eISSN: 2576-4500

Review Article Volume 5 Issue 1

Business School, Dublin City University, Ireland

Correspondence: Marina Efthymiou, Business School, Dublin City University, Glasnevin, Dublin 9, Dublin, Ireland

Received: January 31, 2021 | Published: February 10, 2021

Citation: Efthymiou M. The fundamentals of environmental regulation of aviation: a focus on EU emissions trading scheme. Aeron Aero Open Access J. 2021;5(1):9-16. DOI: 10.15406/aaoaj.2021.05.00122

Air transportation is contributing to economic prosperity, facilitating growth particularly in developing countries. The main objective of the paper is to give an overview of the fundamentals of environmental regulation of the aviation industry and provide a comprehensive analysis of the European Union Emissions Trading Scheme (EU ETS). A functional comparative analysis of the existing environmental regulations and policies in the aviation industry with reference to welfare economics literature review provides a more solid understanding of the policy differences in terms of objectives, efficiency and enforcement measures.

Keywords: sustainable aviation, environmental regulation, emissions trading scheme, aircraft emissions, climate change

Air transportation is contributing to economic prosperity, facilitating growth particularly in developing countries. Air transportation facilitates world trade by transporting goods of high value.1,2 The main benefit that aviation offers is the connectivity that encourages investments and improves productivity.3,4 Aviation has direct, indirect, induced and tourism catalytic economic impacts.5 Aviation according to ATAG6 is a major employer offering 58.1 million jobs globally (8.7 million direct jobs, 9.8 million indirect jobs and 35 million aviation-enabled tourism jobs).

Apart from the positive economic impact of aviation, aviation contributes to society. Aviation facilitates the transportation of people and goods. It increased cross-border travel, which contributed to a closer relationship between states. The improved social and economic networks, encourages social and economic integration.7 Furthermore, it improves the living standards, alleviates poverty and increases revenues from taxes. Finally, air transportation is necessary for places with poor road or rail connections and offers connectivity in case of an emergency, like natural disasters, health epidemics or wars.8

Nevertheless, the rapid air transport growth has created a series of environmental problems from noise pollution to climate change.9 Aviation is one of the most energy- and carbon-intensive forms of transport, whether measured per passenger, per km or per hour of travelling. The main objective of the paper is to give an overview of the fundamentals of environmental regulation of the aviation industry and provide a comprehensive analysis of the European Union Emissions Trading Scheme (EU ETS). A functional comparative analysis of the existing environmental regulations and policies in the aviation industry with reference to welfare economics literature review provides a more solid understanding of the policy differences in terms of objectives, efficiency and enforcement measures.

Section 4 summarises the contribution of aviation to climate change. Section 5 discusses the fundamentals of environmental regulations and section 6 explains in detail the European Union Emissions Trading scheme of aviation. Section 7 outlines the principles of carbon offsetting and the parameters for linking the various ETSs. Finally, section 8 concludes the paper.

The combustion of fuel in the engines of airplanes results in emissions of carbon dioxide (CO2), nitrogen oxides (called NOx) and water vapour and particles. Carbon dioxide is a greenhouse gas and alters the balance of incoming and outgoing radiation from the earth's surface and contributes to the warming of the atmosphere. Emissions of carbon dioxide from the air have the same effect on the climate, such as terrestrial broadcasting, from power plants, industries etc. Carbon dioxide has an atmospheric lifetime of up to 200 years, so it reaches the lowest point of the atmosphere for all that time and it does not matter where it is emitted from.10,11

Emissions of nitrogen cause a series of chemical reactions in the atmosphere. Nitrogen oxides form ozone (O3) in the presence of light, and as the light intensity is higher in altitude, the more ozone is formed because of altitude than from terrestrial sources of NOx. The nitrogen oxide emissions from subsonic aircraft accelerate local production of ozone in the lower atmosphere, where the aircraft usually flies. The increase in ozone concentration will generally be proportional to the amount of nitrogen oxides emitted by airplanes.

Ozone is a powerful greenhouse gas, whose concentration is highly variable and controlled by the atmospheric chemistry and dynamics. The increase in the retention of radiation by ozone is greater than that of carbon dioxide emissions. However, ozone is responsible for the destruction of atmospheric methane (CH4). Methane is also a powerful greenhouse gas, with an atmospheric lifetime of 14 years. The destruction of methane as a direct result of civil aviation leads to the reduction of global warming caused by aviation emissions.11

Water vapour is also an important greenhouse gas, but emissions of water vapour only by air have little direct impact on the planet. Water vapour have short atmospheric lifetime and is controlled by the hydrological cycle. The vapour emissions at high altitudes produce contrails, a cloud-like trail behind the aircraft and are visible from the ground. These contrails also trap heat in the atmosphere and their thermal effects are believed to be equivalent to that of carbon dioxide. The contrails are not formed at lower altitudes, so they could be avoided if the planes flew lower. This however could not be done because the density at lower altitudes is greater and airplanes will burn more fuel.10,11

Emissions of sulphate and soot from burning also have little effect on the temperature of the atmosphere. Traces of sulphate are present in the combustion and form aerosols of sulphate compounds. Those reflect the incoming solar radiation back into space, and thus have a small cooling effect. Conversely, small particles are produced from combustion (soot) trap outgoing infrared radiation into the atmosphere and thus have little effect on global warming. These are quantitatively insignificant and it is believed that they almost cancel each other.10

The key feature that is affected by "greenhouse gases" is radiation balance. This is the balance between incoming solar radiation and microwave outgoing long-wave infrared radiation. Any disturbance to the balance is called Radiative Forcing, RF and is expressed as the change in energy flow in W/m2.12

The RF does not account for the influence of a single flight a day, but the overall impact of all known historical aviation emissions. IPCC has estimated that the change in RF emissions from aviation in the pre-season is 0,049 W/m2.13 The effect of RF on aviation in terms of contribution to the general RF was estimated to be 3.5% in 1992 and 5% in 2050.14 The Aviation Climate Change Research Initiative (ACCRI) researches the RF and claims that a 2% increase in fuel efficiency and a decrease in NOx emissions thanks to advanced aircraft technologies and operational procedures, combined with alternative fuels use, will decrease significantly the aviation’s impact on climate change.5

To provide lift to an aircraft, thrust is produced by means of the combustion of an energy source. This combustion produces noise due to the explosion processes of the energy carrier, combined with that of moving parts of the engine, and chemical pollutants. The exhaust composition is known to be 70% carbon dioxide (CO2), 29% water vapour (H2O) and 1% of other pollutants such as the various oxides of nitrogen (NOX), carbon monoxide (CO), oxides of sulphur (SOX), unburned hydrocarbons or volatile organic compounds (VOCs), soot or particulate matter (PM) and other trace compounds. These are considered to be local air quality (LAQ) pollutants or greenhouse gases (GHGs) depending on whether the emissions occur near the ground or at altitude respectively; though CO2 is always a GHG, not an LAQ pollutant.

Efforts to reduce NOX increase fuel consumption and other pollutants, while reducing noise increases NOX and fuel consumption. The combustion of 1kg (1.25 litres) of conventional jet fuel emits 3.15 kg of CO2. There are also indirect effects–warming and cooling-due to contrails (though there are still major uncertainties regarding their precise impact).

Environmental regulation is looking into minimizing and internalizing the negative externalities. One of the possible ways to address externalities in aviation is by imposing restrictions on travelling.15 Its implementation is very difficult and the society loses the surplus from the sale of this service. On the other hand, the airlines can continue the volatile work, but to use inputs that are more expensive. For example, they can use cleaner types of fuel that will emit less Greenhouse Gases (GHG). However, the use of more expensive input is a cost to society.

In the absence of corrective action, those who pollute will continue doing so up to the point where the marginal private benefit from production equals marginal private cost.16 The company that pollutes incurs no additional cost due to its negative production externalities if there is no external regulation. In this case, negative production externalities are not due to the failure, but due to the absence of the market for clean air or property rights.16 Emissions trading scheme in aviation is the creation of a cap-and-trade market addressing negative externalities.5,17

One way the government can intervene in a market with externalities is through a system of "standards and charges". Whereby the government decides a fixed size of damage caused by the externality and then charges to force the responsible ones to reduce the externality to a desired level.18 Some countries have imposed taxes such as the Air Passenger Duty (APD) in the UK. Another way of regulating environmental externalities is the Command and Control regulation, where the polluter is obliged to reduce its emissions in order to avoid incurring legal penalties. Single European Sky (SES) performance regulation requires the Air Navigation service Providers (ANSPs) to improve the horizontal en-route flight efficiency.19

Taxes are one of the best-known Market Based Measures (MBM). Pigouvian tax is a tax levied on each unit of production that pollutes and is exactly equal to the marginal damage that creates the optimum level of production.16 Taxes levied on passengers depending on the flight length and the class travel could only reduce emissions through their effect on air travel demand, and they would give rise to some leakage effects.15 Adopting a Pigouvian tax on aviation, carriers would be forced to take into account the cost of the external economies they create; hence, carriers will be forced to produce in the optimum level of production.

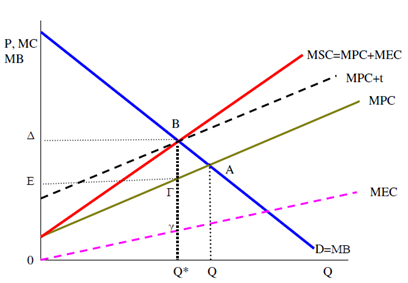

As seen in Figure 1, the equilibrium of the market if it runs smoothly is at point A, which is not optimal in Pareto. It is assumed that marginal private benefit equals to marginal social benefit, i.e. there is no demand side externality and all externalities are related to production. Point B is an optimal point and the difference between social and private costs is BΓ. When imposing a tax t per unit in good/service that pollute and which is equal to BΓ, then the private cost curve is shifted to the position of the curve (Marginal Social Cost) MPC +1, which passes through the optimal point B.

Figure 1 Implementing tax to correct the impact of negative externalities.5

However, there are several practical problems in the enforcement of this tax. First, someone must define what activities produce pollution and how much. In addition, which polluting units actually cause damage and what is the value of the damage being caused.16 The Pigouvian taxes aim at bringing marginal private costs, as these influence choice, into line with social costs, as these are objectively measured. Only with objective measurability can the proper corrective devices be introduced.

The existence of externalities like government intervention documentation was challenged by Coase theorem according to which if there are no transaction costs (TC) and negotiations, individuals affected by an externality will agree themselves in a distribution that is Pareto-optimal and independent of property rights. The presence of deficiency enables the parties involved to gain from working together to eliminate it.16 The rationale is that if the benefits to someone from an activity that has externalities exceed the costs incurred by the other, then the first can compensate (bribe) the second and improve the position of both. However, there are some practical problems with the theorem of Coase. Initially there is a cost of trading and the logic that each person has an incentive to let others bear the cost, when he enjoys the benefits.16 Finally, there is difficulty in determining the source of loss and asymmetric information.16 The assumption that TCs are negligible or equal to zero leads to a frictionless economic system according to Rao.20 Coase aimed to examine the implications of such a system on efficient functioning and to throw light on the sub-optimality of certain stipulations in a non-zero TC world.20

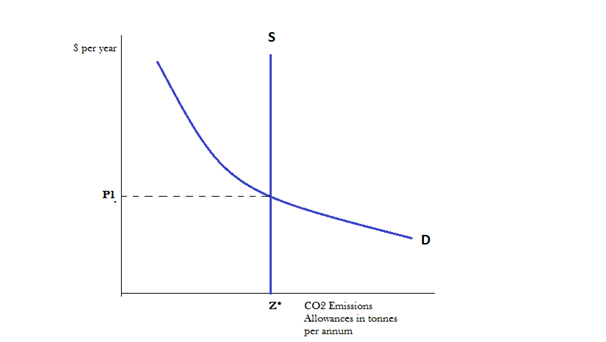

Finally, a very important way of state regulation of external economies is creating market. The government increases economic efficiency by selling emission permit to producers.16 Thus, a market for clean air is created. The price paid for the license to emit is called emission allowance.16 According to Figure 2, the government decides to sell emission permits Z * and firms compete to buy the right to hold an allowance. The price charged is the one that equates the market supply and demand and so is set by government (P1). The offer of permits is perfectly inelastic in Z *. Businesses that are not willing to buy at this price must either reduce their production or change their technology.16

Figure 2 Market for pollution permits.5

The creation of a market to be effective requires that someone knows who pollutes and in what quantities. Auctioning reduces the uncertainty on the upper level of pollution and acts as an economic incentive.16 The problem of time inconsistency concerns situations where someone creates an expectation with the intention of inducing another in specific options, and then does not fulfil the expectation. Of particular interest is the case that the time inconsistency improves the position of all. A typical example is the EU ETS and ‘stop the clock’.

The main difference between the Pigouvian and Coasian approaches to this issue arises in their methods of dealing with economic externalities. The role of the state in assigning property rights versus the levying of taxes and/or subsidies has been the underlying difference between them. According to ATAG21 air travel is the only means with access to remote and isolated areas and therefore performs social work.

Welfare economics is the part of the economic, where the possible effects of different kinds of economic policy on the welfare of society are studied.22 Welfare economics allow the separation of situations under which markets can bring good results from situations where they will produce undesirable results.16 Pigou could be considered the founder of welfare economics. Pigou argued that it is obvious that any transfer of income from a relatively rich to a relatively poor man of similar temperament, should increase overall satisfaction, since it enables the overall satisfaction in being able to meet more pressing needs at the expense of less pressing needs, which provoked strong reactions from Robbins.22

A very important aspect of welfare economics is the social welfare function. Bergson in 1939 was the first to introduce the concept of social welfare function.22 A general form of the function is:

W=W(A1,…..Am)

Where W is the social welfare and A is the variables which determine the social welfare.22

A Pareto-social welfare function can be expressed as follows:

Fn=f (U1,…Un)

Welfare economics is based on two fundamental theorems.18 The first argues that any competitive equilibrium is a Pareto optimal balance for the economy. Thus, demand equals to the production when the economy reaches the competitive allocation. The second fundamental theorem is in a sense the opposite of the first, which tells us that each Pareto optimal allocation of an economy can be achieved as a competitive equilibrium for an appropriately defined distribution of income. A situation is Pareto efficient if someone cannot be brought in a better situation without worsening someone else’s. An example can be the airlines that pollute the environment and create a negative externality on society.

According to the Coase theorem ‘in the markets with externalities if property rights are clearly defined and if the parties can negotiate inexpensively, then the parties will reach a Pareto-optimal outcome regardless of who owns the property rights’.18 A method of government intervention to mitigate the effects of externalities caused by pollution is creating tradable pollution permits.18 Each permit allows a company to pollute up to a certain degree. The advantage of this method is that because firms can pollute only if authorized and because the government decides how many licenses will be available, knows exactly the amount of pollution after the sale of licenses.18

For example, there are two airlines, A and B. Figure 3 shows the functions of the marginal cost of reducing pollution. The regulator decides that pollution should be reduced and decides to give allowances to allow a certain amount of pollution. Any company can choose whether to buy allowances to continue polluting or reduce its activities to comply with the regulation or take other measures (like operational improvements) to comply with the pollution limit.

Figure 3 Functions of the marginal cost of reducing pollution for two airlines.5

If airline A does not purchase further allowances, it will have to pay $4 for an equalizer with the first unit of pollution and $6 for the second, so $10 in total. Airline B has a higher marginal cost of reducing emissions, and will have to pay $14 to equal the emissions. When these rights are auctioned for airlines A and B, Company A will reach up to $10, after that amount the company will not "bid" anymore since that would be the cost to "clean up" its emissions. Company B could bid up to $14, but since Company A will stop at $10, company B can earn additional rights with a price slightly above $10. By this way, a reduction of emissions for the society is achieved at the lowest possible cost. Because of the existence of external economies, people and companies do not pay the true social costs for specific resources, but fewer.23 The more a company pollutes the environment, the greater the social cost. The government can control the output by imposing an emission charge (effluent fee) or by issuing transferable emissions permits.23

The EU ETS is one of the main instruments used by the EU to reach the statutory reduction of greenhouse gas targets. The EU ETS is a ‘cap and trade’ scheme. Under the EU ETS, the European Union (EU), plus Iceland, Liechtenstein and Norway have set a ceiling or a maximum amount for annual emissions of carbon dioxide (CO2) from large industrial sources.24

Global carbon markets can be divided into two categories: the regulator (or compliance) and the voluntary market. The Emission Trading Scheme belongs to the first category, the regulatory market. Trade of pollutants is used by governments to reduce greenhouse gas emissions (GHG). The ETS uses various mechanisms of the economy to create a price on emissions. The carbon trading involves trading of rights (permits, allowances, credits) to emit a certain amount of emissions. Because of this commercial dimension, an economic incentive is created.5 For example; airlines reduce their emissions or acquire emission units from other projects under the auspices of the ETS and/or by investing in reduction strategies.

A quantity of "allowances" or permits to emit one metric ton of CO2 is given or it needs to be bought by each individual. At the end of each year, each emission source must return the allowances at least equal to its emissions for the year. In case, that the source does not return with sufficient allowances it will have to pay a fine. As time passes by, the emission ceilings will be reduced and fewer allowances will be issued, causing CO2 emissions to be reduced because of the level established by the ceiling.25,26 The original European application of the Kyoto Protocol did not include emissions from aviation. In 2008, the European Parliament and the Council adopted a new law, Directive 2008/101/EC, amending the EU ETS (Directive 2003/87/EC) to include aviation activities. The EU ETS in aviation is only about CO2 emissions from airplanes.24

For every MT CO2 emitted by a source, should be transformed to a right/allowance. For 2012, the 85% of emission allowances in aviation were offered free to aircraft users and the 15% were auctioned.27 For the period 2013-2020, the 83% are offered free, the 15% are auctioned whereas the remaining 3% are banked for new entrants in the market or for fast growing airlines.27 This intertemporal flexibility reduces the overall compliance costs.5,28

The initial allocation to the units is done through a benchmark system regarding the tone-kilometres that the aircraft flown from, to or within the EU during 2010. Every unit is receiving the 0.6797 free allowances (baseline) for every 1,000 ton kilometres of flight. For the period 2013-2020 the cap is reduced to 95% from the emissions from 2004-2006, the target is also further reduced.25 In phase three, an airline receives 0.6422 allowances per 1,000 tonne-kilometres flown.27 The cap on total allowances for phase three has been set at 210,349,264 per year. This is equivalent to 95% of 'historical' emissions.27

Airlines requiring more allowances can purchase them from EU auctions, other carriers and other sources of emissions in the EU ETS or other international emissions trading mechanisms. A small reserve of free allowances will be available for new or rapidly expanding airlines.29,30 The entry into force of the EU legislation covering emissions from international aviation is a significant move in the last two decades regarding whether and how the aviation CO2 emissions can be mitigated. According to the rules of the UNFCCC,31 almost all the emissions are calculated in the country where they occur. Much of the emissions associated with international air transport, however, take place in international airspace.

To minimize compliance costs and to provide flexibility to sources, the EU ETS permits allowances to be negotiated. A source that has more allowances than necessary can sell the extra to another source that needs more, or to other entities, such as "allowances agent". The amount of the purchased allowances affects the price for the allowances. It is the aim to establish price of allowances, which are higher compared to the costs of reducing emissions by one ton. This aim gives economic incentives to reduce the amount of emission and to sell unused allowances to other polluters. It also gives businesses (e.g., technology companies) incentive to develop new, lower-cost means of reducing emissions.24

Directive 2008/101/EC amended the EU ETS Directive 2003/87/EC and included aviation activities within the scope of the ETS as follows:

The EU ETS excludes certain types of flights from the cap-and-trade system, such as flights from airports that do not belong to EU Member State, flights transferring governors, military aircraft, search and rescue flights, circular flights, Public Service Obligation (PSO) and flights for training purposes.27 Furthermore, flights under the de minimis criteria are excluded. These criteria include flights with airplanes with maximum certified take-off weight of less than 5,700 kg, flights from airlines with less than 243 flights for 3 continues 4-month periods or flights with annual emissions under 10,000 Mt per year.24

An airline that needs more allowances that the ones that allocated to it for free, can bit in the auctions that are frequently organised by the national governments or the market that holds allowances that wants to sell.27 Because the high needs of airlines are part of an open system of emissions trading, the allowances can be purchased from entities from other sources (i.e. non-airlines) that are part of EU ETS or from credible/approved sources that have excess allowances coming from projects of developing countries. Moreover, airlines that have excess allowances can sell to other entities too.28,29 If an airline does not comply with the EU ETS there is a fine for excessing the permitted quantities. The fine is 100 € for every tome of CO2 that is above the allowances allocated, a quantity many times higher than the expected prices in the carbon market. The air carrier is also responsible for the submission of allowances for the next year’s emissions. The EC regulation took under consideration also the situation when an air carrier does not comply from for than a year to the regulation. The worst-case scenario is that the carrier will not be allowed to operate to the EU.25

The Member State is required to inform and consult the EC on how they will use the profit coming from EU ETS. There are concerns if the revenue will be used for the aviation industry and/or for the decrease of the Green House Gases (GHG).25 Within each Member State, a designated “competent authority” is responsible for administering the EU ETS with respect to airlines. To reduce administrative costs, each operator is administered by a single Member State, the one that issued its operating licence or by the state with the greatest estimated attributed aviation emissions from that operator in the base year.27

Airlines can be allocated to the Member State to and from which most of their flights operate. Given the role of London’s Heathrow Airport as a significant hub for flights into and out of Europe, a large number of airlines have been assigned to the UK. Germany, France, Spain and the Netherlands also act as administering States for a large number of carriers. Thus, there is high administration cost related to EU ETS for those countries. Forsyth15 argues that an air transport specific ETS would be an inefficient means of achieving a country’s targets. He also argues that the emissions reductions in aviation may be quite small, because they do not have much scope to reduce. Nonetheless, if the ETS operates sufficiently overall, there is no problem if aviation does not achieve a great reduction in emissions. The regulation has different percentages for the different options for allowances in the area of aviation.

The EC is following a multisectorial/multidimensional approach in handling the GHGs from aviation taking measures in the Member States separately and all together. EU ETS is one of the many measures the EC is using to handle environmental problems in aviation.17,28 Other measures are for example research projects for technology and biofuels, like Clean Sky Joint Undertaking or changes in the airspace structure like SES.

EC suspended the application of the Emissions Trading Scheme to all the airlines overflying Europe pending new impetus that might be given by the ICAO Council to find a multilateral solution to combating climate change in the aviation sector. European Commission decided to ‘stop the clock’ (Decision No. 377/2013/EU). According to this Decision air carries that depart or land to an EEA airport are not obliged to surrender any allowances back and are exempted from the EU ETS. Carriers that depart and land to an EEA airport are obliged to submit the same amount of allowances they were given. For example, a flight from JFK to FRA is not subject to EU ETS, but a flight from HRW is subject to EU ETS. Emissions from flights between aerodromes in the European Economic Area (EEA) remain fully covered under the EU ETS. Flights from and to outermost regions are excluded, with the exception of Canary Islands, Melilla, Ceuta Aland Islands, French Guiana, Guadeloupe, Martinique, Reunion, Saint Martin, Azores, Madeira, Jan Mayen, Gibraltar.

The emission factor from biofuels according to the EU ETS is zero. Therefore, there is no need to return allowances and possible future costs are avoided. If the materials or fuels containing both, and fossil and biomass percentage, the percentage of biomass is the ‘calculation factor’.32 Sustainability criteria should be applied to biofuels and bio-liquids consumed in order to assure that they have a zero emissions of greenhouse gases in the activities of the aircraft operator covered by EU ETS. A biogenic material that does not comply with the sustainability criteria of the Directive on Renewable Energy, as applicable, is considered as a mineral, i.e. the emission factor is greater than zero.32

According to ICAO Doc 988533 one allowance is generally defined as a permit to emit one tonne of CO2-equivalent. There are companies that have excess credits, meaning they stay under the cap and have spare allowances that they can sell to other companies that exceed their allowances. This practice is based on the financial incentive of the buying/selling process. Consequently, trading emissions allowances is a way to offset carbon. The credits offered by the International Emissions Trading are called Assigned Amount Units (AAUs). Additionally, to AAUs tradable units and pricing information for offset credits under the EU ETS are based on those used for the CDM and JI project-based mechanisms respectively.34

There are two principal types of carbon credits: certified emission reductions (CERs), which are backed by the UN, and voluntary emission reductions (VERs). VERs are backed by recognised quality standards such as the Voluntary Carbon Standard (VCS) and the Gold Standard. VERs plays an important role in emission projects with high sustainable development benefits.24 Airlines have also the option to bank the excess allowances for future use. Allowing carriers to bank allowances for future use reduces social costs by efficiently distributing abatement choices among different time periods.5 According to ICAO35 most airlines provide a fair degree of transparency about the price of offsetting a flight. There is a huge variation between the prices per tonne of CO2 that customers can pay to offset their aviation emissions.

Monitoring, reporting and verification (MRV) of emissions play an important role in the reliability of any emissions trading scheme. Without MRV, there would not be transparency in compliance and it would be much more difficult to enforce. Therefore, MRV applies to the EU Emissions Trading Scheme (EU ETS). It is the complete, consistent, transparent and accurate monitoring, reporting and controlling that creates trust in the emissions trading system. This is the only way to ensure that air carriers and aircraft operators comply with their obligation to surrender sufficient allowances.32

The EU ETS is an instrument based on the market. The market participants therefore want to know the monetary value of the options granted to them, trade and must hand back. At the same time, it is a means of ensuring and achieving environmental benefits in Europe level. This requires a significant level of fairness among participants, ensuring a stable MRV system to ensure that a ton CO2 emitted "meets" the corresponding tonne mentioned (under the principle that: a tone must be a tone). The competent authorities monitor to ensure that the objectives set by the "cap" are achieved.32 In order to ensure efficient implementation of the directive for EU ETS, every aircraft user is assigned to only one member-state. In case the aircraft user holds a valid Air Operator Certificate (AOC) that is given by a member state according to the EU regulation 2407/92, the member state that gave the licence is the one that is responsible. In all the rest cases, the member state where most of the emissions take place is the responsible one.

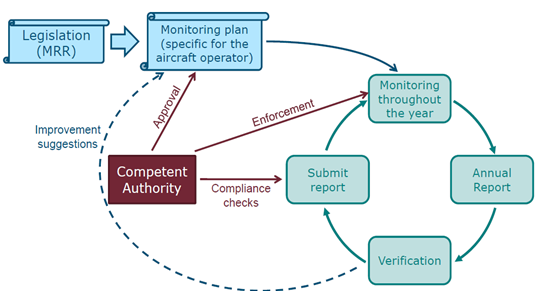

Every aircraft user should monitor its annual emissions from activities that are involved in EU ETS.32 The annual process of monitoring, submission of reports, compliance checks and acceptance of the reports about the emissions from the competent authority is usually referred as compliance cycle.32

The cycle in the right side of Figure 4 is the main cycle. The airline is monitoring its emissions during all year. After the end of the calendar year (within 3 months), the airline should prepare its annual report about its emissions (AER), ask for verification and submit the verified report to the Competent Authority (CA) as indicated by Reg N0 100/2014. The last report should be associated with the surrender of the allowances to the system. Monitoring continues without any break until the end of the year. The process is very important for the trust towards the system and the credibility of EU ETS. The process should also be consistent during all the years thus the airline should ensure that the monitoring process is documented and cannot change without any notice. Regarding the EU ETS, the written process is called Monitoring Program (MP).32

Figure 4 The compliance cycle of EU ETS.36

Figure 4 also depicts some very important responsibilities of the CA. CA should focus on the compliance of the aircraft users. The first step is to approve every monitoring plan before its implementation. Nevertheless, the compliance cycle has a wider perspective. Finally, there is a second cycle. This is the tactical re-examination of the monitoring plan, for which the verified form might offer important information. Moreover, the aircraft users are requested to continuously try to improve the methodology of monitoring.32

Carbon Offsetting projects are an attempt to internalise the externalities associated with anthropogenic climate change. According to Golden Standards’ Carbon Offset Handbook, Carbon Offsetting is the financing of emission reductions outside of your flight’s emissions. There are several ways of offsetting carbon emissions, ranging from purchasing carbon allowances from a cap-and-trade scheme, to using carbon credits from unregulated or regulated carbon offset projects. Each airpassenger can pay to offset the emissions caused by their share of the flight’s emissions. Passengers can offset their emissions by investing in carbon reduction projects that generate carbon credits. For example a passenger when booking the ticket has the choise of donating money for instance to the Envira Amazonia Project. Envira Amazonia is a payment for ecosystem services forest conservation project, otherwise known as a Reduced Emissions from Deforestation and Degradation (REDD+) project, protecting nearly 500,000 acres/200,000 hectares of tropical rainforest.

In addition, IATA discribes market possibilities for Carbon Offsetting. There are two markets for carbon offsets in aviation and in the overall industry: the voluntary and the compliance market. Both of them are a way for individuals or organizations to “neutralize” the proportion of aircraft’s carbon emissions on a particular journey by investing in carbon reduction projects. Furthermore, there is also the possibility that indivudal customers participate directly in Carbon Ofsetting programs. Each airpassenger can pay to offset the emissions caused by their share of the flight’s emissions. Passengers can offset their emissions by investing in carbon reduction projects that generate carbon credits.

The main goal of buying carbon offsets is that they should generate genuine emissions reductions. In order to ensure the quality of the offset programmes, the following principles should be respected:37

The term “linking” describes that the one system’s allowances or another system’s commercial units can be used directly or indirectly by one system joining another system for compliance.38 The linking of systems creates larger emission reduction systems with better financial liquidity and harmonized prices without distortions due to competition, and thus less vulnerable.39 The existing emission trading systems differ in size, cognitive characteristics, cost-containment and geographical scale, but also the type and volume of trading units.39

The direct connection allows transactions between different systems and can be distinguished by whether they allow trading in one or more directions. According to a unilateral connection, entities belonging to the system A can buy and use rights coming from the system B for compliance, but not vice versa.39 If the system A establish a one-way connection recognizing rights from system B, and the rights price of system A is higher, trading between systems will occur until prices converge at an intermediate level. If the price of the system A is lower, there will be no incentive for trade between the two systems.39 A critical factor in unilateral connections is the effect it will have the A system that will be connected to B system.39 The connection of big cap and trade system with a smaller will increase the price of the small equalling to the value of the largest.

In a complete linking, emission rights are traded freely between two or more systems and are equally valuable for compliance.39 There is the option of using as intermediate link the Clean Development Mechanism.39 In addition, areas with rising carbon prices due to linking systems will experience more leakages. The opposite will occur in areas with declining prices. There is also the possibility the caps be relaxed to the countries in order to benefit from the additional sales.39 The economic impact of linking emissions trading systems can be of three types:40 a) quasi-static, short-term gains efficiency; b) dynamic efficiency gains; and c) the distribution results.

To link two or more emissions trading systems among themselves, the following parameters should be considered:39

Carbon offsets should be part of a climate strategy by a company/organization. Aviation for instance, cannot be carbon neutral, since it operates in an energy mix based in fossil fuels. A climate strategy is not enough in order the company to eliminate internally the emissions. Two developments have substantially affected aviation, EU ETS and the continuous rise in fuel prices. This trading scheme shall provide economic incentives to reduce CO2 emissions based on market principles as well as set fix limits of the mount of emitted emissions. The Kyoto Protocol and the EU ETS are based on the principle that the emission of pollutants is a commodity and a measure is required to calculate the degree of equivalence between the different gases.

Emissions trading are a market-based policy tool that can be used to promote economic efficiency in achieving environmental goals. By harnessing market forces, emissions trading regimes can create incentives for economic agents to discover and implement cost-effective approaches to complying with environmental targets. The aircraft operators are obliged to monitor and report their annual emissions to their Competent Authority (CA). The CA should make compliance checks on the surrendering of allowances, inspect the monitoring throughout the year and approve (or not) the GHG permit and monitoring plan pf the aircraft operators. It is evident that the aircraft operators and the CA have many responsibilities and a lot of documentation to fill in as well as well as management procedure.

The EU Emissions Trading Scheme is the biggest ETS in scale and size in the world. Aviation was recently included in it and so far only CO2 emissions are regulated. Despite the lower abatement costs (i.e. the cost of reducing negative environmental externalities) for aircraft operators in comparison to other possible environmental regulations, the inclusion of aviation to EU ETS was not widely accepted by all airlines and states outside Europe.

The strong point of the EU ETS is the safeguarding systems to address environmental and social risks as well as the sustainable development criteria. EU-ETS can be used to simultaneously promote economic efficiency and achieve environmental goals on a sustainable basis. The policymakers should approach EU ETS by taking into consideration all industries and addressing climate change holistically. The discussion of the present study will hopefully contribute in this direction.

None.

Author declares that there is no conflict of interest.

©2021 Efthymiou. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.