technologies is acknowledged to drive an increasing demand for certain materials. Some of these materials are largely produced outside the EU and are flagged as critical in different studies. This paper presents a new and comprehensive methodology to determine the EU resilience to supply of materials used in major low-carbon technologies. It assesses the security of supply across the materials value chain by adopting specific indicators related to upstream and downstream production stages. A case study, i.e. lithium in the context of rechargeable batteries for electric vehicles, demonstrates the applicability of the methodology. While the overall issue of lithium availability for electric vehicle batteries is known, an integrated analysis at EU level based on the latest technological/market developments is however not available. This paper reveals that the EU resilience to the roll-out of EV will decrease by 2030 unless specific mitigation measures are undertaken at EU level. Such measures include recycling of waste Li-ion batteries, increasing the production of raw lithium, processed materials and cells/batteries in the EU as well as diversification of the supply of lithium and/or cells/batteries from third countries.

Keywords: raw material, resilience, criticality, lithium, battery, electric vehicle, supply chain

A new quantitative and dynamic methodology is developed to assess the EU resilience to potential bottlenecks in the materials supply chain. The effect of different mitigation measures such as recycling, substitution and increasing the EU raw materials production on the overall resilience is quantitatively estimated. The methodology is applied to the case of lithium required for Li-ion batteries in the electric vehicles sector in EU until 2030. The EU resilience to the roll-out of EV will decrease by 2030 due to issues with Li supply, unless specific mitigation measures are undertaken at EU level.

In general, criticality studies of raw materials are used to assess the supply risk of materials and associated implications for a given technology, industry or economy. Three main components are normally taken into consideration, i.e. supply risk, environmental implications and vulnerability to supply restrictions, in defining material criticality.1 Various methods and methodologies are used in criticality assessments2–31 In most cases, these are based on materials flows and are used ultimately to support decision makers in taking steps to avoid restrictions and shortages in materials supply. However criticality methods are not consistent among each other since in most of the cases they are based on different sets of parameters. This is because they aim at accommodating the particular concerns of a company, country or region, regarding a specific technology /application or an entire economic sector. According to Jin et al.32 about 50 English-language studies on materials criticality were published in the last 40 years, almost half of them being conducted by European organisations. Several reviews of these studies confirmed that there is no 'one-size fits all' methodology for assessing the criticality of raw materials in all industrial sectors.10,33–35 At the EU level, challenges associated with the undistorted access of raw materials are addressed by the European Commission (EC) through the implementation of the Raw Materials Initiative (RMI). A Commission expert group36 defines the 'critical raw materials' as those non-fuel, non-agricultural materials of high importance to the EU economy as a whole, and for which a high supply risk is expected. The criticality study, published by the EC in 2014, identified 20 raw materials as critical.37 A new evaluation is currently ongoing based on a revised methodology. While the EU criticality assessment addresses all sectors of the European economy, the Joint Research Centre has carried out specific studies that focused on materials used in low-carbon energy technologies (LCT).15–17 In the 2013 JRC analysis, 32 materials were identified as significant for the decarbonisation of the EU energy and transport sectors. When taking into account market and geopolitical factors, 8 of them, i.e. Dy, Eu, Tb, Y, Pr, Nd, Ga and Te, were qualified as 'highly critical'. Similar results on the role of materials to the US clean energy economy were obtained by the Department of Energy.38 The EU demand for critical materials with specific uses in low carbon technologies is expected to increase significantly in the future in view of the EU decarbonisation targets.39 Due to continuous evolution of supply and demand (e.g. technologies deployment scenarios, new players and technological advances), a regular revision of the criticality methodology is necessary to properly reflect the latest developments and factors which might affect the resilience. In this paper, we present a new methodology, which offers a comprehensive approach to evaluate potential bottlenecks in the supply chain of materials under scenarios of rapid deployment of low-carbon technologies in the EU. Finally, the methodology is applied in the case of lithium required for Li-ion batteries (LIB) used in electric vehicles.

The methodology incorporates elements from our previous work,40 further revised to reflect more adequately the supply – demand balance. The considered time-horizon for the analysis extends from 2015 to 2030. Besides raw materials supply issues, already extensively discussed in the literature, the proposed methodology addresses in addition potential limitations and dependencies on manufacturing capacities of both processed materials and components specific to each technology under consideration. The original aspect of this methodology is that it evaluates both upstream (e.g. raw materials mining and refining) and downstream (e.g. materials transformations to components or products) problematics of material supply. These are expressed along two dimensions, which are drawn from a set of indicators pertinent to the entire supply value chain. The proposed methodology is based on a robust dataset and analysis and the indicators are quantified in a transparent and reproducible way. Several assumptions were taken regarding the indicators related to the future recycling and substitution possibilities. The methodology relies on sets of indicators covering market, geopolitical, geological and macroeconomic parameters as well as other materials/technological aspects such as recycling and substitution. These aspects are addressed along two dimensions. Dimension 1 (D1), called upstream dimension, measures the EU resilience in terms of raw materials supply security, adequacy and sustainability. Mining and refining stages are considered under D1. It is based on a set of nine indicators. Dimension 2 (D2), called downstream dimension, is composed of four indicators and serves to assess the EU resilience downstream supply chain steps, namely supply of processed materials and components/final products. D2 dimension is therefore more relevant to a specific technology while the D1 dimension is rather material related. An overview of the methodology and proposed indicators is given in Figure 1. Such approach is suitable to evaluate the EU resilience to the roll-out of a given technology, in terms of materials supply issues, within the context of meeting the EU's renewable and low-emission mobility goals.41,42 This new methodology is applied to lithium, required in electric vehicle batteries. More details on the methodology, including indicators' description and rationale are presented in the Supplementary material.

An increasing of material demand is not considered as a limiting factor if the supply capacity can grow fast enough to cope with the demand. In a very general context, a bottleneck in the supply of raw materials may occur if demand exceeds available supply at a given point of time and in a given region. This is valid at global level:

This is also applicable at European level, which is scope of this assessment. Therefore, a bottleneck in the supply of raw materials in the EU might occur if demand of EU exceeds supply available to the EU:

However, demand and supply are influenced by a variety of factors. From the demand side, several constituents were taken into account in this assessment such as:

Global demand corresponds to the sum of the applications in all technologies in all sectors in all countries:

where: c = countries, s = sectors, t = technologies.

where:

ROWc = rest of the world or the number of countries outside Europe;

EUc = the number of the EU countries;

os = other sectors excluding the one specific technology investigated;

st = specific technology under investigation.

The EU material demand in a specific energy technology competes with the demand from other technologies / sectors in the EU as well as the demand by all sectors in the rest of the world. Indicator D1.1, composed of three sub-indicators D1.1.1 & D1.1.2 & D1.1.3, is addressing the 'demand' aspect. Cc1

Global supply comes from primary (e.g. mining/refining) and secondary (e.g. recycling) sourcing produced in different countries, and eventually tapping in stockpiles.

Stockpiling can help coping with variations, however on the short term only. Stockpiling is not a sustainable solution when looking at the 2030 horizon or at 5-year windows. Stockpiling is thus not further considered in this assessment. The global supply thus can be obtained using the formula:

For the purpose of this assessment, the primary sourcing by the EU countries is singled out: the EU supply includes mining within the EU, trade with other regions and recycling within the EU:

In a global market, the need of the European economy can be met by mining in Europe, trade with the rest of the world as well as by recycling in Europe.

The stability of the EU supply depends on various factors:

Despite the logical theoretical basis, the formulas described above present several challenges. The major challenge relates to data sources. Finding reliable, consistent and complete dataset at global level is a challenging task. The second challenge is linked to the time dependence of these formulas. The equations are static and can describe the supply/demand situation only at a given moment. To surpass these obstacles, a simplified approach was adopted to determine the demand/supply figures for the considered timeframe.The global supply and demand at present is assumed equal to the mining supply for prime materials; alternatively - refining supply for by-product materials.

In general, the current EU demand for many materials in all sectors is available in different sources, e.g. in a recent study on raw materials flows in the EU. However, information about the current EU demand in a specific technology is not easily accessible in literature due to different factors that influence such demand: e.g. deployed technology capacity, material amount required per unit output (e.g. MW, kWh etc.), and specific technology related aspects (e.g. type of EVs / batteries). A large variety of sources (market outlook reports, scientific publications and expert interviews, etc.) were screened to derive meaningful data. Often these data are not consistent; therefore it was necessary to perform a structured analysis to estimate the current EU demand in LIB for electric vehicle technology.

Forecasting the future global demand and supply of materials is also not a straightforward task. The global demand and supply figures show different dynamics:

These dynamics call for an assessment to ensure that no bottleneck in the supply of raw materials will appear on the long run. When introducing a temporal dimension, different factors should then be considered:

The future EU demand for all sectors can be affected by several factors which can vary in time:

In general, the growth rates for well-established applications can be derived from past data. Eurostat is providing such data for the main well-established sectors (e.g. electronics, chemical sector etc.) To derive a meaningful growth rate for an emerging application, existing deployment targets and EU policies in support of such applications as well as the growth tendency from the past years when available should be considered. A learning curve approach is used in addition to extrapolate the future growth rates for a longer period.

The factors considered in this work which are affecting the EU demand in a specific technology (under investigation) are as follows:

Aggregation of indicators

To summarise, the upstream dimension (D1) relies on a set of eight indicators. The 'D1.1 Material demand' indicator is purely demand related – both global and EU demand are reflected. The 'Upstream supply adequacy' indicator is dependent on the global demand figures, while 'Import reliance' is EU demand relevant. The rest of the indicators are supporting the supply side (see Figure 1 and Supplementary material for more details). There is a clear prevalence of the supply- supporting indicators, which is however logical since there are a variety of factors which might affect the supply side. The global demand is mainly dependent on the end-use applications and their future developments. As for the EU demand, it is also reliant on considered deployment scenarios for the considered technology and material efficiency factors. Therefore, the upstream dimension can be considered well balanced in terms of supply and demand. Supply bottleneck could potentially occur at various stages of the supply chain, from extraction and refining to the assembly of the final product. Therefore the likelihood of bottlenecks along the entire supply chain is reflected in the methodology as an important part of the downstream dimension (D2). The concentration of supply and political stability of countries supplying processed materials, components and/or assemblies is used as a proxy to assess if the supply is adequate and sustainable (see indicator D2.1 Supply chain dependency). The share of the EU production at each step of the supply chain is also specifically taken into account within D2.1 indicator. The macroeconomic evolution of key competitors can also influence the material supply chain and therefore is considered within the indicator D2.2 Purchasing potential. These two indicators are clearly supporting the supply side. The cost of technology plays also an important role. Should the cost of specific materials represent a large share of the cost of the final product and if the EU has little control over these costs, the EU may become less competitive against global players. It is therefore also important to monitor the share of material costs over the cost of the end product to assess the vulnerability of the EU to manufactured end-products. This last aspect is regarded via indicator D2.3 Material cost impact. That can be considered a supply/demand neutral indicator since cost is logically affected by supply – demand dynamics. Clearly, up to now, the supply side is sufficiently covered while the demand is only indirectly reflected. More adequate supply-demand balance of the downstream dimension is achieved via a dedicated demand-relevant indicator, adapted to the downstream problematic. An adequate supply-demand balance along the technology supply chain can be only achieved if the supply can meet the demand at each considered step of the chain. This aspect is reflected via the D2.4 Downstream supply adequacy indicator.

The previous considerations serve as rational for the selection of the 13 indicators shared among dimensions D1 and D2. The indicators are assessed at annual basis (or 5 years basis) between 2015 and 2030. Available forecasts as well as official EU targets, latest trends and learning curves are used to establish the indicators evolution and make the necessary projections until 2030. In cases of data unavailability, dedicated analysis was performed case by case to extrapolate the missing figures. Each indicator is rated in a scale ranging from 'zero' to 'one'; 'zero' representing minimum EU resilience and 'one' representing maximum resilience in view of successful deployment of a particular low-carbon emerging technology. The indicators are aggregated to determine the dimensions D1 and D2, which in turn are used to define a single score, representing the EU resilience to bottlenecks in the supply of a given material along its entire supply chain. Currently, the indicators within the upstream dimension are weighted evenly since no specific reasoning could be found to justify putting more weight and consequently more importance on particular indicators. Whilst, the 'D2.1 Supply chain dependency' and 'D2.4 Downstream supply adequacy' indicators reflecting the dependency and misbalance along the materials supply chain are clearly more essential indicators within the downstream dimension, deserving thus more weight than the other two indicators. More comprehensive description of the methodology, the established dimensions and the selected indicators, including calculation procedure to quantitatively assess them is presented in the Supplementary material. It provides also details about the indicators' aggregation and rationale of the chosen thresholds.

Assessment of EU resilience to lithium supply for Li-ion batteries used in electric vehicle

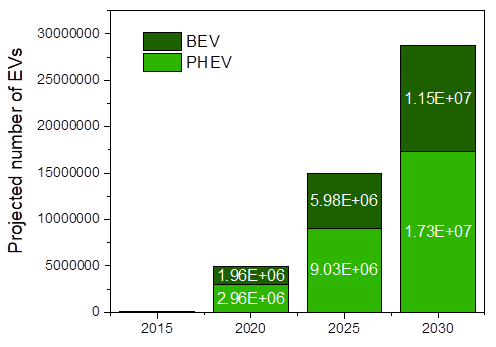

Although currently lithium is not perceived as a critical material in terms of availability and supply risk, recent increasing demand for batteries and price rise of lithium carbonate call for a new criticality analysis. Li-ion batteries are expected to dominate the battery market in medium to long-term, whereas nickel-metal hydride (NiMH) will probably lose market shares.44 The issue of lithium availability for electric vehicles batteries has been already highlighted by several authors.45–48 An integrated analysis at EU level based on the latest technological/market development and considering several deployment scenarios has been also recently carried out40 In this paper lithium is used as a case study to demonstrate the newly proposed methodology. Around 150 000 PHEVs and BEVs are registered in the EU in 2015.49 It is expected that a strong EV sector will emerge by 2020 and beyond as a result of the EU and national policies (e.g. through incentive schemes, lower taxation, etc.) aiming to boost larger penetration and meeting ambitions sustainability and climate goals.50 There are several uptake scenarios and deployment targets of EVs within the EU. However specific targets and timelines are subject of negotiation with the Member States. In this case study we apply the methodology to evaluate whether lithium used in lithium-ion batteries (LIBs) may become a bottleneck to the deployment of EVs in the EU until 2030. Two EVs types are considered in this paper: battery electrical vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The European Roadmap for Electrification of the Road Transport (ERERT) is taken into account to calculate the future demand for lithium in EVs until 2025. The ERERT envisages 5 million EVs on the European roads until 2020 which number is foreseen to increase up to 15 million EVs in 2025.51 To calculate the number of the new vehicles to be introduced each year between 2025 and 2030, the same annual growth rate is applied as for the period 2020-2025. In addition, the average lifetime of a battery is taken into account. The considered period for the analysis is 15 years while the average lifetime of a battery is approximately 10 years. This means that electric vehicles produced between 2015 and 2020 - in total around 5 million vehicles - will reach end-of-life in the period 2025 - 2030. The number of new batteries (counted as new cars) that will have to replace the recycled batteries is added up to the number of batteries (cars) between 2025 and 2030. The expected cumulative number of electric vehicles until 2030 is shown in Figure 2. The EU resilience can vary across the value chain of automotive LIB, e.g. from producing LIB specific materials, including cathodes, anodes, separators, binder and electrolytes, through manufacturing of cells and to assembling of battery pack as a final product (Figure 3). Details on calculations of the indicators and dimensions for lithium are presented in the Supplementary Material. The assessed indicators pertinent to both dimensions – Upstream and Downstream – are visualised on polar charts in Figure 4 & Figure 5, respectively.

Figure 2 Projected cumulative numbers of electric vehicles until 2030 according to ERERT scenario (ERERT, 2012).

The overall EU resilience to the roll-out of EVs for what concerns lithium supply along the Li-ion battery supply chain (Figure 6) is evaluated as medium in 2015 and the supply situation became more problematic towards 2020 when significant number of vehicles has to be put on the EU roads. In 2020 the EU resilience is assessed as low, anticipating thus potential supply issues for the EU. The situation is improving towards 2025 and 2030, yet remaining in the low resilience zone. The EU resilience along the upstream dimension is increasing by 16 % in the period 2015 - 2030. Although the EU might need significantly more lithium in future to meet the EVs deployment targets, apparently the likelihood of supply shortages upstream may diminish by 2030 mainly due to a decrease in the import dependency and increased recycling potential globally which can generate additional flows of supply. Improvements in the import reliance are expected due to potential increase of the domestic European production (e.g advanced exploration projects in Czech Republic, Serbia, Finland, Austria and Spain) as well as some recycling potential in the EU, becoming more feasible between 2025 and 2030. It is to be noted that although recycling of lithium is industrially feasible and permits rather high recovery rates, no impact of recycling of lithium is expected to occur in the EU until 2025. The holding up point for lithium recycling is economical rather than technological. No significant recyclable volumes are expected to be generated from consumer electronics batteries until 2025. The calculations shows that there is a potential to recover only between 1 and 3 thousand tonnes of lithium annually assuming that collection rates of consumer electronics should exceed 70 % in 2025 and recovery rate of lithium is 85 %. A significant potential for generating secondary lithium is expected only beyond 2025 where most of the EV batteries produced in 2015 onward will reach their end-of-life. Recycling as potential supply of secondary lithium can even become more vital for the EU when the new BMZ GmbH gigafactory opens doors in Germany, which announced an annual production of 800 million lithium-ion batteries of different sizes with an overall storage capacity of 30 GWh by 2020.51

Regarding the scenarios simulated to forecast changes in the import reliance, we conclude that increasing solely the domestic lithium production, assuming that no recycling of lithium will occur until 2030 in the EU, could lead to a slight increase in the resilience of 6 % as a result of increased EU production. Recycling alone, assuming that the lithium production in the EU will remain the same over the years, can assure up to 9 % increase in the upstream resilience. In regards to lithium substitution, a number of alternatives to the Li-ion batteries such as metal-air, lithium–sulphur, sodium-ion, magnesium-ion, flow batteries, are currently being investigated for use in electric vehicles.52 Aluminium-ion and graphene batteries are also stated as potential future alternatives of Li-ion.26,53 All these battery chemistries are at different development stage and according to the experts, 15 to 20 years down the road. Therefore, only beyond 2030, substitution can be seen as a possible solution considering the long times needed for the development, demonstration and market penetration of a new technology as well as having in mind the huge investments done globally on LIB technology. Therefore, in the studied timeframe – until 2030, the substitution is not expected to affect the EU resilience in the case of lithium for li-ion batteries. To assess the indicators within the downstream dimension, detailed evaluation is performed for two supply chain steps: LIB-specific materials (processed materials) and cell/module/ battery pack production. The main LIB-specific materials, namely cathode, anode materials, electrolyte and separator are used to manufacture the electrodes, being the key component of the battery cell. Cells and other components are assembled into battery packs to be integrated in the vehicles. Battery pack and cell/module manufacturing are assessed together since no information is available for companies having only battery assembling/packaging activities as main business. Therefore the D2.1 indicator is calculated as the average of the two supply chain steps (i) LIB specific materials and (ii) cell/module/packs manufacturing (see Figure 3 & Supplementary Material for data). The results show that, unlike the upstream dimension where improvement can be expected, the EU resilience along the downstream dimension might decrease by 33 % until 2030 with respect to 2015 level mainly due to high EU dependency on LIBs specific materials and cells/modules manufacturing capacity (to be noted that such conclusion is based on limited information on future capacity). Of course the downstream resilience will increase significantly and new estimation has to be done if a battery gigafactory is built in the EU.

An important outcome of this analysis is that the envisaged increase in the resilience upstream due to increased domestic lithium production and significant recycling will be not enough to compensate the drop in the overall resilience due to strong downstream supply chain dependency. In terms of cell manufacturing capacities the cell/batteries manufacturers might be confronted to gear up the production fast enough to cope with the increasing demand globally. The EU is highly dependent on supply from outside regions, mainly Asia, which currently has almost monopoly on cell/battery manufacturing. The future prospects are that the most LIB cell production will remain in Asia although some other regions, such as North America can become competitive in the future LIB market. At the downstream level, the likelihood of supply shortages in the EU until 2030 can increase significantly which leads to an overall decrease in the resilience by 22 % even in the optimistic scenario where both increased domestic production and recycling are considered. This shows clearly the necessity of having stronger downstream sector for LIBs. Diversifying the supply of processed materials and cell/batteries manufacturing facilities, including opening of new facilities within the EU can diminish significantly the probability of supply dependencies and limitations and thus improve our resilience. The EU resilience can even drop by 29 % if no recycling occurs in the EU until 2030. If no new lithium production is realised in the EU until 2030 but lithium is recycled, the resilience may still drop by 26 %. Possible policies and incentives need to be streamlined at EU level in order to cope with the future higher demand for lithium, diminishing our dependency on lithium from third countries as well as constantly increasing pilling up of batteries for recycling considered waste. In conclusion, the proposed methodology offers a comprehensive, quantitative and transparent way to assess the EU resilience to supply of materials along the whole materials/technology supply chain. The proposed approach is dynamic since the evolution of the resilience can be estimated over the time. The methodology gives also the opportunity to measure separately the effect of different mitigation measures, such as recycling, substitution and increasing the EU raw materials production, to the overall resilience score. Therefore, the proposed methodology can be used in support to policy decisions in order to increase the EU resilience towards more sustainable energy and transport sectors.54–71

None.

The author declares that there is no conflict of interest.

©2020 Blagoeva, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.