Journal of

eISSN: 2574-8114

Review Article Volume 8 Issue 5

1PhD Scholar, Amity University, India

2HOD, Amity School of Fashion Design & Technology, India

Correspondence: Indrila Goswami Varma, PhD Scholar, Amity University, Mumbai, India, Tel +91-9820420152

Received: September 21, 2022 | Published: October 21, 2022

Citation: Varma IG, Chanana B. Sustainable packaging - a roadmap for Indian fashion and apparel industry. J Textile Eng Fashion Technol. 2022;8(5):156-161. DOI: 10.15406/jteft.2022.08.00315

Environmental sustainability has become a key managerial issue for most industries and in particular fashion industry looking into its scandalous reputation for being one of the largest contributors to global pollution. A critical aspect when looking at sustainability in supply chains of fashion is, Packaging. A big part of the waste crisis is the result of packaging, which the fashion industry is using ever more in this age of cheap fashion and online retail across the world. This paper attempts to trace the initiatives taken by Indian apparel manufacturers and retailers in creating sustainable packaging and trace the Life cycle Management of the packaging wastes. The objective of the paper is to create a sustainability road map for the fashion industry in India in terms of packaging by assessing the various global initiatives being taken in closing the loop on recovering material value. The methodology adopted is mainly review of literature and unstructured personal interviews with retail professionals from the field of beauty, FMCG and fashion.

Keywords: packaging, sustainability, lifecycle management, landfills, fashion

Packaging forms an integral part of the fashion industry and is responsible for major environmental impact. Global B2C e-commerce sales are expected to reach $2,251 billion, which means a lot of items being shipped around the world in protective packaging which will then be discarded upon arrival at its final destination. It’s estimated that every 30-40 days the average person discards their body weight in packaging. These boxes, bags, and wrappers total 30% of our total trash by volume and 50% by weight.1 Much of it is plastic, which is often not recyclable and can take a significant toll on the environment. An estimated 42 percent of all plastics produced are used for packaging.

Generation of plastic packaging in India and its impact

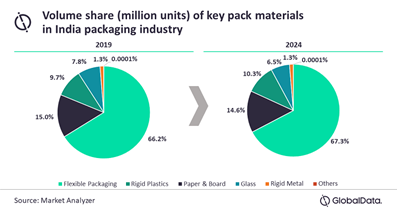

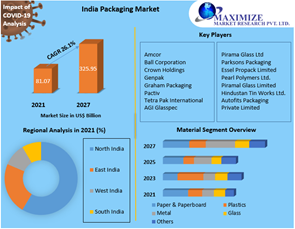

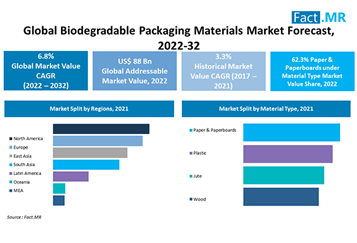

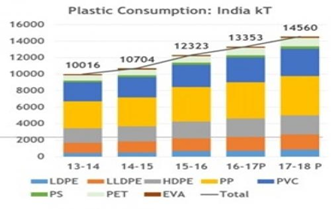

India is the 15th largest plastic polluter globally and generates almost 26,000 tons per day as estimated by the Central Pollution Control Board (CPCB). Of this, approximately 43% of manufactured plastic in the country is used for packaging purposes, most of which is single-use plastic waste. Of the 26,000 tons of plastic waste produced,94% are thermoplastic or recyclable materials such as PET (polyethylene terephthalate), and PVC (polyvinyl chloride) which can be recycled utmost 7-9 times before they can be disposed of. This highlights the lack of efficient waste management systems in India. Since majority of the plastic used is by the packaging industry, finding a substitute is critical as it has been estimated that plastic packaging industry is estimated to grow to 22 million ton a year by 2020 out of which almost 50% is single-use plastic, according to a study by Federation of Indian Chambers of Commerce and Industry (Figure 1) (Figure 2).2

Figure 1 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Figure 2 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

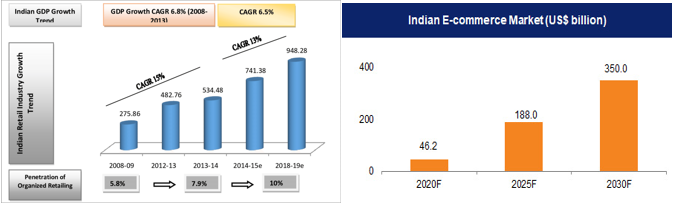

Retail industry and packaging

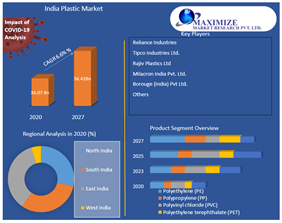

Retail is one of the major contributors to the Indian economy and has been steadily growing year on year. Indian retail has been experiencing a gradual shift towards modern retailing formats attracting multinational companies and thereby resulting in increased demand in spaces such as apparel, F&B, FMCG products, cosmetics etc. This has led to an increased demand for innovative and attractive packaging concepts. The shift is more towards flexible packaging with polymers being majorly used for packaging (Figure 3).

Figure 3 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Importance of packaging in fashion and garment industry

There has always been a requirement of different and attractive packaging in the garment industry. Packaging helps in preparing goods for transport, warehousing, logistics, sale, and end. Due to the emergence of e-commerce, product branding and marketing has gained increased importance and so has personalized and customized packaging. Rise of online brand influencers and "unboxing" videos on youtube and Instagram have made first impressions important for the fashion business. By using eco-friendly, compostable or recycled packaging apparel companies can both create a good impression and reduce waste (Figure 4) (Figure 5).1

Figure 4 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Figure 5 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

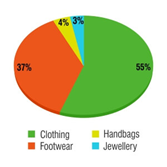

Packaging materials used in the garment industry

There are different types of packaging used in the garment industry depending on the product and its requirements. The basic types of packaging used in apparel and allied products are Bags, Boxes, Cartons, Cases, Crates, Twine, Wrappers, plastic tape, paper, plastic, film, wood, nails, staples, cords, gum tape and metal bands tissue paper, back support, pins or clips, inner collar patty, outer patty, and plastic and wooden hangers. Corrugated boxes like Mono Cartons and Litho Laminated are used as primary packing as well as secondary packing. Window Cartons are majorly used for displaying ties, belts, dresses, scarfs, etc. Some essential packaging functions are protection, storage, loading and transport, promotional function, security, and information transmission. Facts indicate that almost 52% of consumers rebuy products if it is in premier packaging (Figure 6).3

Figure 6 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Solutions for and Innovations in ecofriendly packaging

"With so much effort spent on manufacturing greener goods more sustainably, industry players must not neglect the final links in the chain which include how footwear and apparel are packaged," advises Beth Wright, apparel correspondent at Global Data. The problem extends to both plastic and paper packaging she says (Figure 7).

Figure 7 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Reusing packaging

Fashion brands are encouraging customers to reuse packaging as reusing materials is far superior to recycling. Clothing brand Toad&Co partnered with LimeLoop, a US startup that replaces cardboard boxes and disposable mailers with recycled vinyl packages. Customers can choose this packaging and drop the empty packages in the mail for return and reuse. LimeLoop, claims that for every 100 shippers used, a brand saves 1,300 trees and nearly 2 million gallons of water. Braiform, one of Britain’s largest manufacturers of clothes hangers, has developed a reuse system that saved 1 billion plastic hangers and accessories from landfill in 2017.4

Plastic alternatives

In 2014, Patagonia tried eliminating plastic from its packaging and use paper packaging, but it resulted in 30 percent of the garments getting damaged beyond the point of sale. Maggie Marilyn a designer from New Zealand uses ComPlasts cassava-based compostable bags and courier bags, made from recycled limestone quarry waste. The bags which are made from cornstarch and synthetic polymer represent a 60% reduction in C02 emissions compared to traditional plastic bags. The bags are produced by The Better Packaging Company, which has achieved one of the toughest standard regulations in Australia, the AS5810 for compostability. The Better Packaging Co. works with brands ranging from Maybelline to Billabong to Toms Shoes New Zealand and is growing sales by 15 to 20 percent a month.5 Returnity manufactures customized reusable shipping and delivery packaging out of rPET fabrics for both B2B and B2C businesses. The bags and boxes that can be folded when returned empty, saving on cost and resources. Returnity bags can be used 40 times and once returned can be recycled. Evocative’s Mushroom® Packaging is made using mycelium as a biological binder to bind together organic agricultural byproducts, such as wood chips, to produce durable, bio-based and home compostable packaging. Ecovative is Cradle to Cradle Gold Certified (Davis, 2020).

A RePack envelope (made from recycled material) can be easily returned to RePack for multiple reuses. Customers are encouraged to return by giving discount vouchers at stores that use RePack. Once no longer usable the packaging can be upcycled into backpacks. The duo is a U.K based bio-plastic packaging alternative which is more sustainable alternatives to single-use oil-based plastic. In addition to recycled poly bags they now also offer mailing bags made from plastic from sugarcane (Viivi, 2017).

Apparel Company PVH, which owns brands including Calvin Klein and Tommy Hilfiger, has pledged 100% sustainably and ethically sourced packaging by 2025. 74% of its packaging is now recyclable. By reducing the thickness of its polybags the group company has saved nearly 200 tons of plastic. PVH is the first apparel company to join How2Recycle, a project of the Sustainable Packaging Coalition. It provides clear instructions for customers on how to recycle packaging materials, such as whether to consult a local recycling program or use a store drop-off station at a participating retailer. London-based global luxury retailer, MatchesFashion.com, made three pledges: first, to ensure all packaging is widely recyclable; second, to introduce a half-size box with less material; and third, to incorporate sustainably-sourced materials including FSC-certified card and post-consumer waste. PrAna a premium clothing brand uses recycled paper and soy-based ink for its packaging, tying its garments with strips of raffia palm tree and is 80% polybag-free. Amazon India has pledged to eliminate single-use plastic from its packaging by June 2020 by replacing plastic wraps like air pillows and bubble wraps with paper cushions, a recyclable material. The company also launched Packaging-Free Shipments (PFS) by securing multiple shipments together in a reusable crate or corrugated box, thus minimizing the secondary packaging required for individual shipments. Reformation delivers its e-commerce orders in vegetable bags which are 100% compostable. The packaging is made from 100% recycled paper products and compostable bio-based films, with even the hangers being bio-based. With the average lifespan of a plastic or metal hanger lasting only 3 months, Reformation has opted to use recycled paper hangers to minimize the demand for new materials and reduce landfill waste. E-commerce giant ASOS uses 25% recycled content for the bags. The company has also reduced the thickness of the bags, which is saving approximately 583 tons of plastic annually. The retailer is also working towards having a closed-loop system, recycling consumer packaging into new packaging. Having 10% post-consumer waste integrated into the new bags helps to reduce virgin plastic usage by 160 tons annually. Italian brand Prada has decided to switch to recycled material for its iconic nylon bags, while British label Burberry has launched a collection made out of green yarn.6 British surf brand Finisterre’s new “marine-safe” garment bag can be recycled or dissolved at the end of use has been created in collaboration with Aquapak, which develops and manufactures marine-safe and non-toxic hydrophilic polymer resin pellets. Casual footwear brand Skechers USA has pledged to recycle 94 percent of its shoeboxes and all of its tissue paper, with an 85-per-cent reduction of plastic in its footwear packaging since 2016 (Figure 8).7

'

Figure 8 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Polybags in fashion industry

Across the fashion industry value chain, the carbon impact assigned to packaging and distribution is insignificant, perhaps even less than 5% of the total carbon emissions of a garment lifecycle. Due to the changing consumer sentiment, brands are now focusing on finding solutions and alternatives to polybags. There are five key material choices to look at when considering polybags. These are LDPE (Polyethylene), recycled LDPE, bio-based LDPE, compostable plastic blends, paper and polyvinyl alcohol (PVA). Each of these materials comes with specific trade-offs and their unique qualities. The environmental impact of these materials differs, with recycled and bio-based LDPE being the lowest in greenhouse gas emissions, whilst materials such as PVA and paper fare less well. Compostable plastics are more difficult to assess due to the blends of bio-based and petroleum-based plastics used – but are generally quite good – more so if they have a high bio-based content. In the fashion industry, there are a few different sources of plastics. By far the largest usage is polyethylene terephthalate (PET) as fibers, but there are also buttons, hangars (made from polypropylene – PP, or Polystyrene – PS), as well as packaging, including garment polybags, e-commerce mailing bags, and various filler materials mostly made of polyethylene – PE (Figure 9) (Figure 10).8

Figure 9 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Figure 10 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

What happens currently with the polybag wastes?

The end destinations for all polybags are retail stores, consumers' homes via e-commerce and distribution centers due to e-commerce returns and repacking operations. These poly bags etc are finally sold to waste collection services by the retailers and DCs. Generally, recycling rates from the commercial collection are much higher than from household collection. 41% of packaging is recycled in Europe with the rest being sent to landfill or incinerated. In the USA consumers have the choice to deposit packaging in-store drop-off locations. In Europe, Germany, Netherlands, Finland, Iceland, Italy, Norway, Portugal, Spain and Sweden plastic packaging is collected at the curbside from consumers. These plastic packagings are recycled into trash bags or incorporated into hard products such as plastic lumber.8 With Extended Producer Responsibility’ (EPR) schemes being the norm in most countries, companies only use packaging that is either recyclable or has recycled content. For example, the U.K Government has proposed to tax packaging without at least 30% recycled content. The European Commission has mandated that packaging in the EU market should be either reusable or recyclable by 2030. Germany by its new law on packaging vides Verpack G, promises incentives for recyclable and sustainable packaging. Many US states are pursuing legislation including EPR, single-use plastic bans, and waste reduction targets. Retailers like H&M, Stella McCartney and Bestseller have pledged to make all plastic packages reusable, recyclable or compostable (Figure 11) (Figure 12).8

Figure 11 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Figure 12 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Sustainable packaging – a road map for Indian fashion industry

Sustainability packaging is ensuring that the waste resulting from the packaged products never leave the value chain and also using materials that may cause little to zero environmental harm. According to the Ellen MacArthur Foundation (EMF), just 14% of the plastic packaging used globally makes its way to recycling plants, while 40% ends up in landfills and a third in fragile ecosystems. By 2050, it is estimated there will be more plastic than fish in the world's oceans. Treating plastic packaging as a valuable resource to be managed efficiently and effectively is a key priority in achieving Sustainable Development Goal 12 (Sustainable Consumption & Production). The industry needs to shift away from a "take-make-dispose" model of consumption to a circular model.8 According to the definition given by SPC, sustainable packaging:

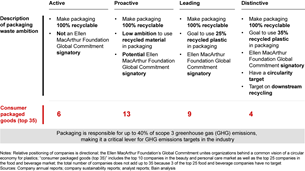

Outcomes of a survey conducted concluded that for the majority of international brands and retailer’s, recyclability and waste management aspect of packaging was a top priority under sustainable packaging. Reduction in the amount of plastic was the second most priority. The reduction of carbon emissions was not of concern to the majority of brands and retailers. Ecological health and water usage were identified as the least important factors, with a clear majority indicating waste usage as a factor that was the least important.8 Based on the findings, the following was suggested for reducing the impact of polybags: A) reduction of material usage, B) creating a closed-loop system (by collecting and recycling or composting), and C) decoupling from fossil resources.8

Evaluation of the various material option indicated that reducing the size (dimensions or thickness) of the polybags was identified as one of the most pursued initiatives by brands and retailers. Brands in Europe incorporated recycled content more often than brands in North America which indicated the advanced recycling infrastructure availability in the U.K. Elimination of polybags although considered a viable option was not pursued by retailers and brands as it was highly dependent on the supply chain of the brand. Collecting polybags for recycling was also implemented by the majority of Retailers. Master polybags as an option were mainly popular with Value’ retailers. Price played an important factor in the choice of polybag material, and bio-based drop-in plastics, compostable plastics and paper alternatives all seemed to be more expensive which was the main deterrent for implementation of these options (Figure 13) (Figure 14).8

Figure 13 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Figure 14 N=57; Epidemiological distribution of the pathological fractures, traumatic fractures, and nonunion.

Sustainable packaging initiatives by Indian retailers

In India, the sustainable packaging sector is growing at a fast pace of about 25 percent per year compared to the overall packaging industry which is growing at about 20 percent annually, according to a study on Domestic Green Packaging Industry prepared by The Associated Chambers of Commerce and Industry of India (ASSOCHAM).

"Many of our clients are looking at green or 'greener' packaging for three reasons. Firstly, as a part of their CSR, secondly, for cost reduction through re-engineering and reduced use of plastics and to appeal to a customer base that is increasingly becoming green conscious. There are a lot of developments in Western countries concerning eco-friendly packaging, which is slowly catching on in India as well,” says Vimal Kedia, Managing Director, Manjushree Technopack Ltd.

However green packaging is a niche area in India and currently being adopted by FMCG companies mainly. It’s an expensive proposition but as more players join the bandwagon, the economies of scale will drastically reduce prices it is predicted.7 Currently, 16 retail fashion brands have signed the Su.Re (sustainability resolution) project launched by the Textile Ministry, IMG Reliance and Clothing Manufacturers Association of India (CMAI). Brands like Spykar, Westside, Trends, Shoppers Stop, Fbb, House of Anita Dogre and Lifestyle and Max have recently joined the movement to develop sustainable sourcing policy to have a positive impact on the environment. However, sustainability and its impact is still a nascent topic in India not only in fashion retail but in almost all industries.6 The Copenhagen Fashion Week is said will ensure that by 2023, all designers comply with 17 minimum standards of sustainability, which includes “Using at least 50% certified organic, upcycled or recycled textiles in all collections and using only sustainable packaging and zero-waste set designs for shows”. On similar lines initiative has been taken by the textile ministry to launch Project SURE which stands for ‘Sustainable Revolution’. Some of the most prominent signatories to the resolution include Future Group, Shopper’s Stop, Aditya Birla Retail, Arvind Brands, Lifestyle, Max, Raymond, House of Anita Dongre, W, Biba, Westside, 109F, Spykar, Levi’s, Bestsellers, and Trends. These signatories have pledged to use a substantial portion of their total consumption using sustainable raw materials and processes by the year 2025.9 ABFRL with brands such as Louis Philippe, Van Heusen, Allen Solly, and Peter England Pantaloons and The Collectives with international brands under it like Ted Baker, Ralph Lauren, American Eagle, and Simon Carter has declared to use 100% sustainable packaging material and innovative packaging solutions to reduce our carbon footprint. Aditya Birla Fashion and Retail Ltd. (ABFRL) recently launched an open ‘Innovation Challenge’ with Circular Apparel Innovation Factory (CAIF) to initiate a change in packaging and find innovative alternatives to plastics. According to ABFRL chief sustainability officer Naresh Tyagi, the company began a unique sustainability program called ‘ReEarth’ in 2013 that addresses the most significant economic, environmental and social issues faced by humankind today.10 Unstructured interviews with domestic kids wear retailer and an exporter revealed that only initiatives taken by them is replacement of PP polybags to PE polybags or compostable polybags (Figure 15).11–16

A lot is already underway in terms of sustainable packaging in India but it’s mostly happening in the FMCG, F&B and electronic goods space. Fashion Industry in India is still far behind in this regard. Sustainability so far has only percolated to the product and sourcing level. There is no significant movement in terms of sustainability in packaging. It’s mainly the influences from the west and the International brands and companies which are bringing in the concept of sustainable packaging in India. Indian industry, consumer and the government seem yet not ready with initiatives that need to be taken in the value chain to create a closed-loop economy thereby reducing, reusing and recycling packaging waste. Infrastructure needs to be in place and policymakers need to bring in some stringent rules. Other than the ban on single-use plastic which was also unsuccessful, no other mandate has been laid down by the government. Indian retailers and brands can borrow concepts and technology from the developed countries to implement this on a war footing. An interview with the Retailers Association of India (RAI) exposes that no narrative on packaging sustainability has been initiated by them yet, indicating the industry is still at a nascent stage where Sustainable Packaging is concerned. India needs to wake up and soon.

None.

None.

No potential conflict of interest was reported by the authors.

©2022 Varma, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.