eISSN: 2576-4500

Research Article Volume 6 Issue 1

1Escola de Gestão, Engenharia e Aeronáutica, Instituto Superior de Educação e Ciências, Portugal

2Escola de Gestão, Engenharia e Aeronáutica, Instituto Superior de Educação e Ciências, Portugal

3Turismo e Lazer, Escola Superior de Hotelaria e Turismo do Estoril, Portugal e Universidade Aberta, Portugal

Correspondence: Ana Barqueira, Centro de Estudos e Investigação Aplicada (CEIA), Instituto Superior de Educação e Ciência, Alameda das Linhas de Torres, 179, Lisboa, Portugal

Received: February 18, 2022 | Published: February 26, 2022

Citation: Barqueira A, Quadros R, Abrantes J. Airline booking applications: the case of Ryanair, Easyjet and tap air Portugal. Aeron Aero Open Access J. 2022;6(1):7-15. DOI: 10.15406/aaoaj.2022.06.00135

The internet favors direct contact with airline followers: mobile devices, including smartphones, are the ideal platforms to sell without any kind of intermediation. Digital technologies in airlines facilitates the process of acquiring various services including airline tickets which is the main objective. The aim of this study is the mobile applications used by airlines and what are the main differences arising from their use. The research question that arises is: do the digital tools that airlines use associated with their business model present many differences? This study adopted a cross-sectional survey design where data was collected from 184 individuals who habitually use smartphones and mobile applications, using an online questionnaire. The methodology used involved statistical treatment of the answers obtained from the questionnaire that was drawn up in accordance with the objectives of the study. According to the results, 92.9% of participants used a smartphone and it is noted that airline applications and online booking applications are the most preferred. The results also show that flight check, check-in and flight booking are the services most requested by consumers and when assessing preferences regarding its function versus its ability to attract customers, TAP's application is the preferred one.

Keywords: Airlines, Airline business models, Digital technologies, Mobile devices, Smartphone applications

ICTs, Information and Communication Technologies; APP, application; LCC, low cost carrier; ULCC, ultra low cost carrier; FSC, full service carrier; U.S.A., United States of America; UK, United Kingdom; URL, uniform resource locator; SMS, short message service; MMS, multimedia message system; PC, personal computer; IATA, international air transportation association; IOS, Apple’s mobile operating system; OTAs, online travel agencies; R&D, research & development

In recent years there have been major changes in the air transport industry due to the introduction of new digital tools, which have a strong impact on the way companies operate. The biggest advantage of mobile communications and commerce is that it offers suppliers a direct communication channel with consumers through a mobile device, anytime and anywhere.1 Mobile devices create an opportunity to offer new services to customers and attract new ones. Airlines should perceive mobile communication and e-commerce as interactive ways of doing business.1 The concept of fully exploring the business environment that the internet has made possible is a reality that all companies have been facing.

Research in service innovation has evolved from a generic perspective to a product and service differentiation perspective, emphasizing the need for an integrated approach to technological and non-technological aspects.2

The context of vigorous competition in the markets, leads airlines to improve their operations by offering applications to make reservations that can be obtained on mobile devices.3

Recent advances in information and communication technologies (ICTs) have transformed the business models of distribution channels and traditional players will continue to disappear due to technological development.4 With the development of ICTs, mobile devices such as smartphones allow consumers to access the Internet to retrieve information about a variety of services.

Airlines are aware of the benefits, and end up improving their operations by improving their websites and offering apps to purchase airline tickets.3 In 2015, over 25% of the global population used a smartphone, demonstrative of the growing importance of bookings made in a smartphone environment, and the use of social media.5 In 2022, the global smartphone penetration rate will reach 67.1% of the world population, an estimated value of 5.31 billion smartphones,6 and this figure is expected to increase to 7, 69 billion users by 2027.5 We live in a digital age with 62.5% of the world's population using the internet regularly and 58.4% (4.62 billion users) are active users of social networks.6

The starting question of this work is: "How do brands in the air transport industry communicate and promote service offerings on mobile devices in Portugal"? The objective is to analyze how low cost carriers, on the one hand a Low Cost Carrier (LCC) and on the other hand an Ultra Low Cost Carrier (ULCC), as well as the so-called flag carriers (Full Service Carriers – FSC), communicate through the use of different mobile devices. It is also interesting to assess whether the devices made available are suitable for effective use by their customers, namely through the consumer's perception of the particularities of this sector.

Today people live the "time of the customer", that is, people do not absorb anything in a passive way as they do with outdoor advertising or e-mails. Technology is everywhere in communication, and this is increasingly personalized. It is becoming more and more usual for people to shop around, and to guide business in the way people want, and consider to be the most convenient.

The “time of the customer” and the mobile marketing

The world is increasingly digitalized and more interconnected by millions of connected networks converging on the customer, and the customer can take advantage of this just by "surfing" on a single device (smartphone). The word "smartphone" was reportedly first used in 1997 to describe a mobile phone that had been manufactured by Ericsson. They allow users to install and run computer applications on their devices over a wireless network without resorting to a personal computer.7 The growth of the Internet and personal computers, accessible since the 1990s, has offered unparalleled opportunities for airlines to reduce their distribution costs.

The civil aviation industry was inherently suited to e-commerce, as carriers needed to continuously sell large quantities of a perishable product (airplane seat) to a large number of geographically dispersed buyers.7 The first airline websites appeared in the early 1990s. The pioneers (e-pioneers) included American Airlines (U.S.A.), the Norwegian airline Braathens, and the low cost carriers EasyJet (UK), Ryanair (Ireland), and Southwest Airlines from the United States of America. Initially, these sites operated as simple services for delivering contents, route and schedule information and that was available in printed form, with no function to interact with the site and no ability to book or manage flight reservations.

In a relatively short time, airline websites have evolved into flexible, interactive, and secure reservation systems and communication tools. Most airlines have registered Internet domains (URLs) that matched with their name and in many cases have become an intrinsic part of the brand and service offering. Companies capture their customers through various channels, and mobile has become an integral part of the marketing strategies of large companies. Mobile marketing is a digital, multi-channel marketing strategy aimed at reaching a target audience through their smartphones, tablets, and other mobile devices, via websites, e-mail, SMS (Short Message Service) and MMS (Multimedia Message System), social networks, and apps.

While it may seem that mobile marketing has been around for a long time, it is in fact a mistake, being a marketing activity that has been around for less than a decade, constituting a new channel. Benitez considers that mobile marketing is a tool where projects, advertising and marketing can be developed.8 Kaplan defines mobile marketing as any marketing activity conducted through a permanent network through which consumers are constantly connected via a personal, mobile device.9 Today, everything that can be done on a computer desktop is available on a mobile device. The consumer of an airline company, for example, opens his e-mail account, visits his company's website, and reads the content, all through a small screen on a smartphone.

The ability to browse, shop, send a text, explore a map, using only one device has become the norm. The more "intelligent" the consumer is, greater the involvement and connection with companies.

Online booking has been widely used in the management and marketing areas of airlines. Smartphone usage has been low, and in 2016, only a small percentage of people in the US (13%) used their cell phone to book online, or to purchase an airline ticket, due to the challenging nature of the process, when compared to doing so through online travel sites on a Personal Computer (PC).10 A new survey in 2018 from Travelport (based on 16,000 travelers in 25 countries) showed that 61% of U.S. travelers are more dependent on their smartphones and booked and payed for their trips through mobile devices.11

Due to the fast rhythm of life, travelers tend to choose high-speed transportation. Globally, the number of passengers carried by air reached 4.543 million in 2019, up 4,1% from 2018.12 The effects of the COVID-19 pandemic have dictated sharp drops in world passenger traffic (-65.9%, or 1.807 million passengers in 2020), with a slow recovery in the coming years. According to the IATA, the number of passengers in air transport will rise to 3.432 million, an increase of 51% compared to the values forecast for 2021.12 The commercial aviation industry considers digitalization an important strategy to improve its productivity, attract more customers and play a vital role in its survival.13

The traditional approach of doing business offline has moved to the internet platform, and success depends on how you manage your e-commerce site to attract customers and promote your business.14 Hootsuite's Digital-2022-Global-Overview-Report (2020) found that the total global internet users reached 4.66 billion in 2020, which is 59.5% of the global population (evolving, as previously mentioned, to 62.5% in 2022 –[6]).

The figures show the rapid growth of e-commerce in the current business environment, and confirm that effective website maintenance is crucial to the survival of all industries, such as tourism, accommodation, and air transport.13 Global Online Travel Market Size is projected to be US$ 1,463.98 Billion by 2027, from US$ 800.72 Billion in 2021,15 mainly by Online Travel Agencies (OTAs) and Direct Travel Suppliers as airline direct websites.

According to the International Air Transport Association, as of the second quarter of 2016, the market share for online ticket sales via airline websites reached 33% and the airline mobile apps was 2%. These figures can be expected to increase to 37% and 7% respectively till 2021.16 In that way, airline IT services are rising significantly in priority, with the majority of airlines investing in mobile applications for passenger services (88% of airlines planning major programs in R&D by 2024).17 EasyJet has sold 90% of tickets online since 2003 and 20% of total tickets via mobile app.18 Low-cost airlines rely on online sales and sales and apps are growing more and more.

According to a study conducted by Sales Force Research in 2018 of over 7000 consumers and titled "State of the Connected Customer," 58% of consumers agreed that technology has changed the way companies should interact with their customers.19 Its 2020 edition, based on more than 12,000 consumers in 27 countries, reinforced engagement and trust in brands (the result of the high lock down period caused by the pandemic), with 88% of consumers expect companies to accelerate digital initiatives due to COVID-19.20

Companies are continuously looking for new forms and vehicles of innovation, namely mobile technology, cloud platforms and emerging forms of artificial intelligence. With a cell phone in hand, the customer becomes the great facilitator, the one who is permanently connected, the one who buys, the one who reviews products, the one who follows brands on social networks, among many other tasks/activities.

Companies that do not involve the smartphone in their communications with their target audience are already at a disadvantage. This 'way of life' will expand as the influence of millennials as they are the ones who are permanently connected, adopting lifestyles and focused on mobile devices. This generation belongs to the digital age and depends on the virtual phenomenon based on their small smartphone. As customers become more connected, the ability to share and discuss experiences with products, services and brands becomes easier. It is customers who decide about their trips and they are the ones who increasingly have the power to influence their peers.

The implications for companies are dramatic if they cannot control the reputation of the brand they represent. The content that people create becomes the trusted sources on brand reputation as posts and social media are the trusted source of proof of brand quality (for better or worse). As a result, companies must prove the value of the brand as a customer experience worth talking about and disseminating to others. Everything happens in real time and the expectation of interaction is increasing. Customers and companies want interactions with brands to be instantaneous, rewarding the culture of immediacy between consumers, products and services.

Mobile applications, which abbreviate is apps, are a set of mobile marketing tools and have become important in the service sector, and for this reason cannot be considered as a simple communication tool. Marketing should not be just a "fashion" tool or something that companies adopt to keep up with the competition.

The internet is an important medium, and the increase in smartphone and tablet users means a big rise for mobile marketing. Apps live with people permanently and are increasingly becoming an essential and exclusive tool for their users.

An example in the air transport sector is Amsterdam Schiphol Airport that treats mobile marketing as a great opportunity to increase the satisfaction of its passengers, also improving the image of the airport itself.21 The creation of an app has improved the experience of passengers in all areas that they enjoy at the mentioned airport. Following that, according to the World Airport Awards data in 2013, Schiphol won in that same year the award for the best airport in Europe and the third best in the world. Indeed, for 30 years, Amsterdam Airport Schiphol has won almost 200 European and global airport awards from both airline and passenger organizations, including Best Airport in Western Europe in 2020 (Skytrax), Best Airport in Europe 2012, 2013 and 2016 (Business Traveller), Best Airport in Europe 2015, 2016, 2017 and 2018 (Business Traveller UK) and so on.22

The usefulness of an application for a mobile device is not imperative to its geo localization, but, from a marketing point of view, the ability to customize and adapt the experience of the passenger who is the direct user of it. Therefore, in a digital economy, companies must create wealth by aggregating and applying knowledge.23 Airlines should try to manage all their offer and resources to the potential passenger so that he can have all the necessary information in a fast way and through a smartphone. The mobile application is a marketing tool with similar characteristics as direct marketing. Bernardo and Priede even describe "mobile marketing as a new way to connect".24 For other authors, direct marketing is the main means used by an organization to communicate in a direct way with current and potential customers.25

Passenger behavior

Until very recently, the concept of "mobile" meant application for mobile devices, and could be found in an App Store or on the web and accessible via URL (Uniform Resource Locator). More and more the traveler wants to experience using the app and not just search and make reservations.

A study conducted by Travelport Digital with 955 travelers in November 2017 showed that 58% of people prefer apps to research flights and that 53% prefer using those same apps to find their hotel. The same study shows that consumers want an extremely fast mobile experience and that this can only be a reality if it is through apps. This work also shows which activities people use apps for and why they prefer apps to the web. The research highlights the opportunities that brands may have when studying how to connect to the customer journey.26

In the near future the large majority of passengers will use smartphones to plan their leisure trips with travel-related apps. Travel-related apps appear in seventh place in the category of most downloaded apps.26 According to the same 2017 Travelport Digital study:

The landscape on digital operates very quickly in the pretense and desire to fulfill the needs of passengers.26 According to other Travelport Digital report, titled by "Mobile Travel Trends" 2018, airlines took 68 years to gain 50 million users. Super Mario Run surpassed 50 million users in just 8 days in early 2017 (an impressive fact on IOS, Apple's mobile operating system).27

Once the digital transformation has begun, one of the airlines' major objectives is to gain the attention and loyalty of their customers. The smartphone is a key device in the relationship with customers due to the "power" of apps. According to the report mentioned earlier, in 2017 the total number of app downloads was estimated at $197 billion and in 2016 it was $149 billion, and by 2021 it is estimated to reach $352 billion.27

The reasons why apps are used, how often they are used, including the predisposition to use emerging technologies including voice and chat bots (software that uses artificial intelligence to mimic conversations with users on various platforms) were also studied.27 The frequency with which passengers use travel-related apps is growing as never before, in fact 64% of passengers have an app installed on their cell phone and 69% use apps on a very regular basis.27

The same study said that 36% of respondents now have two or more apps installed, which is an indication to travel and transport companies of the excellent opportunity to use apps as a marketing platform to drive engagement between customers and companies. It highlighted a growing trend in app usage and the demonstration that there is still a very large margin for this trend to continue.27

Airline and travel company brands place a strong focus on user experience by noting that the primary reason for using apps is the interest in researching and booking a trip, with the usual benefits of alerts and notifications. The results of the Travelport Digital study also revealed that app-specific functionality, such as mobile boarding passes, resulted in an optimal user experience, with speed and personal preferences playing a key role for travelers as they prefer to use a smartphone app.27 Travelers increasingly prefer to use airline and travel apps for mobile devices, especially to search and book a flight, as well as to check-in and generate a mobile boarding pass.

According to Accelya, a world leader in technology products for aviation and tourism, in 2016, internet users are currently and rapidly moving from the desktop PC (Personal Computer) environment to mobile devices. Data for 2022 show that most people between the ages of 16 and 64 use smartphones to access the internet (90.7%), with 71.2% of respondents also using laptops or desktops.28 This change affects all industries and air travel is no exception. In 2017, according to the same source, 10% of airline revenues would come from mobile channels, representing $70 billion.28

Travelers use mobile devices for various reasons, such as researching flights and itineraries, buying tickets, managing reservations, and providing feedback on the service provided. The shift from desktop to mobile Internet access offers airlines the potential to generate huge revenue gains and valuable margins. Airlines will need to apply their marketing strategies to mobile applications in order to improve the passenger experience, thereby generating additional revenue to the available aircraft seats.

Several airlines are leading the way in mobile marketing. According to the Future Travel Experience website, KLM has has a partnership with Schiphol Airport to install 2000 beacons (a Bluetooth-based signal transmitter, with the smartphone merely a receiver) to help direct passengers to boarding gates and keep them informed about flight details. KLM customers can also use the app to select seats, check in or purchase additional services, such as increased baggage allowance.29

According to Accelya (2019), Virgin Atlantic and British Airways, meanwhile, are two of the biggest leaders in mobile marketing at Heathrow Airport. Both use beacons to connect with passengers from the moment they arrive at the airport and to receive offers from partners and/or to provide updates and important information. Emirates is another leading airline with a website that redirects users to a page optimized for mobile devices when customers connect via smartphone. Passengers can use the app to order a meal, arrange transportation, and to get information about dedicated departure lounges for premium customers.28

The more users adopt mobile devices, the more the airlines will engage with potential passengers by taking advantage of the new mobile environment. Wireless applications are likely to continue to evolve and drive innovative and powerful features. The development of 3/4/5G connectivity, enhanced speed, geographic coverage and bandwidth guess that it is vital that airports and telecom companies invest in fixed infrastructure on the ground to facilitate mobile activity and airlines develop strategies that allow them to capitalize on the benefits of mobile commerce in an increasingly digital marketplace.30

Eyisi defines the research design as a conceptual framework where research is conducted and establishes a basis for collect, measuring, and analyzing data.31

This study used a quantitative research methodology based on the development of a questionnaire that allowed to obtain the response of several variables that were defined in order to provide a more complete understanding of the research topic. The study focused on the main airlines operating in Portugal. On the one hand, the Portuguese airline TAP Air Portugal as a Full Service Carrier. On the other hand, by choosing the main low cost airlines, such as Ryanair (ULCC) and EasyJet (LCC).

The target group of the questionnaire had the common characteristic of being active users of smartphones and mobile applications in their daily lives, showing interest in technological innovations. The study used probability sampling techniques, in particular simple random sampling. The advantage of simple random sampling is that it creates highly representative samples of the population, decreasing the possibility of biased responses. The questionnaire was made available on line using the google forms tool (see appendix) and responses were obtained between January and May of 2019.

The data collected from the questionnaire responses were validated and imported into SPSS software (version 27) to perform statistical analysis. Data analysis was performed using different methodologies - univariate and bivariate. The univariate analysis was based on obtaining frequencies and percentages related to single variables addressed in the questionnaire and the bivariate analysis consisted of using the Chi-square hypothesis test which helped to establish possible relationships between different variables under study. The test statistic used in the Chi-square test is given by the formula presented in equation 1 below.

(1)

The result of the Chi-square test is obtained from the observed value of the test statistic and the respective calculation of the p-value, allowing accepting or rejecting the hypothesis H0 considering a significance level of 5%. The participants of questionnaire were informed about the details of the study, the confidentiality and privacy of their answers.

This chapter presents the most relevant results obtained as well as their interpretation after the statistical analysis performed in SPSS.

Univariate analysis

The presented study involved 184 individuals who habitually use smartphones and other mobile utilities. Table 1 presents results regarding the demographic characteristics of the study participants. Results in Table 1 show that more than half of the participants (63%) were male, and only 37% were female. The majority of participants were aged 36–50 years (39.7%), and the “less 18” and “66 or more” age groups contained the fewest participants (1.1% each). 60.3% of participants are employed, 23.4% are students and 12.5% self-employed.

|

|

Frequency |

Percentage (%) |

|

Gender |

||

|

Male |

116 |

63 |

|

Female |

68 |

37 |

|

Age Group |

||

|

less 18 |

2 |

1.1 |

|

18-25 |

53 |

28.8 |

|

26-35 |

29 |

15.8 |

|

36-50 |

73 |

39.7 |

|

51-65 |

25 |

13.6 |

|

66 or more |

2 |

1.1 |

|

Occupation |

||

|

Student |

43 |

23.4 |

|

Self-employed |

23 |

12.5 |

|

Employed |

111 |

60.3 |

|

Unemployed |

3 |

1.6 |

|

Retired |

4 |

2.2 |

Table 1 Demographic data of participants

Source: Survey (2019)

The analysis of question 4 of the questionnaire ("Is your phone a smartphone?") showed that 92.9% of respondents used a smartphone. As smartphones are devices that allow the installation of applications, it is important to inquire about those that people use when looking to book their travel. Figure 1 shows that airline applications and online booking applications are the most preferred by the participants.

When using applications or other tools to make a reservation, it is important to evaluate the type of devices that are necessary to initiate the user experience in the internet space. For this purpose and as a summary of the answers in this questionnaire (Table 2), the computer continues to be the preferred tool to make a reservation (37%). Smartphones, through applications, appear as the second most voted. The use of tablets is very marginal.

|

|

Frequency |

Percentage (%) |

|

Smartphone |

47 |

25.5 |

|

Computer |

68 |

37 |

|

Tablet |

7 |

3.8 |

|

Smartphone e Computer |

41 |

22.3 |

|

Computer and Tablet |

3 |

1.6 |

|

Smartphone and Tablet |

1 |

0.5 |

|

Smartphone and Computer and Tablet |

9 |

4.9 |

|

Other option |

8 |

4.3 |

Table 2 Analysis regarding the type of device to make a reservation

Source: Survey (2019)

Another relevant aspect is to analyze how low-cost airlines (Easyjet and Ryanair) and the so-called flag carriers, in this case TAP, communicate with their current and potential customers through mobile devices. Customer's perception of the use of these devices may also be reflected in their trust in the mentioned companies. When asked which brand each respondent trusts the most, the answer regarding the TAP brand stands out with 77% (Figure 2).

The frequency with which you travel also requires that communication should be more effective because it can create greater brand loyalty, whether it´s for the way it is informed about the price or for any other reason. It was possible to verify through question 8 that 77 of the participants travel only "once a year", corresponding to 41.8%, while "Four or more times a year" corresponds to the answer given by 40 participants, (21.7%). Turning to the function, and when asked about the existence of a mobile application that allows improving the relationship with the airline that developed it (question 13), the 70% response in agreement is quite illustrative. The 26.6% regarding irrelevance may be related to the non-use of applications in favor of the use of the personal computer.

Regarding the use of apps in the choice of services considered important in the experience of a potential passenger, 24.7% use the app to check flights, 24.5% to perform check-in, and thirdly, the act of booking corresponds to 21.6% of respondents. According to Table 3, the use of apps is not for exclusive use, booking for example, but to use in a set of services as shown in the table below.

|

|

Frequency |

Percentage (%) |

|

Check in |

127 |

24.5 |

|

Select seats |

89 |

17.2 |

|

Booking |

112 |

21.6 |

|

Only explore |

46 |

8.9 |

|

Check flights |

128 |

24.7 |

|

Others |

16 |

3.1 |

Table 3 Type of services you look for when using a smartphone application

Source: Survey (2019)

Bivariate analysis

It is often necessary to measure the degree of relationship between two or more variables. Finding out precisely how much one variable interferes with another involves using methodologies that evaluate the association between them.

To evaluate the association between the two variables represented in Figure 3, the chi-square test was performed and a p-value of 0.021 (<0.05) was obtained, so the null hypothesis should be reject and conclude that the frequency of travel has a significant effect on the use of travel apps. In the analysis of Figure 3 it is observed that those who travel less frequently use the airline apps less. As the frequency of travel increases, so does the use of airline apps.

The analysis of other results obtained also shows that for those who travel once a year, which corresponds to 41.8% of the respondents, 15.2% use hosting apps, 16.8% use online apps, and 9.8% airline apps. Those who travel four or more times a year (21.7% of the selected respondents), half of them (10.9%) use airline apps. The analysis of Table 4 indicates that the age group between 36 and 50 years old is the one that most uses the apps (40.9%), particularly when checking in, booking and consulting the desired flights. The age group between 18 and 25 is the second one with 27.8%, with particular emphasis on check-in and seat reservation.

|

|

Need of services |

||||||

|

Age group |

Check in |

Making airplanes seats |

Booking |

Only explore |

Consult flights |

Other |

Total |

|

Less 18 |

0.00% |

0.00% |

0.60% |

0.00% |

0.60% |

0.00% |

0.60% |

|

18-25 |

23.30% |

17.00% |

21.60% |

6.30% |

22.20% |

1.10% |

27.80% |

|

26-35 |

11.40% |

10.80% |

10.80% |

5.70% |

13.60% |

1.70% |

15.90% |

|

36-50 |

29.00% |

17.00% |

22.20% |

10.20% |

27.30% |

3.40% |

40.90% |

|

51-65 |

8.50% |

5.70% |

8.50% |

3.40% |

9.10% |

2.30% |

13.60% |

|

66 or more |

0.00% |

0.00% |

0.00% |

0.60% |

0.00% |

0.60% |

1.10% |

|

Total |

72.20% |

50.60% |

63.60% |

26.10% |

72.70% |

9.10% |

100.00% |

Table 4 Age Group and Need of services

Source: Survey (2019)

The analysis of the results allowed to observe that two of the age groups considered in the questionnaire included few participants ("less than 18 years old" and "66 or more"). Thus, a new variable was defined, which we called "Age". This variable had three categories, “less or equal to 25”, “26 – 50” and “more than 50” and was used to obtain the graph in Figure 4. In order to evaluate the association between the two variables under study in Figure 4, the chi-square test was performed and a p-value of 0.061 (>0.05) was obtained, so the null hypothesis should be accept and conclude that age does not have a significant effect on the use of travel applications.

According to Table 5 and in relation to the companies under study, when the word "trust" is pronounced in the air transport industry, the TAP brand is always associated in a very positive way. The total value of 76.7% is very significant, namely in the use of check-in applications (54%), flight reservation (46%) and flight consultation (53.4%). Obviously, trust in the brand influences the services to be used.

|

|

Need of services |

|||||||

|

Check in |

Making airplane seats |

Booking |

Only explore |

Consult flights |

Other |

Total |

||

|

Airline you trust the most |

TAP |

54.00% |

35.20% |

46.00% |

19.90% |

53.40% |

8.00% |

76.70% |

|

EASYJET |

2.80% |

2.80% |

2.80% |

1.10% |

2.80% |

0.00% |

3.40% |

|

|

RYANAIR |

4.50% |

4.00% |

5.10% |

1.10% |

4.50% |

0.60% |

6.80% |

|

|

Other Airline Company |

10.80% |

8.50% |

9.70% |

4.00% |

11.90% |

0.60% |

13.10% |

|

|

Total |

72.20% |

50.60% |

63.60% |

26.10% |

72.70% |

9.10% |

100.00% |

|

Table 5 Airline you trust the most and the need for services

Source: Survey (2019)

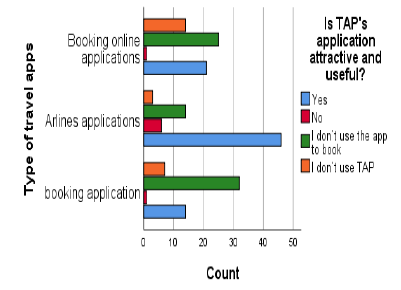

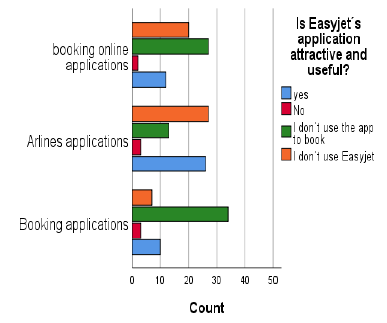

Focusing mainly on the airline applications, the analysis of Figure 5 allows observing that 46 participants say that TAP has an attractive and useful app (33% of participants that use airline apps). The answer "No" represents only 6 answers (4%), and the question of not using the app to book a certain flight has a significant value of 10.1%. As for the opinion about Easyjet's app, 26 agreed that it is useful (18.8% of participants that use airline apps). A significant figure of 9.4% is also observed for participants who do not use Easyjet's app to book flights. Also noteworthy is the 19.6% of those who do not use the low-cost carrier. About Ryanair, dubbed the ULCC, 30 of respondents assessed its app as useful and sufficiently "attractive" (21.7% of participants that use airlines apps). Not using the app to book flights contributes 8% of the choices and 17% do not use Ryanair.

Figure 5 Usefulness and attractiveness of the application in each airline and the type of applications used.

Source: Survey (2019).

Based on the results previously presented, a new scenario was studied which consisted in removing from the sample the participants who reported that they did not use the services of the airlines under study and the objective was to evaluate, for the airline users, if distinct behaviors were observed in the three airlines regarding the association between the usefulness/attractiveness of the apps and the types of apps used in each company.

Table 6 was followed by the chi-square test with a p-value of 0.00 (<0.05). In this case, the null hypothesis should be reject and conclude that, depending on the type of application used for TAP, a different effect is observed in the evaluation of its usefulness/attractiveness (Table 6).

|

|

Type of travel apps |

|||

|

Hosting applications |

Airline applications |

Online booking applications |

||

|

Is TAP´s applications attractive and useful? |

Yes |

17.30% |

56.80% |

25.90% |

|

No |

12.50% |

75.00% |

12.50% |

|

|

I don´t use the app to book |

45.10% |

19.70% |

35.20% |

|

Table 6 Attractiveness/utility of the TAP airline application and the type of travel applications

Source: Survey (2019)

In order to evaluate the association between the two variables under study in Table 7, the Chi-square test was also performed, obtaining a p-value of 0.001 (<0.05), from which the null hypothesis must be reject and conclude that the type of application used by Easyjet has a different effect on the evaluation of its usefulness/attractiveness (Table 7).

|

|

Type of travel apps |

|||

|

Hosting applications |

Airline applications |

Online booking applications |

||

|

Is Easyjet applications attractive and useful? |

Yes |

20.80% |

54.20% |

25.00% |

|

No |

37.50% |

37.50% |

25.00% |

|

|

I don´t use the app to book |

45.90% |

17.60% |

36.50% |

|

Table 7 Attractiveness/utility of the Easyjet airline application and the type of travel applications

Source: Survey (2019)

Finally, the analysis of Table 6 was also accompanied by the Chi-square test, with a p-value of 0.001 (<0.05). In this case, the null hypothesis must be reject and conclude that, depending on the type of Ryanair application used, there is a different effect on the assessment of its usefulness/attractiveness (Table 8).

|

|

Type of travel apps |

|||

|

Hosting applications |

Online booking applications |

|||

|

Is Ryanair´s applications attractive and useful? |

Yes |

20.00% |

50.00% |

30.00% |

|

No |

40.00% |

40.00% |

20.00% |

|

|

I don´t use the app to book |

42.90% |

15.70% |

41.40% |

|

Table 8 Attractiveness/utility of the Ryanair airline application and the types of travel applications

Source: Survey (2019)

Although there are reasons to state that in the different types of mobile applications made available in each airline under study there are significant differences in the evaluation of their usefulness/attractiveness and it is curious to observe that the type of differences found are similar in the different airlines. This fact may suggest that the applications used in the different airlines do not present many differences between them.

The key factors contributing to the massive growth of mobile applications are:

These two factors drive the growth of mobile applications and consequent utilization. Users enjoy the convenience and simplicity of mobile apps. Most smartphone owners keep their devices close at hand, allowing them to perform a quick search for the application they need. It is easy to find the application, "download" it and install it on the smartphone. Phones are always at fingertips, unlike a computer, which is probably why the use of apps has started to increase significantly and sustainably as a priority focus for airlines.

Theoretically, this study allows to answer the question about the importance that smartphone applications have in today's society and the use that companies can subtract from it. Despite the visible trend, the research carried out showed that a large part of people use computers to experience all the services associated with travel (37%). The tablet, and according to the study developed, is definitely not a choice given the low usage (3.8%). The large majority of people already use smartphones and have more and more knowledge about the usefulness and variety of existing mobile applications. Of the chosen population, 92.9% use smartphones.

According to this study, and with regard to the type of apps used, airline apps are the more popular (37.5% of participants). Those who travel less frequently use airline apps less often. Increasing the frequency of travel also increases the use of airline apps. The survey results show that flight check, check-in and flight booking are the services most requested by consumers with 24.7%, 24,5% and 21.6% respectively. When assessing preferences regarding its function versus its ability to attract customers, TAP's application, collects 33% of the preferences, while Easyjet and Ryanair have the preference of respondents at 18.8% and 21.7%, respectively.

None.

Authors declare that there is no conflict of interest regarding the publication of this paper.

Questionnaire

Q1. Gender

Q2. Age bracket

Q3. Ocuppation

Q4. Is your phone a Smartphone ?

Q5. What travel apps do you have on your phone ?

Q6. When you want to make a reservation, which device do you use ?

Q7. Which brand do you trust most ?

Q8. How often do you travel ?

Q9. Do you find the TAP mobile application attractive and useful ?

Q10. Do you find the Easyjet mobile application attractive and useful ?

Q11. Do you find the Ryanair mobile application attractive and useful ?

Q12. The effective operation of a mobile phone application would improve my "relationship" with the airline

Q13. The appearance of the mobile application, when attractive, enhances my experience with the airline.

(1 - Improves very little, 5 - Improves a lot).

1 2 3 4 5

Q14. What services do you need when using a smartphone app?

©2022 Barqueira, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.