eISSN: 2577-8250

Research Article Volume 6 Issue 1

Universidad de Panama, Panama

Correspondence: Reyes Arturo Valverde Batista, Universidad de Panama, Panama City, Panama

Received: October 24, 2023 | Published: January 4, 2024

Citation: Batista RAV. Impact of the Panama Canal on the Panamanian economy: analysis with input-output tables. Art Human Open Acc J. 2024;6(1):6-12. DOI: 10.15406/ahoaj.2024.06.00215

The effects of canal activity not only prevent a greater economic contraction derived from the pandemic, but also allow for rapid economic recovery in Panama. The objective of the study is to determine the economic impact of the Canal in relation to production, added value, employment and salary income. The methodology used is the analysis of direct, indirect and induced impact attributed to the Input-Output Tables (IOT) method, for which the 45X45 IOTs have been developed in the years 2019, 2020, 2021 and 2022, incorporating the financial information from the Panama Canal Authority and the Supply and Use Tables at 2018 prices and with chained volume measurements provided by the National Institute of Statistics and Census. The results indicate that at the time of the considerable economic contraction in the country, estimated at 17.9%, the Canal grew by 7.2% of its production compared to fiscal year 2019, maintaining that the weight of this activity for this referenced year reached 5.5% of the GDP when adding indirect and induced effects; while in 2020 it reached 7.6%, gaining 2.1 units of this magnitude. For its part, the added value exceeds the growth in production, setting an evolution in its growth of 11.1%, with a less intense participation than in production, going from 4.2% in 2019 to 5.8% in 2020 of the value total added; However, the results in employment and salary income show a different dynamic when compared to 2019, with the former falling by 2% and the latter by 5%, considering that by 2019 canal employment included all the effects between 0.5% and 1.2% of total employment; improving this relationship in 2020 with a range between 0.6% and 1.5%. In subsequent years, the behavior of this service activity provides an important contribution to the aforementioned indicators in the country, ignoring the negative impacts of the container crises, the war between Russia and Ukraine; and the increase in interest rates.

Keywords: Panama Canal, jobs, economic impact, direct production, salary income

After its opening on August 15, 1914, this work has defined the course of the Panamanian economy, linked to the conviction that it is a fundamental pillar of the comparative advantage of the geographical position that, since 1532, Panama would become a passage for extracted treasures. from Peru to Spain or other European countries and in turn from merchandise from the old world to Latin American countries, mainly to the recently created Viceroyalty of Peru, as stated by historian Celestino Andrés Araúz1 at the XXXIX Annual Conference of Executives, CADE 2005. This comparative advantage was taken advantage of by the United States from the middle to the end of the 19th century, with the inter oceanic railroad that in the work of Juan Santiago Correa,2 the highest level of profit obtained by the railroad company is revealed at 1,937,079 million dollars for 1868, however there are no records of the quantified estimate of the benefits to the northern country for developing it, although the same author points out that This railway did not connect any local production center with the international market, which would explain why for Colombia it became a challenge to its sovereignty and later the secession of Panama came. Such was the importance of the geographical position of Panama, that in 1878, after several studies of the particular routes through the isthmus, meetings and discussions, the delegate of the limited company, Societé Civile Internationale du Canal Interocéanique de Darién, Lucien NB Wyse Lieutenant of the French Navy, he travelled to Bogotá and negotiated a treaty with the Colombian government, called “the Wyse Concession”, selecting the route parallel to the railway described above.3

The estimates made by Ferdinand de Lesseps to build the canal reached a value of $. 168 million and duration of the work of 12 years, but the theoretical conduction of creating a channel at the level and the opposition of the North American government, led to such work being ruined.4 Hence the negotiations between the French Panama Canal Company and the United States government in 1904.1, led to the purchase of their rights and properties for the order of $. 40 million, to achieve its final construction in 1914 at an estimated cost of $387 million.3

It is important to highlight that after its inauguration, very little is known about the economic impact generated for Panama by the Canal administered by the United States and this is maintained by Maurer and Yu,5 pointing out that there are very divergent positions between Lebergott in 1980, which indicated that Panama has received little or nothing, contrary to the positions of Hutchinson and Ungo in 2004. However, between 1950 and 1979 the economic impact generated2, that is, the direct effects3, indirect4and induced5through the Canal to the country represented 26.3% ($185.1 million) of the GDP in 1950, showing an attenuated trend of 16.7% ($599.8 million) in 1979; while in employment the same behavior is manifested, going from representing 19.1% of national employment, that is, about 45,999 jobs in 1950 to 17.7%, more than double that of 1950, amounting to 93,074 jobs in 1979.6

At the end of this analysis under the North American administration, a study led by Intracorp, which included the Canal Institute of the University of Panama and professors from the Transportation Center of Northwestern University in Chicago, determined that by 19996 was generated directly around $975.9 million, 9.8% of GDP, $255.6 million indirectly, reaching 2.6% of GDP and $501.1 million or 5.0% of GDP as an induced effect.7 A comparative fact at the end of the 20th century, raised by Gene Bigler,8 as co-author of the book “Modern Panama: from occupied territory to the center of the Americas", which, with the administration of the United States, only around 200 containers passed through a year and currently approximately 13 million; a reality that implies differentiation between administrations, one seeking a global strategic interest and the other seeking maximization of profitability.

When evaluating the economic impact considering the change in administration since the year 2000, they show an upturn in participation with respect to GDP, when adding all the effects, supporting a new business vision on the part of the Panama Canal Authority, reaching in 2005 according to the study coordinated by Sabonge and Sánchez,9 a production of $2,876.7 million, which translates into a 22% share of the GDP, whose estimation was referenced to 2006 prices. The aggregation starts from the direct effects with $1,147.2 million, indirectly considering the sales to ships in transit, the effects were estimated in $390 million, while the activities related to the ports, the railway and the Colón Free Zone, grouped in the induced effect, were calculated in $674.3 million and in the end the multiplier throughout the economy in the order of $611.4 million. In line with this study, 25% of national employment has some relationship with the impact of canal activity, that is, around 293 thousand Panamanians have a job due to the effect of exports from the Canal Economic System.

In this journey as a process of retrospective analysis whose objective is to measure the impact of the Panama Canal on the entire economy starting in 2019, the change that the expansion of the canal represented is evidently shown, in terms of income, tonnage, transit. and contributions to the treasury; taking as reference the works of Bejarano and López,10 in which for 2017 the barrier or goal of 2 billion for tolls is exceeded for the first time, that was reached $2,238 million, also in relation to the transit of ships, 13,548 passed through, loading 403.8 million CP/UMS net tons and the record contribution to the National Treasury in the amount of $1,650 million; leaving clearly the consistent and wise decision that the Panamanian people made in the referendum held on October 22, 2006.11

The construction and operation of the Panama Canal became the greatest asset of the newly created nation, leading to the dependence of the Panamanian economy on international trade, understanding that, based on that condition, that is, due to the comparative advantage of the geographical position, a process begins that over time defines the economic structure based on the Service Platform.12 Next, the Republic of Panama, in terms of its economy, responds to the ups and downs of the changes caused by developed countries, which contain crisis processes, increasingly repetitive as the seventies enter and that result in constant shocks to said economy.13

To establish the above, the research must answer the following question: In the face of global changes, will the Panama Canal be able to strengthen the service economy? The effects of canal activity not only prevent a greater economic contraction derived from the pandemic, but also allow for rapid economic recovery in Panama.

1Of course, the separation of Panama from Colombia was achieved on November 3, 1903, supported by the United States.

2The effects were obtained considering that they were referenced to prices from 1982.

3For this purpose, the study included wage payments, sales of goods and services of Panamanians to United States residents in the Canal Zone, expenses of United States residents in Panama, payments to the government and other exports.

4While the indirect effects included sales of goods and services to ships that transited the canal.

5Finally, the induced in the study were concentrated in the contributions of the Colón Free Zone and to a lesser extent those generated by the ports.

6The effects were obtained considering that they were referenced to prices from the year 2000.

The methodology used is the analysis of direct, indirect and induced impact attributed to the Input-Output Tables (IOT) method, for which the 45X45 IOTs have been developed in the years 2019, 2020, 2021 and 2022, incorporating the financial information from the Panama Canal Authority and the Supply and Use Tables at 2018 prices and with chained volume measurements provided by the National Institute of Statistics and Census. Additionally, the INEC publications of February 8, 202314 were considered regarding the employment matrix for the years 2018-21 and the publication of June 24, 2022 called “Situation of the employed population, April 2022”, related to the jobs; also taking into account the GDP and Value Added data with the publication of March 17, 2023 “Advance of Gross Domestic Product Figures: 2022”.

Methodology to determine indirect effects

When defining the tables to be developed and the information required, we proceed with the sectoral distribution proposed by Pérez,15 which is noted below;

That is, the sectorial distribution of intermediate consumption and investment is quantified, based on the data extracted (purchases and non-current assets-investments) from the financial reports presented by the Panama Canal Authority, considering that said amounts totals are integrated exogenously into the simulation model. With this, the vectors of direct demands received by each sector are obtained.

By multiplying each direct demand vector by the Leontief inverse, the total indirect production is obtained

By dividing the added value of each sector by production, the value added coefficient is obtained.

Likewise, the total number of jobs for each sector is divided by production, obtaining the employment coefficients.

By multiplying the estimated total indirect production in each sector by the respective added value coefficients, for each of the impact channels, that is, purchases and investment, the indirect added value will be obtained.

Similarly, by multiplying the estimated total indirect production in each sector by the respective employment coefficients, the result is indirect employment.

The aggregation of the results allows us to determine the joint effects of purchases or inter sectoral demand and investment in terms of added value and jobs.

Methodology to determine the induced effects

It is evident that the activity of the Panama Canal, by impacting the economy, is a generator of jobs in other sectors, creating income and, thereby, increasing internal demand, in this succession of relationships, it is known in economic literature, as induced effects.12

From there, indirect employment will be obtained in each sector, by adding in each of the sectors the employment by each means of impact, whether through purchases and investment; and salaries in each sector, by dividing salaries among employees in each sector.

To then obtain the indirect salary income, by multiplying the indirect employment by the average salary in each sector.

Next, it is necessary to obtain the total induced consumption (TCI), which in the Panamanian case the deductions from salary income involve social security contributions, educational tax, professional risk and the deductions established in the regulations of the Ministry of Labor; as well as by subtracting the savings propensity, around 10% on average. Once this is given, we continue with obtaining the induced consumption in the different sectors by multiplying the total induced consumption by the percentage of the sectoral distribution of private consumption given in the Input-Output Table.

By multiplying the Leontief inverse by induced consumption, the total income-induced production will be obtained.

It is necessary to determine both the value added and the induced employment in each sector, by multiplying the induced production by the respective coefficients of value added and employment.

It ends by measuring the income effect of added value and induced employment, considering the aggregation of each indicator in each sector.

Once the appropriate methodology has been provided to determine the direct, indirect and induced production generated by the activity of the Panama Canal, additionally the effects on the employment generated in these sectors and the others in the economic system; they will be known by exercise analyzed in the following sections.

Starting from the direct effects as an initial process to measure the impact, the income of the Panama Canal reached $3.2 billion in fiscal year 2019, meaning a share of 4.6% of the GDP, that is, the economy produced $ 69.7 billion (Table 2). It appears for this year that the added value when deducting purchases is in the order of 2.5 billion7and the employment generated is estimated at 9,7018; highlighting that 12% of the staff belongs to the female group with 140 in leadership positions.16

An important aspect in 2019 to highlight in Table 1 is the average salary that exceeds $85 thousand, about $7,128 on a monthly average, a figure that substantially exceeds the national average of $701.90 estimated by the National Institute of Statistics and Census,17 evidencing the enormous inequality between the privileged within this company and the rest of the workers, that there does not seem to be any changes with the former residents of the Canal Zone, called Zonites, Americans who had a higher salary and lived in luxury, something that It did not apply to Panamanians.18

|

Accounts |

2019 |

2020 |

2021 |

2022 |

|

Production |

3,213.40 |

3,443.40 |

3,958.60 |

4,322.60 |

|

Shopping |

725.7 |

679.3 |

723.6 |

767.7 |

|

Value added |

2,487.70 |

2,764.10 |

3,235.00 |

3,554.90 |

|

Operating expenses |

1,766.90 |

1,705.20 |

1,773.80 |

1,897.60 |

|

Personnel expense |

829.8 |

788.5 |

810.5 |

895.3 |

|

Amortizations and provisions |

211.4 |

237.5 |

239.7 |

234.7 |

|

Employment |

9,701 |

9,510 |

8,958 |

8,727 |

|

Average wage |

85,536.30 |

82,907.50 |

90,475.70 |

102,585.0 |

Table 1 Direct effect of canal activity in Panama in the years 2019, 2020, 2021 and 2022 (Millions of dollars, employment units and average income)

Prepared by the author based on the financial and annual reports of the Panama Canal Authority for the years 2019, 2020, 2021 and 2022.

|

Accounts |

20-19 |

21-20 |

22-21 |

|

Production |

7.2 |

15 |

9.2 |

|

Shopping |

-6.4 |

6.5 |

6.1 |

|

Value added |

11.1 |

17 |

9.9 |

|

Operating expenses |

-3.5 |

4 |

7 |

|

Personnel expense |

-5 |

2.8 |

10.5 |

|

Amortizations and provisions |

12.3 |

1 |

-2.1 |

|

Employment |

-2 |

-5.8 |

-2.6 |

|

Average wage |

-3.1 |

9.1 |

13.4 |

Table 2 Evolution of canal activity accounts (percentage changes)

Prepared by the author.

On the other hand, amid the effects of the health crisis caused by COVID-19, the Panama Canal acted as an essential activity, avoiding the paralysis of international trade,19 which translated into a 7.2% improvement in production (Table 2), while the economy as a whole fell by 18.1% when observing Table 4. Similar behavior is reflected by the added value generated by said organization, above it of course, growing by 11.1% and, on the other hand, the national value fell by 17.7% (Table 3).

|

National Indicators |

2019 |

2020 |

2021 |

2022 |

|

GDP |

69,721.80 |

57,086.80 |

67,406.70 |

76,522.50 |

|

Value added |

67,595.10 |

55,661.00 |

65,379.30 |

74,178.50 |

|

Paid jobs |

1,857,532 |

1,493,016 |

1,683,754 |

1,846,353 |

Table 3 National Economic Indicators of Panama in the years 2019, 2020, 2021 and 2022 (Millions of dollars and employment units)

Prepared by the author based on data provided by INEC.

However, employment shows a reduction of 2%, much less than that experienced by paid employment in the country, which decreased by 19.6% (Table 4); although for Diana Díaz.20 In the expansion process, the canal hired an average of 30,000 workers since 2007, pointing to a normalized trend after developing a work that cost around $5,250 million in a period of 9 years, starting in September 2007.21 The channel also presented a decline in the average annual salary compared to 2019 of 3.1% as the decrease in personnel spending of 5% inclined more quickly in relation to the variation in employment.

|

National Indicators |

20-19 |

21-20 |

22-21 |

|

GDP |

-18.1 |

18.1 |

13.5 |

|

Value added |

-17.7 |

17.5 |

13.5 |

|

Paid jobs |

-19.6 |

12.8 |

9.7 |

|

National Indicators |

20-19 |

21-20 |

22-21 |

|

GDP |

-18.1 |

18.1 |

13.5 |

|

Value added |

-17.7 |

17.5 |

13.5 |

|

Paid jobs |

-19.6 |

12.8 |

9.7 |

Table 4 Evolution of economic indicators (percentage changes)

Prepared by the author.

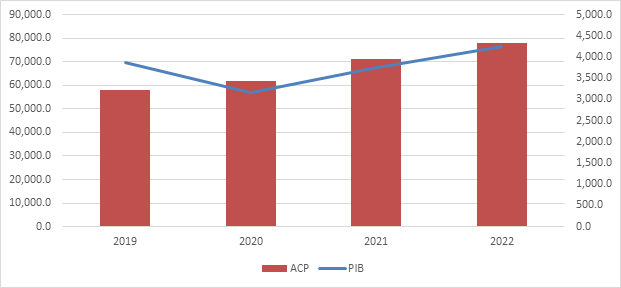

The economic recovery marks the favourable conditions of the Panamanian economy, denoting a growth in GDP of 18.1% in 2021 compared to 2020, 17.5% in added value and 12.8% in paid jobs; data driven by the dynamics of the activities of the Panama Canal, as its production grew by 15% and added value by 17%9; However, there is a drop in employment in the company of 5.8%, although the average salary earns 9.1% (Table 2). By measuring these indicators in 2022, it is shown that there is a relationship between the good performance of the Panama Canal and the general economy by verifying the evolution of the magnitudes observed in Graph 1, ignoring the impact of the war between Russia and Ukraine, which became negative due to the reduction in international trade in Liquefied Natural Gas in April 2022 according to Vásquez,22 around $90 million below estimates for the date.

Graph 1 Evolution of Panama's GDP and the turnover of the Panama Canal authority (millions of dollars).

Prepared by the author.

The previous analysis confirms the unequivocal significance of the direct effects of the activity visualized since 1878 by the French, which requires as a necessary element or aspect the evaluation of the indirect and induced effects to concretely assess the importance for the country of said activity.

From this point, the exogenous magnitudes in the simulation model contain the purchases10 What the Panama Canal does to other sectors and investment, this last variable being the one obtained from the financial information presented in Table 5 for 2019. The result reveals an investment of $-50.71 million, falling by almost $260 million compared to fiscal years 2018, exceeding the provision for amortization of fixed assets (depreciation), exhibiting a slight impact or indirect effect contemplated in Table 6.

|

Accounts |

2019 |

2018 |

Investment |

|

Immobilized |

9,454.40 |

9,714.09 |

-259.69 |

|

Intangible assets |

368.68 |

612.8 |

-244.12 |

|

Property, plant and equipment |

8,926.90 |

8,942.46 |

-15.56 |

|

other fixed assets |

158.82 |

158.82 |

-0.01 |

|

Depreciation |

208.98 |

208.98 |

|

|

Investment to measure indirect impact |

-50.71 |

Table 5 Determination of the magnitude of investment in the Panama Canal for 2019 (in millions of dollars)

Prepared by the author based on data from the state of situation of the Panama Canal Authority.

|

Production |

Rent |

Employment |

Salary income |

Quotes |

I/In come |

Available rent |

saving |

Consumption |

||

|

Direct effect |

3,213 |

2,488 |

9,701 |

830 |

216 |

124 |

490 |

49 |

441 |

|

|

indirect effect |

3.1 |

3.4 |

553 |

6 |

1 |

1 |

3 |

0 |

3 |

|

|

induced effect |

638 |

354 |

12,148 |

94 |

||||||

|

TOTAL EFFECT |

3,855 |

2,845 |

22,403 |

929 |

||||||

|

Part. C-GDP |

4.6 |

3.7 |

0.5 |

|||||||

|

Part. IC-GDP |

5.5 |

4.2 |

1.2 |

|||||||

Table 6 Economic impact of the Panama Canal for the year 2019 (Millions of dollars and percentage shares)

Prepared by the author.

For its part, the income effect has more impact, expanding up to 0.9 percentage point of GDP, setting the participation of the Canal's activity at 5.5% when adding all the effects, presenting a lower intensity in the added value of 0.5%11 and 0.7%12 in employment; however, salary income has a growth of 12%, considering the contribution of $94 million based on this effect (Table 7).

|

Accounts |

2020 |

2019 |

Investment |

|

Immobilized |

9,373.47 |

9,454.40 |

-80.93 |

|

Intangible assets |

644.8 |

368.68 |

276.12 |

|

Property, plant and equipment |

8,560.72 |

8,926.90 |

-366.18 |

|

other fixed assets |

167.95 |

158.82 |

9.14 |

|

Depreciation |

221.08 |

221.08 |

|

|

Investment to measure indirect impact |

140.15 |

Table 7 Determination of the magnitude of investment in the Panama Canal for 2020 (in millions of dollars)

Prepared by the author based on data from the State of Situation of the Panama Canal Authority.

The dynamics explained above on the direct effects of the activity of the Panama Canal in 2020 translates into a better and greater impact on the Panamanian economy, as a result of the good performance of the activity that achieved a record when a cargo crossed through this route. quantified at 475 million tons, despite the slowdown in the economy and trade due to the covid-19 pandemic.23 Even the Panama Canal Authority is more concerned about the condition of the reduction in rainfall, which was 20% in 2019 and which forced it to take measures to reduce the passage of deep draft ships, than the effects of the coronavirus itself.24 This good behavior is evidenced by the estimated investment of $140.15 million that was submitted to the model, as well as the magnitude of purchases in the order of $679.3 million (Table 1), although it could have been higher if it had not fallen by 6.4% (Table 2).

Given the above, when observing Table 8, the total effects on production exceeded $3.4 billion to $4.3 billion, that is a jump of 1.6 percentage points, as well as the added value of 1.8 points, when going from $2.8 to $3.2 billion and with less intensity in employment estimated at 0.9% as 12,389 jobs were generated indirectly (2,465) and induced (9,924). In the same way as the direct effects, the valuation of salary income analyzed in previous sections reveals that they have a great impact on the economy, but less than that experienced in 2019, that is, 11.5%, exceeding the total effects of $879 million to those recorded as personnel expenses of $789 million; resulting in a direct tax reduction of $19 million compared to 2019 ($ 340 MM in 2019 and $321 MM in 2020), but $6 million more indirectly ($2MM in 2019 and $8MM in 2020).

|

Production |

Rent |

Employment |

Salary income |

Quotes |

I/Income |

Available rent |

saving |

Consumption |

|

|

Direct effect |

3,443 |

2,764 |

9,510 |

789 |

203 |

118 |

467 |

47 |

420 |

|

indirect effect |

266 |

133 |

2,465 |

21 |

5 |

3 |

12 |

1 |

11 |

|

induced effect |

605 |

347 |

9,924 |

69 |

|||||

|

TOTAL EFFECT |

4,314 |

3,244 |

21,899 |

879 |

|||||

|

Part. C-GDP |

6 |

5 |

0.6 |

||||||

|

Part,. IC-GDP |

7.6 |

5.8 |

1.5 |

Table 8 Economic impact of the Panama Canal for the year 2020 (Millions of dollars and percentage shares)

Prepared by the author.

In 2021, there is a decline in the estimated investment of $-145.34 million (Table 9), highlighting the reduction in intangible assets in $-292.39 million, tangible fixed assets in $-82.37 million and the $-2.65 million; that sufficiently exceeds the level of depreciation encrypted in $232.06 million. In that sense and as a consequence of this magnitude, the indirect impact is unfavourable (Table 10), despite the fact that purchases have increased in $44.3 million observed in Table 1 (from $679.3 MM in 2020 to $723.6 MM in 2021), after the good numbers in the cargo crossing by establishing a record with 516 million tons.23

|

Accounts |

2021 |

2020 |

Investment |

|

Immobilized |

8,996.07 |

9,373.47 |

-377.41 |

|

Intangible assets |

352.41 |

644.8 |

-292.39 |

|

Property, plant and equipment |

8,478.35 |

8,560.72 |

-82.37 |

|

other fixed assets |

165.3 |

167.95 |

-2.65 |

|

Depreciation |

232.06 |

232.06 |

|

|

Investment to measure indirect impact |

-145.34 |

Table 9 Determination of the magnitude of investment in the Panama Canal for 2021 (in millions of dollars)

Prepared by the author based on data from the State of Situation of the Panama Canal Authority.

|

Production |

Rent |

Employment |

Salary income |

Quotes |

I/Income |

Available rent |

saving |

Consumption |

|

|

Direct effect |

3,959 |

3,235 |

8,958 |

811 |

219 |

122 |

470 |

47 |

423 |

|

indirect effect |

-158.3 |

-75.8 |

-963 |

-12 |

-3 |

-2 |

-7 |

-1 |

-6 |

|

induced effect |

595 |

339 |

10,296 |

77 |

|||||

|

TOTAL EFFECT |

4,395 |

3,498 |

18,290 |

876 |

|||||

|

Part. C-GDP |

5.9 |

4.9 |

0.5 |

||||||

|

Part,. IC-GDP |

6.5 |

5.3 |

1.1 |

Table 10 Economic impact of the Panama Canal for the year 2021 (Millions of dollars and percentage shares)

Prepared by the author.

However, the boost from the income effect given the growth in personnel spending of 2.8% (Table 2), allows the production of the Panama Canal with all effects to gain 0.6%, the added value to expand by 0.4% and in employment, 10,296 new jobs will be generated. These indicators are lower than those obtained in 2019, including the induced salary income ($77 MM vs $94 MM generated in 2019), but higher than that observed in 2020, which was estimated at $69 million.

The scenario in which the activity of the Panama Canal takes place for 2022, includes the increase in interest rates by the Federal Reserve of the United States, whose objective is to slow down the economy and thus control inflation, which As Wiseman25 puts it, affects everyone, from which this activity does not escape, which slows down its growth estimates, placing the variation in production at 9.2%, at 9.9% in added value and at 6.1% in purchases from others. Sectors, below the change seen in the previous year (Table 2). This implies that the cargo that passed through the Canal slightly exceeded that of fiscal year 2021, on this occasion it reached 518 million tons CP-Suab13, with a record ship transit record of 14,239, of which 13,009 are deep draft; condition attributable to the passage of 897 more ships than in 2021.26

Under this situation, the impact of production managed to stretch the direct effect of production with respect to GDP by one percentage point, going from $4.3 billion to $5.1 billion; while added value and employment expanded by 0.6% (Table 12), indicators with a lower level presented in 2020, considering positive investment values, of course with a marked gap, which for this year was in $10.06 million (Table 11). Once again, the income effect generates a considerable impact on the economy, as it cannot be otherwise, the change shown of 10.5% in personnel spending explains the improvement in the average salary of 13.4% (Table 2), managing to obtain the best results in production ($674 MM), added value ($383 MM) in the entire period analyzed since 2019, while in jobs (11,655) and in salary income, They remain below what was achieved in 2019.

|

Accounts |

2022 |

2021 |

Investment |

|

Immobilized |

8,783.88 |

8,996.07 |

-212.19 |

|

Intangible assets |

285.45 |

352.41 |

-66.96 |

|

Property, plant and equipment |

8,331.86 |

8,478.35 |

-146.49 |

|

other fixed assets |

166.56 |

165.3 |

1.26 |

|

Depreciation |

222.25 |

222.25 |

|

|

Investment to measure indirect impact |

10.06 |

Table 11 Determination of the magnitude of investment in the Panama Canal for 2022 (in millions of dollars)

Prepared by the author based on data from the State of Situation of the Panama Canal Authority.

|

Production |

Rent |

Employment |

Salary income |

Quotes |

I/Income |

Available rent |

saving |

Consumption |

|

|

Direct effect |

4,323 |

3,555 |

8,727 |

895 |

242 |

134 |

519 |

52 |

467 |

|

indirect effect |

74.1 |

37 |

798 |

9 |

2 |

1 |

5 |

0 |

4 |

|

induced effect |

674 |

383 |

11,655 |

88 |

|||||

|

Total effect |

5,070 |

3,975 |

21,179 |

991 |

|||||

|

Part. C-GDP |

5.6 |

4.8 |

0.5 |

||||||

|

Part,. IC-GDP |

6.6 |

5.4 |

1.1 |

Table 12 Economic impact of the Panama Canal for the year 2022 (Millions of dollars and percentage shares)

Prepared by the author.

This increase in personnel spending explains the better direct tax benefits, that is, $35 million ($376 MM in 2022 and $341 MM in 2021), as well as in the indirect effects that reach $3 million, although exceeded by the data generated in fiscal year 2020, which was estimated at $8 million, of course considering the best condition of the investment for that exercise of $140.15 million, meaning $21 million of salary income indirectly (Table 8).

In short, the dynamics of the Panama Canal has led to the economic management of our country, taking into account the elements whose traceability has demonstrated the comparative advantage due to the geographical position since 1532, taken advantage of by the great powers and which has meant a cyclical process as a consequence of the international trade since then. The world is shaken by different economic phenomena and the Panama Canal continues to provide systematic support to the entire global economic system, benefiting the Panamanian economy internally.

7It represents 3.7% of the added value of the Republic of Panama, when observing Table 6.

8Also in the same table, this indicator for 2019 represented 0.5%.

9Some 516 million tons passed through, setting a record despite the fact that the world went through a supply crisis as a result of the pandemic, which led to port bottlenecks and container congestion.23

10In Table 1 they represent $725.7 million for this year.

11It is the proportion when dividing $. 638 million among $67,595 million displayed in Table 1.

12It is the proportion by dividing 22,403 jobs by 1,846,353 jobs.

13Panama Canal Universal Vessel Measurement System.

That the impact of the Panama Canal points the way for our economy based on the service sector and that this is confirmed by participating with all effects between 5.5% and 7.6% of the GDP in the period analyzed, resisting the onslaught of the crises starting with the health sector, the supply or container sector, the war between Russia and Ukraine and the rise in interest. Likewise, the Added Value indicators are presented, whose contributions ranged from 4.2% to 5.8% of the total in Panama; although in employment the pre-pandemic data has not yet been recovered, that is, from the 22,403 jobs in 2019 that were produced with all effects to the 21,179 given in 2022.

That since 2019, the Panama Canal has broken records annually in the cargo transited, maintaining how important the investment was in the expansion of the canal in the order of $5,250 million in nine years starting in 2007 and that it has translated into 400 million tons in 2019, 475 million in 2020, 516 million in 2021 and 518 million in 2022. This has meant a constant growth in turnover that in relative terms ranges from 7.2% in 2020 with respect to the 2019, at 9.2% in 2022 compared to 2021, without taking into account the increase of 15% between 2021 and 2020 that substantially alters the trend, explained by the high demand for inputs, products and other merchandise that this unique milestone represented in the middle of economic recovery around the world.

That the Panama Canal has a very high salary income, its induced effects are significant, to the point that they exceed $600 million, with the exception of fiscal year 2021 in production, with approximately 57% allocated to added value. This income effect is responsible for 12,148 jobs, 54.2% of the total in 2019, while in the midst of the pandemic it contributed 45.3% of the total, that is, 9,924 of 21,899; Even better was the support of the container crisis, by generating 10,296 jobs of the 18,290 of those generated in 2021, being 56.3% and 55% of contribution for 2022, by generating 11,655 jobs of 21,179 in between of the increase in interest rates by the United States Federal Reserve.

None.

The author declares that there is no conflict of interest.

©2024 Batista. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.