International Journal of

eISSN: 2577-8269

Hospitals in communities with a significant percentage of indigent patients have, since 1981, received a federal adjustment to allow them to receive some compensation for treating these patients. The PPACA severely restricted these Disproportionate Share Hospital (DSH) payments as a cost saving measure. However, the law does not account for the potentially devastating impact of the lack of revenue caused in some localities with large populations of undocumented Americans ineligible to obtain insurance under the act. We created two easily identifiable quotients based on U.S. Census Bureau estimates of foreign-born population and Medicaid DSH payments aggregated by congressional district. These quotients allowed us to predict which congressional districts are at risk for continued high demand of their services by indigent patients in the face of severe DSH reductions. Our data can be used to predict which municipalities may be hardest hit by the impending DSH reductions, spurring legislators to offset the spending shortfall and the public health ramifications of inadequate hospital funding.

The Omnibus Budget Reconciliation Act of 1981 created Medicaid DSH payments.1 This was necessary because hospitals serving a larger proportion of low income patients are particularly dependent on the poorer than private-payor revenue stream associated with Medicaid reimbursement as well as the reality that many low income populations including the undocumented are uninsured.2 The architects of the Patient Protection and Affordable Care Act (ACA, P.L. 111-148 as amended) expected its health insurance provisions to reduce the number of uninsured individuals in the United States to the point that there would be less need for Medicaid DSH payments.2 The law directs the Secretary of Health and Human Services to make aggregate reductions of DSH from 2014 through 2020, however Congress extended this reduction through 2022.2–4 Congress planned to reduce DSH payments by $17.1 billion by 2020.5 DSH payments are not evenly distributed with the Middle Atlantic States, Southern Atlantic and Pacific Regions receiving 60% of payments, yet only 46% of Medicare discharges.6 Five states, NY, CA, TX, NJ and PA alone get the majority of these payments.2 Undocumented Americans are also unevenly distributed throughout the United States.7–9 As the Emergency Treatment and Labor Act (EMTALA) requires care and treatment of this population, DSH has secured the safety net, especially in localities with large numbers of these immigrants. Additionally, as new citizens are not eligible for most forms of federal programs for 5 years, these individuals who are low income will not be capable of getting Medicaid and also will remain uninsured despite ACA. In FY2012, the federal DSH payments totaled $11.3 billion.2–10 Given the significant variation in DSH payments and the concentrated populations of both the new citizens as well as the undocumented Americans, we hypothesized that some localities and their hospitals would be significantly impacted by the DSH reduction and that this dramatic reduction in revenue could not be cost shifted onto other payor classes. This adverse economic situation would result in public health devastation if not addressed. We also postulated that as the ACA was so highly politicized that this impending public health emergency would not be addressed unless congressional representatives recognized the significance in their home districts or states.

The DSH Audit and Reporting Rule require states to submit annual independent audits describing payments to DSH hospitals. Publically available reports from Medicaid State Plan Rate Year 2008, provided by the Centers for Medicare & Medicaid Services, were used to compile a list of DSH hospitals that received one million dollars or more in DSH funding in 2008. Coordinate data from these hospitals was used in conjunction with Sunlight Foundation’s Congress API database to assign a congressional district based on the 112th and 113th congressional boundaries. The aggregation of payments by congressional district and state resulted in the estimated 2008 DSH Payments values. Next, an estimate for the fraction of a congressional district’s non-naturalized, foreign-born population was calculated from the ethnicity data available in the U.S. Census Bureau’s 2010 American Community Survey (ACS) 3-Year estimates. Due to the lack of accurate estimates of undocumented immigrants by congressional districts, we relied on the Census Bureau’s estimations for all foreign-born populations, and expect the number of undocumented is proportionate to the total number of immigrants in a region. We also analyzed the data and looked for correlation with the congressional district and state analysis of an Immigration Policy Center data set that was created in association with Rob Paral & Associates.8 These estimates were cross-referenced with the congressional and state level estimates for DSH payments and used to calculate the Mandel-Nunziato Quotient (MNQ) -- a function of a given region’s total DSH payments multiplied by the percentage of non-naturalized, foreign-born persons (NN). The Mandel-Nunziato Indigent Quotient (MNIQ) was similarly calculated first by deriving the percentage of people in a congressional district or state population receiving Medicaid or other mean’s tested public coverage using data from the 2010 ACS table “Types of Health Insurance Coverage by Age”. This data, once combined with the DSH and ethnicity dataset, was used to calculate the MNIQ as a function of total DSH payments multiplied by the percentage of a region’s population that is either non-naturalized or receiving mean’s tested public health insurance coverage (MTC). To enhance readability, all MNQ and MNIQ values were divided by a factor of one million and ranked from highest to lowest.

Mandel nunziato quotient:

DSH x % NN =MNQ

Mandel nunziato indigent quotient

DSH x (%NN + %MTC)= MNIQ

As Tennessee operates their Medicaid programs under a Section 1115 waiver they were not included in our data collection.2

MNQs and MNIQs were calculated and the 20 highest values organized into Table 1 & Table 2. Similarly, Table 3 shows the top 20 states receiving the largest DSH payments with their corresponding MNQs and MNIQs. Table 4A– Table 4G, containing the entire list of the 293 Congressional Districts with at least one hospital that received DSH payments of more than $1 million, ranked from largest to smallest MNIQ, is available to supplement our report. Organized by Mandel-Nunziato Quotient (MNQ)-a function of a given region’s total DSH payments multiplied by the percentage of non-naturalized, foreign-born persons.

Congressional District (112th) |

MNQ |

MNIQ |

2008 DSH Payments |

CA#34 |

130.556 |

216.106 |

436,035,424 |

NY#11 |

55.148 |

135.136 |

304,229,492 |

TX#9 |

54.763 |

76.917 |

210,336,081 |

NY#16 |

44.153 |

134.461 |

191,165,186 |

NJ#13 |

44.114 |

67.598 |

167,078,413 |

NY#7 |

37.656 |

78.841 |

173,951,223 |

NY#15 |

36.972 |

96.049 |

193,419,395 |

CA#15 |

31.921 |

50.071 |

184,917,676 |

NY#14 |

31.802 |

52.389 |

211,736,810 |

TX#30 |

31.085 |

54.621 |

186,632,226 |

NJ#10 |

30.426 |

67.671 |

216,601,845 |

NY#5 |

28.126 |

48.091 |

119,478,124 |

AZ#4 |

26.559 |

52.843 |

120,365,411 |

CA#43 |

25.799 |

48.308 |

133,775,811 |

NY#17 |

25.708 |

60.221 |

174,057,134 |

CA#27 |

23.394 |

39.581 |

124,852,462 |

CA#36 |

23.141 |

37.893 |

163,291,882 |

CA#8 |

19.416 |

40.024 |

127,342,073 |

CA#20 |

17.808 |

36.791 |

73,907,877 |

CA#9 |

17.582 |

34.217 |

120,248,108 |

Table 1 Top 20 Congressional districts at risk of significant financial stress due to DSH reductions

Congressional Districts (112th) |

MNIQ |

MNQ |

2008 DSH Payments |

CA#34 |

216.106 |

130.556 |

436,035,424 |

NY#11 |

135.136 |

55.148 |

304,229,492 |

NY#16 |

134.461 |

44.153 |

191,165,186 |

NY#15 |

96.049 |

36.972 |

193,419,395 |

NY#7 |

78.841 |

37.656 |

173,951,223 |

TX#9 |

76.917 |

54.763 |

210,336,081 |

NJ#10 |

67.671 |

30.426 |

216,601,845 |

NJ#13 |

67.598 |

44.114 |

167,078,413 |

NY#17 |

60.221 |

25.708 |

174,057,134 |

NY#10 |

58.775 |

16.799 |

140,723,119 |

TX#30 |

54.621 |

31.085 |

186,632,226 |

AZ#4 |

52.843 |

26.559 |

120,365,411 |

NY#14 |

52.389 |

31.802 |

211,736,810 |

CA#15 |

50.071 |

31.921 |

184,917,676 |

CA#43 |

48.308 |

25.799 |

133,775,811 |

NY#5 |

48.091 |

28.126 |

119,478,124 |

LA#2 |

40.272 |

8.268 |

193,327,198 |

CA#8 |

40.024 |

19.416 |

127,342,073 |

CA#27 |

39.581 |

23.394 |

124,852,462 |

CA#36 |

37.893 |

23.141 |

163,291,882 |

Table 2 Top 20 Congressional districts at risk of stress due to DSH reductions organized by Mandel-Nunziato Indigent Quotient (MNIQ). The MNIQ is a function of total DSH payments multiplied by the percentage of a region’s population that is either non-naturalized or receiving mean’s tested public health insurance coverage (MTC). To enhance readability, all MNQ and MNIQ values were divided by a factor of one million and ranked from highest to lowest

State |

2008 DSH Payments |

MNQ |

MNIQ |

NY |

2,619,221,027 |

262.8 |

554.9 |

CA |

2,061,345,386 |

263.7 |

465.1 |

TX |

1,394,048,286 |

68.2 |

291.1 |

NJ |

1,203,622,474 |

129.5 |

249.4 |

LA |

937,607,647 |

13 |

127.7 |

MO |

677,878,646 |

10.1 |

74.9 |

OH |

595,008,973 |

12.9 |

95.3 |

PA |

578,869,424 |

19.3 |

80.9 |

SC |

432,791,995 |

6 |

59.3 |

NC |

420,918,230 |

7.5 |

42.8 |

AL |

388,509,120 |

3.8 |

38.8 |

GA |

374,470,631 |

9.5 |

54.9 |

CT |

308,842,114 |

20 |

64.6 |

MI |

255,110,779 |

5.3 |

52.6 |

IN |

250,301,219 |

3.5 |

22.2 |

IL |

219,130,021 |

7.4 |

33.4 |

NH |

218,697,472 |

6.2 |

33.1 |

NM |

216,404,518 |

7.9 |

31.4 |

MS |

174,695,408 |

1.3 |

17.7 |

CO |

169,732,576 |

4.8 |

24.8 |

Table 3 The top 20 states receiving the largest DSH payments with their corresponding MNQs and MNIQs

Congressional District (112) |

MNIQ |

MNQ |

2008 DSH Payments Received |

CA-34 |

216.106 |

130.556 |

436,035,424 |

NY-11 |

135.136 |

55.148 |

304,229,492 |

NY-16 |

134.461 |

44.153 |

191,165,186 |

NY-15 |

96.049 |

36.972 |

193,419,395 |

NY-7 |

78.841 |

37.656 |

173,951,223 |

TX-9 |

76.917 |

54.763 |

210,336,081 |

NJ-10 |

67.671 |

30.426 |

216,601,845 |

NJ-13 |

67.598 |

44.114 |

167,078,413 |

NY-17 |

60.221 |

25.708 |

174,057,134 |

NY-10 |

58.775 |

16.799 |

140,723,119 |

TX-30 |

54.621 |

31.085 |

186,632,226 |

AZ-4 |

52.843 |

26.559 |

120,365,411 |

NY-14 |

52.389 |

31.802 |

211,736,810 |

CA-15 |

50.071 |

31.921 |

184,917,676 |

CA-43 |

48.308 |

25.799 |

133,775,811 |

NY-5 |

48.091 |

28.126 |

119,478,124 |

LA-2 |

40.272 |

8.268 |

193,327,198 |

CA-8 |

40.024 |

19.416 |

127,342,073 |

CA-27 |

39.581 |

23.394 |

124,852,462 |

CA-36 |

37.893 |

23.141 |

163,291,882 |

PA-1 |

37.357 |

8.129 |

113,764,130 |

CA-20 |

36.791 |

17.808 |

73,907,877 |

CA-9 |

34.217 |

17.582 |

120,248,108 |

CA-45 |

33.559 |

17.009 |

123,286,229 |

NJ-1 |

31.414 |

7.319 |

191,834,652 |

NJ-8 |

31.36 |

17.148 |

110,020,834 |

AL-7 |

31.284 |

2.872 |

162,808,593 |

MI-13 |

29.501 |

4.265 |

90,048,395 |

NM-1 |

29.136 |

10.696 |

140,209,339 |

NY-12 |

28.016 |

12.976 |

53,337,737 |

IL-7 |

27.723 |

7.727 |

130,165,516 |

CT-3 |

27.716 |

9.275 |

144,095,511 |

CA-40 |

27.164 |

16.672 |

105,343,430 |

OH-11 |

26.68 |

3.542 |

131,727,319 |

SC-6 |

26.454 |

2.031 |

149,875,473 |

NY-4 |

25.309 |

13.652 |

118,667,059 |

GA-5 |

25.061 |

11.332 |

135,496,789 |

CA-5 |

24.574 |

8.69 |

81,179,071 |

LA-1 |

23.41 |

6.243 |

169,438,687 |

Table 4 Congressional District by MNIQ

Congressional District (112) |

MN IQ |

MNQ |

2008 DM Payments Received |

NY-9 |

23.15 |

9.959 |

69121307 |

IN-7 |

23.086 |

7.138 |

94249,639 |

NY-28 |

22.714 |

3.025 |

87936315 |

Tx-20 |

22.642 |

10.261 |

95779475 |

CO-1 |

22.576 |

10.466 |

94782584 |

CA-18 |

22.079 |

9.266 |

53127683 |

MO-5 |

22.071 |

6.383 |

1.74E+08 |

CA-53 |

21.463 |

12.642 |

83837141 |

NY-18 |

21.073 |

13.227 |

97036963 |

LA-4 |

21.016 |

2.201 |

1.45E+08 |

NY-2 |

20.364 |

10.552 |

106,317„888 |

VA-3 |

20.2.52 |

4.703 |

1.31E+08 |

NY-S |

20.01 |

9.174 |

58383068 |

LA-5 |

19.854 |

1.332 |

1.18E+08 |

NV-1 |

19.186 |

12.605 |

73643353 |

NI-6 |

17.649 |

11.443 |

83335325 |

NC-S |

17.4.52 |

6.576 |

1.03E+08 |

NY-6 |

17.035 |

7.558 |

40004841 |

CT-1 |

17.026 |

5.687 |

80913834 |

NJ-9 |

16.416 |

10.786 |

62119027 |

NJ-12 |

16.08 |

9.856 |

104„911,771 |

RI-2 |

15.945 |

5.796 |

77674225 |

NC-13 |

15.79 |

7.541 |

87268856 |

NY-25 |

15.443 |

3.177 |

1.02E+08 |

MD-7 |

14.988 |

3.462 |

61003931 |

LA-6 |

14.818 |

2.797 |

118,240„957 |

TX-22 |

14.6.32 |

8.726 |

48705495 |

M N-5 |

14.62 |

12907 |

60591737 |

MO-9 |

14.487 |

2.132 |

1.37E+08 |

NJ-11 |

14.474 |

9.46 |

122,971403 |

TX-12 |

14.338 |

8.262 |

87661503 |

CA-7 |

14.18 |

7.084 |

50292.96 |

LA-7 |

14.179 |

1.813 |

103..795,678 |

TX-16 |

14.139 |

7.385 |

49836213 |

OH-15 |

13.774 |

5295 |

102,477..284 |

NM-2 |

13.605 |

4.258 |

56,.557,858 |

CA-12 |

13.149 |

8.28 |

61,914)699 |

NH-2 |

13.019 |

3.495 |

139;449240 |

TX-5 |

12.94 |

6.121 |

85,809)782 |

Table 4A Congressional District by MNIQ

Congressional District1112) |

M N IQ |

IYINQ |

2O DM Payments Received |

TX-14 |

12.936 |

6.257 |

99025308 |

LA-3 |

12.725 |

1.703 |

86731018 |

PA-14 |

12.627 |

1.823 |

63335860 |

TX-23 |

12.201 |

5.827 |

59565094 |

5C.4 |

11.572 |

4.151 |

78,846436 |

M5-3 |

11.412 |

1.009 |

80821478 |

SC-1 |

11.096 |

3.931. |

92566427 |

MO-1 |

10.909 |

2.119 |

701623,661 |

TX-15 |

10,74.5 |

5.402 |

361464.9 |

NY-1 |

10.34 |

4.295 |

83699384 |

TX-21 |

0.099 |

5.054 |

86269122 |

CA.17 |

9.894 |

6.29 |

31397303 |

NC-3 |

9376 |

2.457 |

69657554 |

TX-18 |

9.348 |

5.009 |

27061738 |

M5-4 |

9.305 |

1.205 |

72508940 |

PA-2 |

9.236 |

1.691 |

36186068 |

AL-5 |

9.139 |

2.293 |

81767381 |

PA-6 |

9.049 |

3.328 |

70534577 |

NC-1 |

9.023 |

1.051 |

41335,272 |

1L-12 |

8769 |

0.604 |

55564152 |

KY-1 |

8.68 |

0.628 |

64842072 |

C1-5 |

8557 |

2.984 |

40028290 |

TX-19 |

8.442 |

2.7 |

57894373 |

GA-2 |

8.349 |

1.052 |

45543086 |

NY-22 |

8333 |

2372 |

43,243,788 |

MO-7 |

7952 |

1.363 |

74604137 |

OR-1 |

7.628 |

3.877 |

47352282 |

NY-21 |

7.419 |

1.436 |

41981071 |

MI-15 |

7.384 |

1.611 |

44076741 |

TX .4 |

7.365 |

2.992 |

58268248 |

PA-10 |

7.316 |

0.68 |

60758805 |

AR-2 |

7.27 |

1829 |

54625617 |

fsJ I-1-1 |

7123 |

1.902 |

79248232 |

AL-1 |

6.96? |

1.236 |

52805121 |

VT-2 |

6.945 |

0.592 |

33511969 |

RI-1 |

6.875 |

2.189 |

36461389 |

CA-24 |

6.755 |

3.652 |

40712567 |

CT-4 |

6495 |

3.626 |

30553457 |

TX-29 |

6.48 |

4.047 |

15694240 |

Table 4B Congressional District by MNIQ

Congressional District (112) |

MNIQ |

M N Q |

2008 DSH Payments Received |

NY-19 |

6.444 |

2.494 |

42,028..050 |

CO-5 |

6.428 |

1.73 |

49280282 |

CA-37 |

6.334 |

2.968 |

16349374 |

OH-3 |

6.271 |

0.833 |

53,599..263 |

NY-27 |

6.168 |

0.788 |

33773339 |

TX-1.7 |

5.788 |

2.8 |

40205236 |

OH-12 |

5.784 |

1.924 |

38553809 |

MO-8 |

5.773 |

0.284 |

36101300 |

CA-30 |

5.77 |

3.354 |

36,786.232 |

NJ-7 |

5.613 |

3.552 |

40,676449 |

PA-18 |

5.612 |

0.957 |

54195512 |

OH-9 |

5.529 |

0.604 |

36981310 |

N.1-2 |

5.395 |

1.692 |

29,848.299 |

MO-3 |

5.375 |

1.821 |

47898830 |

M04 |

5.365 |

0.833 |

49681676 |

SC-3 |

5.347 |

1.011 |

40,070„770 |

NC-7 |

5.346 |

1.383 |

32,019..021 |

PA-15 |

5.224 |

1.271 |

39018225 |

OK-5 |

5.17 |

2.258 |

32762186 |

AL-3 |

5.047 |

0.858 |

35399870 |

I N-9 |

5.005 |

1.215 |

43,485,350 |

AL-2 |

4.993 |

0.575 |

37.246,879 |

$C-2 |

4.947 |

1.64.8 |

40260960 |

OH-1 |

4.841 |

0.97 |

33.728,163 |

PA-3 |

4.803 |

397 |

32980108 |

M 1-5 |

4.697 |

0.194 |

21.931,329 |

5C-5 |

4.683 |

600 |

31172229 |

PA-16 |

4.68 |

1.417 |

30898825 |

TX-1 |

4.666 |

1.85 |

29493207 |

NY-24 |

4.643 |

0.612 |

25122250 |

NC-4 |

4.549 |

2.575 |

32895523 |

MO-6 |

4.51 |

0.759 |

50668982 |

GA-10 |

4.413 |

1.149 |

34690084 |

KY-5 |

4.408 |

0.047 |

20801737 |

KY-2 |

4.339 |

0.668 |

33,422,663. |

IN-6 |

4.245 |

0.42 |

40128570 |

NY-13 |

4.183 |

1.518 |

14355848 |

WV-3 |

4.111 |

0.106 |

24794068 |

OH-17 |

4.103 |

0.368 |

31,342,277 |

Table 4C Congressional District by MNIQ

Congressional District (112J |

MNIQ |

MNQ |

2008 D51-1 Payments Received |

NJ-4. |

4.089. |

1.62 |

26080371 |

M N-4 |

4.071 |

1.447 |

20833707 |

PA-9 |

4.068 |

0.269 |

32541560 |

OH-7 |

3.91 |

0.581 |

27923895 |

IA-3 |

3.749 |

0.9.36 |

23819261 |

GA-12 |

3.685 |

0.78 |

27313762 |

TX-22 |

3.634 |

2.372 |

23851010 |

NM-3 |

3.475 |

0.879 |

19637321 |

NY-23 |

3.387 |

296 |

19090013 |

NC-10 |

3.386 |

0.7.55 |

25382475 |

NY-20 |

3.377 |

0.4.57 |

26845115 |

GA-1 |

3.365 |

0.7.58 |

25222037 |

MS-2 |

3.212 |

0.21 |

15134459 |

GA-4 |

3.167 |

19368 |

13200748 |

NJ-5 |

3.082 |

1.594 |

28085589 |

IN-S |

3.005 |

0.257 |

26944628 |

GA-13 |

2.97 |

1.42 |

16824618 |

NE-2 |

2.96 |

1.11 |

23750315 |

GA-9 |

2.927 |

1.31 |

18806680 |

GA-S |

2.901 |

0.55 |

19489590 |

M1-14 |

2.883 |

0.344 |

10322735 |

ME-2 |

2.855 |

0.172 |

11654331 |

OH-13 |

2.831 |

394 |

24940735 |

TX-10 |

2.792 |

1358 |

15070794 |

KY-6 |

2.753 |

0.836 |

20838816 |

MI-6 |

2.688 |

0.404 |

17504211 |

TX-7 |

2.678 |

2.057 |

13420909 |

GA-11 |

2.642 |

1.125 |

21082003 |

UT-2 |

2.565 |

0.902 |

21137387 |

FL-20 |

2.495 |

1317 |

10286832 |

AL-4 |

2.49 |

523 |

15713716 |

OH-4 |

2457 |

0.081 |

19275977 |

NY-3 |

2.446 |

1.137 |

18794345 |

TX-11 |

2.428 |

1.03 |

17588334 |

TX-32 |

2.383 |

1.868 |

8271053 |

M0-2 |

2.32 |

0.9.50 |

37568441 |

VA-5 |

2.311 |

0.505 |

19821744 |

NY-29 |

2.304 |

0.233 |

16120786 |

NJ-3 |

2.235 |

0.664 |

20058796 |

Table 4D Congressional District by MNIQ

Congressional District (112) |

MNIQ |

MNQ |

2008 D51-1 Payments Received |

PA-17 |

2.229 |

0.35 |

18721618 |

ME-1 I |

2.195 |

212 |

14023000 |

IA-2 |

2.185 |

0.493 |

15976087 |

WV-2 |

2.176 |

0.134 |

16609763 |

OH-10 |

2.168 |

0.461 |

13872589 |

HT-3 |

2.165 |

0.64 |

16093456 |

TX-13 |

2.092 |

0.88 |

14345792 |

CO-3 |

2.055 |

0.548 |

13057256 |

CA-21 I |

2.021 |

839 |

6000646 |

OH-18 |

1.998 |

0.072 |

15043206 |

Uri |

1.981 |

0.816 |

15535854 |

CT-2 |

1.96 |

0.507 |

13251022 |

MI-1 |

1.959 |

0.121 |

12688828 |

111.-16 |

1.944 |

0.55 |

12973153 |

AK-1 |

1.916 |

0.522 |

14268274 |

MD-1 |

1.868 |

0.349 |

16,420r800 |

MD-6 |

1.855 |

0.434 |

15842616 |

CO-4 |

1.786 |

0.683 |

12612454 |

1L-19 |

1.77 |

0.112 |

15,202451 |

M I-7 |

1.729 |

0.224 |

11143774 |

MI-8 |

1322 |

397 |

12328190 |

ID-2 |

1.718 |

0.605 |

13030292 |

NY-26 |

1.658 |

0.297 |

12320329 |

TX-27 |

1.646 |

0.77 |

7458,970 |

PA-7 |

1.581 |

0.676 |

13490825 |

WV-I |

1.573 |

85 |

12856337 |

HI-1 |

1.545 |

0.765 |

7341025 |

IN-3 |

1.524 |

0.404 |

14537184 |

OH-16 |

1.52 |

0.149 |

13611668 |

M I-4 |

1.453 |

0.096 |

10584339 |

OH-2 |

1.451 |

0.291 |

12753360 |

M D-3 |

1.418 |

0.615 |

9122195 |

M 1-12 |

1.386 |

305 |

7783945 |

N C-9 |

1359 |

0.633 |

11452096 |

NC-2 |

1.314 |

0.448 |

7491359 |

OH-8 |

1.299 |

0.236 |

11056754 |

GA-3 |

1.249 |

0.313 |

10974328 |

TX-31 |

1.221 |

0.569 |

9589906 |

M D-4 |

1.203 |

0.702 |

5616807 |

Table 4E Congressional District by MNIQ

Congressional District (112) |

MNIQ |

MNQ |

2008 DSH Payments Received |

IL-5 |

1.169 |

0.763 |

5225049 |

IN-4 |

1.15 |

0.387 |

11858766 |

MI-3 |

1.141 |

0.25 |

7539227 |

IN-2 |

1.121 |

0.276 |

9051907 |

TX-3 |

1.042 |

0.758 |

5551301 |

CA-a |

0.989 |

321 |

4548565 |

KS-4 |

0.985 |

304 |

7716222 |

M I-2 |

0.981 |

0.161 |

6674434 |

MS-1 |

0.97 |

0.084 |

6230531 |

GA-7 |

0.957 |

0.613 |

5826906 |

NV-2 |

0.845 |

0.404 |

5956577 |

MN-1 |

0.838 |

0.178 |

61078,997 |

NC-5 |

0.83 |

225 |

6076898 |

OH-6 |

0.787 |

0.035 |

5692315 |

K5-3 |

0.755 |

0.429 |

6691886 |

KS-Z |

0.751 |

0.152 |

7354155 |

KY-4 |

0.743 |

0.089 |

6564694 |

IA-5 |

0.73 |

0.166 |

5400932 |

CA-52 |

0.729 |

375 |

2,1.98,173 |

AZ-7 |

0.714 |

0.264 |

2050404 |

IN-5 |

0.69 |

0.189 |

7837546 |

OH-14 |

0.643 |

0.132 |

7186796 |

01C-1 |

0.617 |

0.243 |

5114840 |

NC-11 |

399 |

0.139 |

4529948 |

N E-3 |

0393 |

(1137 |

5,302,536 |

MT-1 |

366 |

0.057 |

6811855 |

VA-4 |

0.533 |

0.109 |

4937799 |

DE-1 |

0.511 |

0.122 |

2814038 |

011-5 |

0.502 |

0.046 |

4,955421 |

ID-1 |

0.461 |

0.116 |

4173840 |

IA-1 |

0.452 |

0.055 |

3793596 |

PA-13 |

0.402 |

0.129 |

2427145 |

M N-8 |

0.392 |

0.015 |

2560922 |

MI-9 |

0.384 |

0.171 |

2484,631 |

NE-1 |

0.366 |

0.129 |

3629561 |

AZ-5 |

0.345 |

0.153 |

2230487 |

NT-21 |

339 |

0.066 |

1919583 |

PA-19 |

0.317 |

0.059 |

2907802 |

MN-3 |

0.311 |

0.137 |

2150763 |

Table 4F Congressional District by MNIQ

Congressional District (112) |

MNIQ |

MINQ |

2008 D!11 Payments Received |

VA-6 |

0.307 |

0.101 |

3060309 |

NC-4 |

0.3 |

0.17 |

2172210 |

OK -4 |

0.3 |

0.072 |

2892992 |

LA-1 |

0.293 |

0.06g |

2!203,818 |

VA-9 |

0.28 |

0.037 |

2491A94 |

AL-6 |

0.279 |

0.096 |

2767560 |

IN-1 |

0.279 |

0.064 |

2,21)7,629 |

PA-12 |

0.276 |

0.012 |

1783964 |

MD-2 |

0.261 |

0.078 |

1412836 |

MN-6 |

0.251 |

0.044 |

2452676 |

PA-5 |

0.243 |

0.025 |

1736354 |

AZ-2 |

0.236 |

0.066 |

1346092 |

HI-2 |

0.233 |

0.07 |

1195509 |

PA-11 |

0.229 |

0.041 |

1415836 |

TX-25 |

0.226 |

0.128 |

1160131 |

MN-7 |

0.205 |

0.024 |

1374383 |

TX-6 |

0.191 |

0.11 |

1474,154 |

TX-26 |

0.165 |

0.095 |

1438,705 |

TX-8 |

0.142 |

0.06.3 |

1025034 |

WY-1 |

0.094 |

0.02 |

1153843 |

Table 4G Congressional District by MNIQ

Presidents since Theodore Roosevelt have tried to provide health care security for the American population. The development of the public health hospitals as well as the creation of Medicare and Medicaid attempted to supplement the employer based health care system. Congress and health economists have long realized that there are significant differences in the kinds of insurance, as well as the rate of uninsured as well as variation across congressional districts.11,12 In their creation of DSH, Congress recognized that these variations could be extremely damaging to public health disproportionately across the country.1 The politics of creating legislation that would provide affordable universal health insurance for all Americans in what some authors would call the largest domestic reform in 80 years was not lost on the architects of the Affordable Care Act, nor was the importance of rapidly addressing their goal in the first legislative cycle.13 The death of Massachusetts Senator Edward Kennedy, and the election of Senator Scott Brown resulted in the House of Representatives accepting the Senate version of the bill without the planned conference committee that would have corrected significant flaws in the legislation. One major flaw in the bill is that the safety net providing health care access is extremely dependent on DSH---yet undocumented immigrants and new citizens who are impoverished often live in communities served by those hospitals. As both those populations would not be eligible for either Medicaid or the purchase of health insurance with subsidy through the health care exchanges, localities with significant percentages of those populations will not have the revenues to support their safety nets. We believe that we are the first researchers to analyze congressional districts by looking at both the variables of dependence on DSH revenue as well as proportion of population that will not be eligible to obtain health insurance and therefore will remain uninsured.

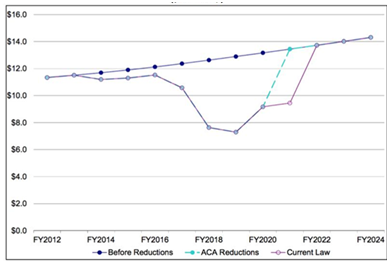

By creating two quotients, the MNQ and MNIQ, we have created a pragmatic tool that will allow health economists, safety net providers and public health officials to easily focus on those localities that we believe will have significant revenue shortfalls as ACA expands and unless rectified DSH levels decrease see Figures 1. As the Secretary of Health and Human Services was given some flexibility in applying the DSH decreases, it may allow planners in HHS another methodology in their analysis to lessen the potential public health harm created when those communities in greatest need of health care access are disproportionately affected. Peter Drucker analyzed in 1995 that (in Los Angeles) “immigration already exceeds what is socially and politically manageable”.14,15 Clearly, as our data indicates, districts like CA34 with $436,035,424 or NY11 with $304,22,492 in DSH per annum cannot cost shift $100 million decreases annually for the next several years. As the annual aggregate DSH reductions are back loaded, we believe that although there will be difficulties over the next few years, that unless rectified the safety net system in the high MNQ, as well as MNIQ districts will have serious financial difficulties starting in fiscal 2018.16

As the economics of the safety net are not specifically related to the immigrant populations, we did not analyze the CDs by population alone as did the Immigration Policy Center group, who looked at potential eligible recipients of the Dream Act. In cities of high population density, it is not uncommon for patients to travel significant distances to go to the safety net providers and hospitals, and therefore why we believe that DSH received must be a significant contributor to our quotients. Observationally, we noticed that states with large discrepancies between MNQ and MNIQ (TX and LA, for example) are also co-incidentally those that have refused to implement the Medicaid expansion. This will need to be explored by public health leaders in those states, as it possibly could become problematic as well. As the Secretary is mandated to decrease DSH, these states, and specific Congressional districts within those states like TX-9 - TX-30 that are currently dependent on DSH, will be under significant cost pressure. They will have to rely on lower DSH revenues to treat both indigent patients that were supposed to be shifted to Medicaid, as well as their high population of undocumented residents. We also believe this article is quite significant because it can offer members of Congress an easy to use new tool that could result in the avoidance of a public health nightmare. With the responsibilities to provide services mandated by EMTALA as well as PHA 330, if the ACA flaw is not corrected, our quotients can be used by state and county treasurers, bond insurers and underwriters to more accurately assess those localities that are at higher risk of default on their financial obligations. We also believe these communities will be hardest hit by increased waiting times to see primary care physicians and specialists and that our quotients will assist planners to focus on those communities to develop reasonable contingency plans.17

Figure 1 Total DSH Allotments before the Reductions, with the ACA Reductions, and under current Law.2

Comprehensive list of DSH payments were obtained from Medicaid State Plan Rate Year 2008 report. Hospitals were assigned to congressional districts with the help of the Sunlight Foundation and their publically available congressional district API. Demographic information was provided both by the US Census Bureau’s American Community Survey as well as the Immigration Policy Center in partnership with Rob Paral and Associates.

The author declares there is no conflict of interest.

© . This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.