eISSN: 2576-4500

Research Article Volume 7 Issue 1

1College of Safety Science & Engineering, Civil Aviation University of China, China

2School of Aviation & Transportation Technology, Purdue University, USA

Correspondence: Chien-tsung Lu, Purdue University, West Lafayette, Indiana 47907, USA

Received: January 05, 2023 | Published: January 17, 2023

Citation: Cheng M, Hosty B, Xu A, et al. Multivariate regression analysis of airline market recovery in the post-pandemic era. Aeron Aero Open Access. 2023;7(1):7-11. DOI: 10.15406/aaoaj.2023.07.00164

While COVID-19 has substantially affected the airline industry, a business rebound is expected. To better anticipate the needed workforce, this study revisited economic datasets from the Federal Reserve Bank, Bureau of Transportation Statistics (BTS), the Federal Aviation Administration (FAA), and other essential resources to predict the market recovery. VOSviewer and multivariate regression analysis were used to identify critical research clusters and important variables of the emerging market recovery. Minitab was used to run the multivariate regression analysis and the correlation coefficients among selected variables were discovered. The result showed that strongly correlated variables for airline market recovery included Net Domestic Product (NDP), Gross Domestic Product (GDP), and Real Disposable Personal Income (RDPI) in this study.

Keywords: airline market, market recovery, post-pandemic preparedness, multivariate regression analysis, VOSviewer

GDPC1, real gross domestic product; DJFUELUSGULF, kerosene type jet fuel prices US gulf coast; INTDSRUSM193N, interest rates discount rate for the United States; SP500, S&P 500 Index; GNP, gross National product; PERMIT, new privately owned housing units authorized in permit issuing places; AWHAEMAN, average weekly hours of all employees, Manufacturing; DSPIC96, real disposable personal income

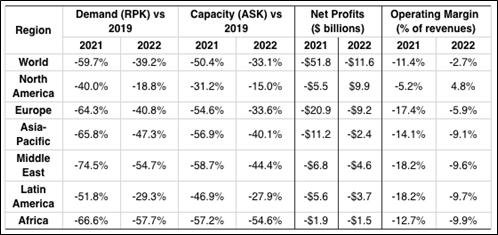

COVID-19 is a highly infectious respiratory virus. Within months, COVID-19 spread across the globe, and political leaders were forced to take emergency action to deter the virus spread. Regardless of the fear of being infected in public areas like airports, imposing travel restrictions, onboard social distancing, and face mask protocol, substantially affected the public desire to travel by air. According to a report published by International Air Transportation Association (IATA), a total financial loss was around $201 Billion, whereas only in 2020 the global airline industry lost $137.7 Billion.1 Airline financial performance by region is shown below in Table 1.

Table 1 Airline financial performance by regions

Note: IATA (2021 Oct.) Losses Reduce but Challenges Continue - Cumulative $201 Billion Losses for 2020-2022.

The purpose of this study was to determine essential variables that could help indicate an industry recovery.

During the COVID-19 pandemic, world passenger traffic decreased by 60%, from roughly 4.5 billion passengers carried in 2019 to just under 2 billion passengers carried in 2020 (Figure 1).2,3 On the bright side, airlines initiated innovative strategies for business survivability while the economy slowly recovered when compared to the passenger volume between 2019 and 2022.

Figure 1 World passenger traffic evolution – 1945~2022.

Note: ICAO (2021). 2020 passenger totals dropped 60 percent as COVID-19 assault on international mobility continues.

ICAO estimates world passenger traffic to increase by 30% in 2022 compared to 2020 levels (ICAO, August 12, 2022). With the prompt development of COVID-19 vaccines and lifted travel restrictions around the world, the commercial aviation industry had started to slowly rebound excluding the “yellow line” Asia/Pacific region (Figure 2).2 This observation was due to the meticulous “Zero-COVID” quarantine policies in China until January 8th, 2023.

Figure 2 Seat Capacity Average, 2019 vs. 2020 ~ 2022.

Note: ICAO (August 12, 2022). Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis.

Air transportation workforce and gross domestic product (GDP)

Civil air transportation directly accounts for “2.3% of Gross Domestic Product (GDP), $850 billion in economic activity, and over 4 million jobs” in the U.S.4 The aviation business is volatile to economic downturns. During COVID-19, American Airlines furloughed 19,000 jobs and 23,500 employees who accepted buyouts, early retirement, or took leaves of absence.5 Many airlines followed a similar strategy and maintained a low-temperature operation expecting the restrictions to be lifted and the market to be restored soon. While the global passenger volume is slowly recovering, the airline industry must arrange the workforce properly to avoid manpower shortages leading to operational disruption.6

The United States government passed public laws to help air carriers sustainable including the Payroll Support Program (PSP1) and PSP2 (PSP1 extension) subsidizing employees, under Subtitle B of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act offered a consolidated amount of up to $40 billion to passenger airlines as of February 2021.7 Unfortunately, the public experienced flight delays and unpredictable cancellations from American Airlines, United Airlines, Spirit Airlines, and Southwest Airlines just to name a few due to demand reduction as well as infected staff.8 The decreased demand and flight cancellations have been subject to a vicious cycle leading to more manpower furloughs.

Strategic responses to the unforeseen crisis

Guzhva and Pagiavlas’s (2004) conducted a study that aimed to separate the impact the 9/11 attacks had on airline performance from the impact of other relevant economic factors that influenced the airline industry using data from 1977 to 2003.9 Using revenue passenger miles (RPMs) to estimate total revenues and real Gross Domestic Product (GDP) as an effective economic indicator. Guzhva and Pagiavlas’s findings suggest that it is difficult to predict how an economic shock will affect an airline regardless of structure but having competent managerial capability as well as effective means of cost control is more important for performance than the airline structure or model. One of the major responses to the terrorist attacks on September 11, 2001, was the creation of the Air Transportation Safety and System Stabilization Act, which provided $5 billion directly to the airlines and $10 billion of loans or loan guarantees under the Air Transportation Safety Board.10 Mantin and Wang (2012) found that after 9/11, the capability of operation and productivity measures are significant factors when predicting airline profitability instead of service quality used to measure profitability before 9-11 attacks. It is simply because passengers have adapted themselves to the tightened security process and long queues.11 According to the IATA report, governmental largesse has to be of critical importance in preventing more airlines from collapsing in 2021 than in 2020 during the pandemic outbreak.12 With the dynamic virus variants, governmental supports include providing loans, loan guarantees, cash injections, equity financing, as well as a tax break for ticket, corporate, and fuel.13

Data-driven strategies

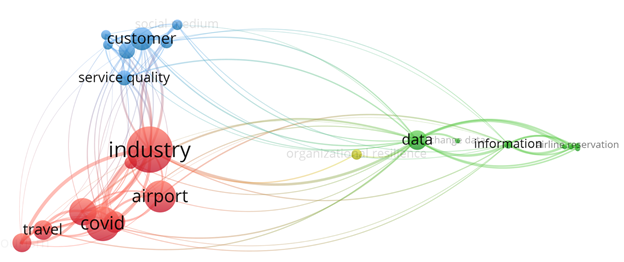

The airline business is extremely sensitive to economic dynamics. To elaborate, the authors used the keyword of “airline business recovery” through the Web of Science database and VOSviewer process to conduct a bibliographical analysis and discovered that two clusters tourism industry and customer satisfaction have been closely tied to data cluster where data was the key component to identify business deficiencies and the customer loyalty, which helped continue enhancing resilience during the economic recession such as the global pandemic (Figure 3).14

Figure 3 Bibliographical analysis of research focuses between 2020 and 2022 (airline business recovery).

Note: Jan van Eck, N. & Waltman, L. VOSviewer manual. 2019.

Another quick bibliographic analysis using “pandemic market recovery” as the keyword. The result showed three vital indicators including economy, strategies of sustainability, and tourism (Figure 4) that had been predominately concerned and studied. The economy cluster included the labor market, employment, financial market, stock market, price, and outbreak.

The quick bibliographic analysis of world airline business above had revealed sound indicators of business resilience during the pandemic. In the same vein, the forecast of airline business recovery would decide the manpower arrangement. Thus, this study focused on the following two research questions for the best decision-making:

The authors chose a mixture of qualitative and quantitative analysis as the methodology to collect data and ensure reliability and validity. The qualitative method is defined as collecting, analyzing, and working with text and diverse analysis techniques without indicating ordinal values.15,16 Using VOSviewer, the authors are able to present visualized data related to initiatives responding to catastrophic events. Multivariate regression analysis was applied to identify the criticality of each selected variable affecting market recovery. The definition of reliability of the qualitative method is the extent of a procedure’s consistency when carried out, however, and whenever, despite circumstances of their P-values.17 If all agree and find them logical and reasonable, the inter-rater must be a hundred percent, and the indicators are reliable.

What variables are essential to airline market recovery?

The authors reviewed previous research archives and presented the following eight economic variables essential to airline market recovery.18–21

GDPC1 - Real Gross Domestic Product, Billions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted Annual Rate (Federal Reserve Economic Data).

How do the identified variables affect airline operations?

The authors chose multivariate regression analysis to decide the relationship between revenue passenger miles (RPMs) (the dependent variable) and the aforementioned eight identified independent variables. Raw data were retrieved from the Federal Reserve Economic Data, dated between 2012 Q2 and 2021 Q2. These were used to provide a general idea of the U.S. economy with the performance of the nation’s workforce, big companies, stock market, and personal living. When analyzing from 2000 Q1 to 2021 Q2, indicators, S&P 500, and average weekly hours of all employees in manufacturing were left out due to limited data availability dates. These two were added to the regression analysis from 2012 Q2 to 2021 Q2. To see how much of the change in RPMs can be explained by each selected independent variable, the natural log of each was taken and analyzed. From 2012 to 2021, the output showed an R Square value of 0.9469, meaning nearly 95% of the variation in RPMs can be explained by eight selected indicators. Meanwhile, the significance F value of 8.25E-16 is statistically significant. Interest rates, S&P 500, new housing permits, and average weekly hours of all employees in manufacturing all have a P-value bigger than 0.05, indicating no statistical significance, while other indicators have P-values significantly less than 0.05 (Table 2).

Furthermore, the regression analysis of data from 2000 Q1 to 2021 Q2 reveals an R Square value of 0.8276, meaning close to 83% of the variation in RPMs can be explained by the following five variables (GDPC1, INTDSRUSM193N, GNP, PERMIT, DCPIC96) excluding DJFUELUSGULF - Kerosene-Type Jet Fuel Prices (Table 3).

This evidence is corroborated by Cohen et al.,22 who found a strong correlation between GDP growth and passenger growth. However, income elasticities during recovery periods tend to be lower than in normal times and in downturns. This implies that income has a small impact on the aviation industry during recovery periods.22 It is important to note the different nature of this recession, where passengers and governments are taking safety considerations. The change of coefficient in Tables 2&3 regarding INTDSRUSM193N (Interest Rates, Discount Rate for the United States) indicated that a lower interest rate could create opportunities of increasing airline RPMs or service preparedness.

Data from the U.S. BTS showed an effort by airlines to offset non-labor operating costs, such as reduction of flight frequency, manpower, and fuel consumption during the COVID-19 Recession. Initial mask mandates and social distancing requirements challenged the operational strategies of airline forcing open seats between passengers, detailed cleaning and disinfection of aircraft between flights, etc. Despite many press releases and news stories about airline employment during the pandemic, labor cuts during COVID-19 were insignificant due to economic stimuli like the CARES Act. Yet, the government’s relief funds only generated a short-term effect. In other words, airlines’ self-sustainability is imperative.

Using the multivariate regression analysis, eight economic indicators (GDPC1 - Real Gross Domestic Product; DJFUELUSGULF - Kerosene-Type Jet Fuel Prices: U.S. Gulf Coast; INTDSRUSM193N - Interest Rates, Discount Rate for the United States; SP500 - S&P 500, Index; GNP - Gross National Product; PERMIT - New Privately-Owned Housing Units Authorized in Permit-Issuing Places; AWHAEMAN - Average Weekly Hours of All Employees, Manufacturing; DSPIC96 - Real Disposable Personal Income) were found to explain 95% of the variation in RPMs from 2012 to 2021. The authors, with the indicators of two multivariate regression analyses and inter-rater reliability, agreed that real GDP, GNP, and personal disposable income are consistent variables because they passed both significance tests in Tables 2&3. These findings could help airlines to be more sustainable in periods of uncertainty. These economic variables can predict passenger growth during times of intense difficulties, but it is also important to consider government lockdowns and vaccine mandates when forecasting an airline market rebound from COVID-19.

When forecasting a market recovery from COVID-19 in aviation, it is important to consider government lockdowns, vaccine mandates, protocols, etc.

None.

The authors declare that there is no conflict of interest.

None.

©2023 Cheng, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.