MOJ

eISSN: 2577-8374

Review Article Volume 2 Issue 1

Laboratoire des Mat?riaux et Valorisation des Ressources (LMVR), Facult? des Sciences et Techniques de Tanger, Morocco

Correspondence: Mohamed Allouch A, Laboratoire des Mat?riaux et Valorisation des Ressources (LMVR), Facult? des Sciences et Techniques de Tanger, Ancienne Route de l?A?roport, Km 10, Ziaten. BP 416-Tangier, Morocco

Received: December 13, 2017 | Published: January 4, 2018

Citation: Chentouf MA, Allouch MA (2018) Renewable and Alternative Energy Deployment in Morocco and Recent Developments in the National Electricity Sector. Open Acc J Photoen 2(1): 00017. DOI: 10.15406/mojsp.2018.02.00017

The energy sector is undergoing a noticeable transition phase in Morocco during the last two decades. This reform is characterized by high penetration of renewables (42% of renewable electricity generation capacity in 2020, and 52% in 2030), rational legal and institutional reforms, and liberalization of the electricity market. In fact, this orientation is the response to the rising demand for electricity following the accelerated development of industrial activities, the population growth, and the increase in per capita energy consumption. This paper covers relevant developments within the Moroccan electricity sector during the last few years, with an emphasis on renewable and alternative energy deployment in this promising sector. The aim is to highlight the opportunities and the challenges that must be addressed by different stakeholders to achieve the targets of a long-term sustainable development of this growing area. Based on this analysis, key recommendations were suggested in order to allow a smooth transition towards green electricity in Morocco.

Keywords: electricity sector, renewable energy, morocco, liberal electricity market, energy efficiency, carbon market

ETS; emission trading scheme, PMR; partnership for market readiness, ISEGP; integrated solar energy generation project, IWEP; integrated wind energy project, NPAC; national plan of action again climate change, UNFCCC; United Nations framework convention on climate change, NCCC; National Committee for climate change, REUNET; renewable energy university network, MASEN; Moroccan agency for solar energy, CDER; centre for the development of renewable energy, NES; National energy strategy, PPA; power purchase agreements, EEM; energie electrique du Maroc, LPG, liquefied petroleum gas, GHG; greenhouse gases, PERG; programme of global rural electrification, energy security index (ESI), CHP; combined heat and power, LDC; local development corporation, CNESTEN; National centre for nuclear energy sciences and techniques, NPP; nuclear power program, MEMEE; ministry of energy, mines, water and environment, PNDM; National programme for municipal waste, NPAC; National plan of action again climate change

Increasing the share of electricity produced from Renewables is a core element of the Moroccan policy regarding the future transition of the electricity sector towards a low-carbon energy mix.

Currently, Morocco is still highly dependent on conventional energies with a recent import rate that exceeds 95%.1 This critical situation is endangering the state budget balances, and presenting a major environmental burden mainly in the form of GHG (Greenhouse Gases) emissions to which the energy sector (electricity and heating) is contributing the most due to major reliance on fossil fuels (mainly petroleum, Natural Gas and Coal) (Figure 1 & 2).

Between 2000 and 2010, electricity consumption in Morocco has risen from 1080 ktoe to 2040 ktoe, while LPG (Liquefied Petroleum Gas) consumption has shown a steady increase due to major use of LPG for domestic applications (about 56% of total LPG consumption).2 Consequently, those challenges are leading stakeholders in the western kingdom to continuously strive for alternative solutions by introducing renewable energies as an important pillar for a long-term sustainable development of this field. 3

In fact, Morocco can take advantages of renewables by exploiting the favorable conditions of Solar potential (an average direct solar radiation (DNI) of 2600 kwh/m²/year4) and Wind potential (estimated at 25,000 MW,4), and also by encouraging the growing expansion in the areas of hydropower, bio-energy and geothermal energy. In addition, the transfer of technological expertise backed with training and education, the creation of new jobs, and the extension of electricity inter-connections between Morocco and Europe can all lead to the emergence of additional opportunities on a global scale.

Recently, the Moroccan government has defined some ambitious targets for the share of renewables in the national energy mix in 2020 and 2030. Others targets for energy efficiency and CO2 emissions were also introduced in this scope with the hope of placing the country as a leading nation in terms of clean-energy use and environmental preservation. However, the achievement of these targets has to take into account many challenges on technical, economic, environmental and social scales.

Kousksou et al.5 reviewed the potential of renewable energy in Morocco and the government strategies for energy security and low-carbon growth. The present work elaborates more topics that were discussed by Kousksou et al.5 in details. Furthermore, additional topics are added including: liberalization of electricity market, emergence of carbon market, cutting energy subsidies, additional measures for energy efficiency, and evaluation of nuclear power potential in Morocco. With that, some new launched projects in the field of renewables were added as an update of previous reviews and findings.

The aim of this paper is to present an up-to-date overview of current and future situation of the Moroccan electricity sector, by pointing out the major updates in terms of governmental orientations, institutional reforms, legal frameworks, financial schemes, social awareness, and environmental education. The core of this paper is dedicated to review the potential and opportunities of renewable energies in Morocco in the light of current infrastructures and projected developments. Within this scope, major challenges hindering the development of green energy in Morocco are also defined, and recommendations are introduced to respond to these obstacles.

The layout of this paper is as follows: Section 2 provides a general overview of the present situation of the Moroccan electricity sector. Relevant developments and reforms of this sector are discussed in section 3, followed by a detailed discussion regarding the potential of renewable and alternative energies in section 4. Major challenges are discussed in section 5 and key recommendations are highlighted. Finally, conclusion of this work is provided in section 6.

Morocco is a north-African country (only 14 km from Europe) with an area of 710,850 km2 and a coastline of 3500 km (shared between the Atlantic Ocean and the Mediterranean Sea). Morocco’s population is estimated at 33.8 million (population census of 2014) with a density of 70.92 inhabitants/km2. According to indexmundi, Morocco’s electricity consumption (23.61 billion kWh) ranked 66th out of 271 countries in 2012, while its electricity production is the 71st in the same ranking with around 21.13 billion kWh.

Currently, the country is the largest energy importer in North-Africa, 6 and this orientation was due among other reasons to

However, the oscillating cost of fossil fuels (following mainly geopolitical concerns and depletion of natural resources) is putting a heavy burden on the country’s economic budget, making it always confined to any unpredictable changing patterns in the future. Other factors including security of supply, energy durability, and low-carbon energy are giving the energy sector a geostrategic dimension, and pushing Moroccan stakeholders to pay great attention to its growing issues, taking into account its value as a critical milestone in a sustainable development process. In fact, the energy sector has witnessed a continuous expansion during the last few years, with a particular increase in electricity demand Figure 2.7

As it can be seen in Figure 2, the electricity demand has almost tripled between 1985 and 2015 to reach 0.23 to per capita. The reason behind this growth can be attributed mainly to population growth, betterment of life standards, and accelerated industrialization.

Morocco’s population reached 33.8 million (population census of 2014) compared to 29.8 million (population census of 2004) with a population growth rate of 1.25%. Life expectancy at birth (in years) has also increased from 70.039 in 2004 to 74.016 in 2014 according to the World Bank. Additionally, a forecast by Trading Economics8 expected that Morocco’s GDP per capita will continue to increase from 3237.83 USD in 2015 to around 3550.05 USD in 2020.8

This continuous increase in population growth and life standards is a main driving force of additional energy needs in Morocco. Figure 39 showed a steady increase of electricity demand during the last few years (the demand was multiplied by 2 from 2002 to 2012) with a growth rate of 7.2%.

This steady increase has resulted from the growing electrification rate of Moroccan rural areas under the umbrella of the so-called PERG programme (programme of global rural electrification) launched in 1995. This national program (global investment budget of MAD 22.4 bn) allowed the increase of electrification rate from 18% to more than 99% in 20 years Figure 4,9 and linking about 35,600 villages to the national grid and installing solar home PV (photovoltaic) systems in more than 60,000 households,10 with a total connected population of 12 million (around 37% of the Moroccan population).9

The extension of both the national grid and the inter-connections, between Morocco - Algeria (two 225kV lines and two 400 kV lines, total exchange capacity of 2400 MW 9) and Morocco - Europe (two 400 kV lines, total exchange capacity of 1400 MW 9), has also played a major role in providing more electricity access to new consumers. This topic will be discussed later in the section on relevant developments and reforms of the Moroccan electricity market.

Simultaneously, industrial growth has contributed remarkably to increasing energy and electricity demand in the country. In fact, the decent environment for investment opportunities in Morocco has attracted a growing number of investments in different industrial sectors. Moreover, the IAP (Industrial Acceleration Plan) for the 2014-2020 periods will contribute to the creation of 500.000 jobs and the increase of industrial share in Moroccan GDP from 14% to 23%.10

In 2010, the manufacturing industry contributed to 10% of national GDP and 48% of industrial GDP. However, its energy consumption increased by 72% between1998 and 2010.2 A report on energy efficiency index in Morocco2 has highlighted major industries with intensive energy consumption in the country, and ranked them into 6 sectors.

Figure 52 showed that the cement industry is the biggest energy consumer so far with about 44% in 2010, due to high energetic needs of cement manufacturing processes and also the increasing demand for this commodity, following the launching of national infrastructure projects in recent years (new ports and airports, new industrial zones, building of 15 dams, high-speed train project…etc).

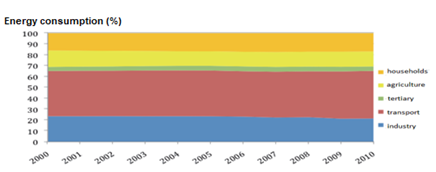

Accordingly, the energy consumption in other sectors (transport, agriculture and housing) has increased clearly between 2000 and 2010 Figure 6.2 Transport occupies about 44% of the total energy consumption due to major reliance on oil products and absence of energy efficiency measures during that period. Industrial activities are ranked secondly with 21% of total energy consumption, followed by households and agriculture consuming respectively 15% and 14%. To this end, the electricity demand of the country is expected to double by 2020 (Reaching 52 TWh compared to TWh in 2008) and quadruple by 2030 (Reaching 95 TWh).11

Figure 6 Energy consumption in different economic sectors in Morocco between 2000 and 2010 (Source: AMEE).

On the other hand, the annual report of the national agency for electricity and water (ONEE) has provided some key numbers regarding the Moroccan Electricity Market in 2015. While the total electricity demand reached 34,413 GWh, only 29,914 GWh was ensured through national production and the remaining share was imported from abroad (mainly from Spain). Additionally, the report showed that Morocco is still dependent on fossil fuels for meeting its energetic needs Figure 7,12 with a limited contribution of renewable energies to the total national production of electricity (only 13.4%). However, the operation of new wind farms and solar parks in the near future will contribute to increase their share with the aim of meeting governmental targets of 2020 and 2030. Moreover, the expansion in installed capacity of renewable energies will most likely reduce the amount of imported energy for balancing supply and demand sides.

This critical situation is behind the heated debate on energy in Morocco, and the role of renewables in answering the growing electricity demand in the near future, taking into account the particular conditions of the country on technical, economic, social and environmental levels. It is important here to consider the questions: what are the potentials, opportunities and challenges of renewables deployment in Morocco? and what are the key recommendations for allowing a smooth transition towards clean energy in Morocco in the upcoming few years?

During the last two decades, the electricity sector has experienced major reforms including: the liberalization of Moroccan electricity market, the extension of power grids and regional exchange, the emergence of the national energy strategy, the legal and institutional reforms, and the creation of a carbon market. This section provides an overview of these reforms and their expected results on the whole electricity sector in Morocco.

Liberalization of moroccan electricity market

Since 1924, electricity production, transport and distribution was monopolized in Morocco by the French company Energie Electrique du Maroc (EEM) and more than 90% of the national electricity production was provided by EEM.13 However, in 1963, the national agency for electricity (ONE) was created, by the Dahir 1-63-226 of 5 August 1963, in order to manage the Moroccan electricity sector.14 ONE was given the right to monopolize the production and distribution of electricity in Morocco, and electricity production from a capacity over 10 MW must be provided only by ONE.13 Since 1994, right before launching the PERG project, a new law allowed IPPs (Independent Power Producers) to produce electricity from a capacity over 10 MW for their own use and the surplus is to be sold exclusively to ONE (the single buyer) on an agreed price (not fixed by legal texts).15 This was the first step in reforming the Moroccan electricity sector and ending the monopolization of ONE.16 The growing increase of electricity demand resulting from the PERG project in 1995, and the adverse effects of drought periods (1983 - 1985 and 1992 - 1993) have contributed to:

Consequently, another law in 2008 enabled IPPs to produce electricity from a capacity up to 50 MW on the condition that all excess power has to be sold to ONE through Power Purchase Agreements (PPA).17 The aim was to improve electricity supply in Morocco, and diversify the local energy mix. This resulted in decreasing electricity produced by ONE from 82.7% in 200013 to 59% in 2012.9 Delegated management of the electricity sector was introduced in the Law No 54-05 of 200618 and ONE was replaced in 2011 by the creation of ONEE. A draft law on Public-Private Partnerships (PPPs) was published in 2012 in order to maximize investments in the Moroccan electricity sector by developing contractual and public-private mechanisms to reinforce the infrastructure and introduce new technologies to the sector.18

Extension of national power grid and regional exchange

As a result of the PERG project and the increasing electricity production from ONEE new plants and IPPs’ utilities, ONEE raised considerably the length of the national power grid between 2000 and 2012 to reach 22,062 km (for transporting electricity) including 1461 km of extra high voltage EHV lines (400 kV), 8696 of high voltage HV lines (225 kV) and 11,905 of medium voltage MV lines (60 kV).9 In 2015, the length of this grid reached 24,508 km with a total 506 transformers (of which 143 EHV/HV transformers, 5 EHV/MV transformers and 358 HV/MV transformers) and an installed capacity of 26,072 MVA (Megavolt-ampere).19

Currently, ONEE is working on extending national power grids for the 2015 - 2020 periods. Another 3040 km of EHV lines will be added by 2020 to link some renewable energy plants including solar parks of Noor Midelt and Noor Tata, and the wind farm of Tiskrad. Also the coal-fired power plant in Safi (2x693 MW) will be linked to EHV lines. While HV and MV lines will increase by 1290 km and 1150 km respectively, and they will link other new plants and territories in Morocco.20

Additionally, the country has a medium-voltage distribution line of 83,933 km and a low-voltage distribution line of 199,314 km. Moreover, the recent law No 48-15 (May 2016) on regulating the electricity sector, has given birth to the creation of the national authority for electricity regulation ANRE. The missions of this authority include regulating the electricity sector, ensuring the proper functioning of this market, and enabling producers’ access to national power grids.21 On a regional scale, Morocco extended its power grids with neighboring countries (Algeria and Spain) in order to enhance electricity exchange and improve its preparedness for energy balancing.

In 1997, the first inter-connection (400 kV) with Spain was built, and the second one (400 kV) was added in 2006, enabling operation at a full capacity of 1400 MW. The Moroccan-Algerian inter-connection (225 kV) dated back to early 1988 (right before the establishment of the Maghreb Electricity Committee (COMELEC) in 1989 with Algeria, Tunisia, Libya and Mauritania), followed by a second line (225 kV) in 1992, and a third line (2 x 400 kV) in 2009. The possible exchange capacity between both countries reached 2400 MW.9

The increasing demand of electricity led the country to import more electricity mainly from Spain (2780 GWh in 2002 and 4895 GWh in 2012)9 to balance supply and demand sides. While, electricity exchange with Algeria is characterized nearly by equilibrium of imported and exported electricity. It is noteworthy to mention that Morocco is hoping to export more energy to Europe in the upcoming years from renewable energy plants, and adding a third line (400 kV) with Spain is under study.

The national energy strategy

In 2008, the national plan of priority actions (PNAP) was launched in order to balance supply and demand side in the mid-term by installing additional capacity for electricity generation and promoting efficient use of energy in different sectors and at different stages. The main result of this plan is the substitution of incandescent lamps by low-consumption lamps (22.7 million lamps by 2012).

Additionally, the National Energy Strategy (NES) was adapted in 2009 in order to define the Moroccan orientation towards the energy sector development in the future. The aim of this ambitious strategy is to:

The NES will be implemented through several measures including energy sector reforms, legal and institutional frameworks, as well as capacity building. The aim is to improve security of supply and enhance energy availability and affordability, while taking into account environmental and safety concerns.23

Highlighting renewables as a priority in this strategy is consistent with the ongoing global changes driven by conventional energy depletion and international increase of fossil fuel prices.24 In fact, the strategy laid its focus upon renewables increased deployment Figure 824 to lower the share of imported energy, to invest local potential of renewables, and to promote clean energies.

According to Figure 824 nearly 42% of total installed capacity for electricity production will be ensured through renewables (solar, wind and hydraulic, 2000 MW for each) in 2020 (compared to 33% in 2009- the year of launching the NES), while fossil fuels will account only for 52% (compared to 67% in 2015- the year of the most updated statistics).

Legal and institutional reforms

In harmony with the NES, rational legal and institutional frameworks have been introduced by the Moroccan government in order to facilitate the achievement of the country’s targets for its energy sector.

Law No 54-05 on delegated management: Promulgated in 2006, this law seeks to promote public-private partnerships PPPs for managing public bodies including electricity. It allows the State or local authorities to delegate the management of a public service to a private entity.25

Law No 16-08 on self-generation: Introduced in 2008, this law allowed some major industrial facilities to generate their power by their owned plants to an equivalent power output of 50 MW.25

Law No 13-09 on renewable energies: Promulgated in 2010, the aim of this law is to deregulate the renewable energy sector in Morocco25 by providing a framework for private producers to produce and export green electricity.26 Depending on the capacity of IPPs, this law sets the subjugation of IPPs to a prior notification for generating capacity ranging between 20 kW and 2 MW, and a prior authorization for a capacity equal to or higher than 2 MW.4

Law No 57-09 on the creation of MASEN: This law gives birth to the Moroccan Agency for Solar Energy MASEN (established in 2010), which will be in charge of the Solar Plan in Morocco. MASEN missions include (1) managing the solar projects of the country (2) building a national expertise in the field of solar energy and (3) playing a major role in developing energy policies on an international scale.27

Law No 16-09 on the creation of AMEE (former ADEREE): In 2010, the existing Centre for the Development of Renewable Energy (CDER) was reorganized and renamed into the National Agency for the Promotion of Renewable Energy and Energy Efficiency (AMEE).18 The tasks of AMEE include, among others, development and conception of national energy management policies in relation with renewable energy and energy efficiency.25

Law No 47-09 on energy efficiency: Enacted in 2011, this law addresses the measures to be taken for increasing the efficiency of energy consumption, reducing energy costs and their financial burden on the national budget, and contributing to a sustainable development.18

In addition to MASEN and AMEE, the Energy Investment Company (SIE) was founded in 2010 as a state body for financing green growth.28 SIE capital accounts for MAD 1 billion endorsed by the state (71%) and the Hassan II Fund for Economic and Social Development (29%).10 The role of SIE comprise:

Another fund called the Energy Development Fund (FDE) was created by His Majesty King Mohammed VI and was endowed with USD 1 billion28 (of which USD 500 m from Saudi Arabia, USD 300m from UAE, and USD 200m from the Hassan II Fund for Economic and Social Development10).

A Research Agency for Solar Energy and Renewable Energies (IRESEN) was established in 2011 for carrying out R&D in the area of solar energy and renewables.30 The missions of IRESEN include:

To accompany the NES on an academic scale, some Moroccan professors and researches took the initiative in 2013 to establish the Renewable Energy University Network (REUNET) that ails to develop and support training, research and innovation in the field of renewable energy and energy efficiency.32

Finally, in early 2016, the first centre for integrated research and training on solar energy in Africa (Green Energy Park GEP) was opened in the green city Mohammed VI - Ben Géurir, Morocco.33 This centre required an investment budget of MAD 220m, and it is equipped with several PV and CSP platforms for testing their performances in conjunction with Moroccan and foreign industries in the field. Moreover, GEP provides many research facilities for academics and students to eliminate traditional boundaries between theoretical and practical studies, and build a qualified local expertise in the field of solar energy.

Climate change and carbon market

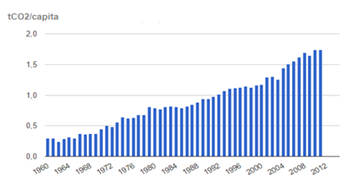

Although CO2 emissions per capita in Morocco are relatively low Figure 9,34 their value will continue to increase in the upcoming years (by 2.59% per annum35) hindering the development of vital economic activities (agriculture, forestry, fisheries…etc) and pushing stakeholders to take urgent responsible measures in order to alleviate the impacts of climate change on these sectors.

Figure 9 Evolution of Morocco CO2 emissions per capita from 1960 to 2012 (Source: The global economy).

After hosting the Conference of the Parties COP7 in 2001 in Marrakech, a National Committee for Climate Change (NCCC) was founded in Morocco in order to draft national communications regarding the Moroccan policy towards climate change to the UNFCCC (the United Nations Framework Convention on Climate Change).36 The third national communication submitted by NCCC in 2015 includes 49 measures for mitigating GHG emissions to reach an average mitigation potential of 81.9 million tCO2 by 2040.35,36

Within this scope, the energy sector accounted for more than half of all GHG emissions25 since almost 60 MtCO2 emissions come from this sector out of a total 50 MtCO2 in 201230 and the Moroccan National Plan of Action again Climate Change (NPAC) presented in 2009 at COP15 in Copenhagen, highlighted the importance of renewable energy deployment and energy efficiency measures for reducing GHG emissions emitted from electricity generation.34

Both the Integrated Solar Energy Generation Project (ISEGP) and the Integrated Wind Energy Project (IWEP) will contribute to an annual emission saving of 3.7 million tCO2 and 5.6 million tCO2 respectively.30 Moreover, in 2009 only two clean fuels were allowed for marketing in Morocco: unleaded gasoline and diesel 50 ppm sulfur. This policy resulted in reducing sulfur and lead emissions by an annual rate of 55,000 and 760 tons respectively.

Accordingly, subsidies of gasoline and fuel oil were cut in 2014 in order to minimize the economic and environmental burden of these conventional energies. Consequently, the national deficit declined from 5.1% in 2013 to 4.5% in 2015. In addition, the ending of fossil fuel subsidies resulted in a global saving of MAD 15 bn in 20015.14 On the other hand, Morocco received in 2012 USD 350,000 under the World Bank Partnership for Market Readiness (PMR) in order to launch its pilot carbon market. This will allow the country to establish its domestic Emission Trading Scheme (ETS) and issuing carbon credits based on NAMAs (Nationally Appropriate Mitigation Actions).34 It is expected that the Moroccan domestic carbon market will start operating in 2018, and be linked with international carbon markets by 2020.

The country identified the target of cutting 13% of its GHG emissions by 2030, but this value could rise to 32% if Morocco receives financial support of up to USD 35 bn. The main areas for developing NAMAs include electricity generation, cement production and the phosphate extraction.37

According to feasibility study of GIZ (Deutsche Gesellschaft für International Zusammenarbeit) for promoting renewable energy resources and energy efficiency for sustainable development of Morocco, the country could potentially ensure its electricity needs 1500 times through renewable resources.6 Moreover, renewable energy attractiveness index of Morocco was ranked 14th worldwide by Ernst & Young in May 2016. This section discussed the potential of renewable and alternative energy and their opportunities on different scales. Moreover, energy efficiency measures and targets are introduced within this scope to illustrate the country’s devotion for taking the lead in the area of clean energy.

Wind energy

The choice of wind energy offers huge benefits for the country since this type of energy is regarded as being abundant, climate-friendly, easy to operate and cost-efficient.38 Moreover, the wind potential in Morocco is highly appreciated due to the ideal geographical position of the country (3500 km of coast).38 In fact, the Average Wind Speed (AWS) in some south cities like Tarfaya and Dakhla ranged from 7.5 to 9.5 m/s at 40m, while this AWS in some northern cities such as Tangier and Tétouan are between of 9.5-11 m/s at 40 m.9 According to past studies on wind potential in Morocco, the technical wind potential in the country was estimated at 4896 TWh/year (1632 GW), while the total wind potential is equal to 7936 TWh/year (2645 GW). Additionally, the exploitable wind potential was evaluated at 25,000 MW.4

Based on these parameters, the “Moroccan Integrated Programme of Wind Energy” was launched with a global budget of MAD 31.5 bn. This plan is expected to increase the cumulated installed capacity of wind energy to 14% by 2020, which corresponds to 2000 MW (compared to only 280 MW in 2010) of installed capacity.39 The fulfillment of this plan will contribute to:

In 2014, Morocco ranked first in the MENA region in terms of total wind installed capacity (787 MW) after a new wind farm in Tarfaya was opened. This farm has 131 turbines and a maximum capacity of 300 MW (Africa’s largest capacity wind farm) and it is able to provide electricity to 800,000 households.41For the 2015 - 2020 periods, five new sites Figure 1042 were chosen for their favorable conditions to install a wind capacity of 1000 MW: Tangier 2 (150 MW), Koudia Baida in Tétouan (300MW), Taza (150MW), Tiskrad in Laayoune (300MW) and Boujdour (100 MW).

A study by Kousksou et al.43 revealed that among renewable energy alternatives (namely wind, solar, hydropower, biomass and geothermal), wind energy is the most suitable power generation alternative for Morocco under the current circumstances. This assessment was made based on the following criteria:

The study ranked renewable energy alternatives as follows: 1st wind, 2nd biomass, 3rd solar and hydropower, and 4th geothermal. Moreover, R de Arce et al.44 showed in another study on the economic impact of renewable energy development in Morocco that most benefits in terms of impact on GDP and employment creation can be taken from the installation of windmills. The study demonstrated that expanding the capacity of wind farms by 20% can increase the GPD by 1.92% and creates 421,355 jobs by 2040, while the same increase in CSP (Concentrated Solar Power) plants and PV plants will increase the GDP by 1.30% and 1.27 respectively, and only 292,891 and 286,153 jobs could be created by these technologies up to 2040.

Solar energy

Morocco offers favorable conditions for implementing ambitious projects in the area of solar energy. In fact, past studies on solar potential in Morocco highlighted the abundance of solar resources in several sites Figure 11.43 With more than 3000 hours of sunshine per year and 5 kWh/m2/year in terms of energy received, the country stands as an ideal spot for developing solar energy projects.40 Moreover, the DNI is estimated with an average of 2300 kWh/ m2/year, which is 30% higher than the best sites in Europe.39

According to a study conducted jointly by AMEE and GIZ, the technical potential of solar energy in Morocco is estimated at 10,829 MW (an energy production of about 13,000 TWh/year) and the achievable potential corresponds to 2018 MW by 2020 (an energy production of about 3.3 GWh/year).40

For 2020, Morocco introduced its solar plan which aims to develop a total cumulated capacity of 2000 MW. This plan (with an investment budget of USD 9 bn) will contribute to:

For its implementation, five locations were chosen with the following DNI (indentified based on satellite and calculated data):

This solar plan is based on two major technological variants: CSP and PV technologies. CSP technologies use mirrors to concentrate solar radiation in order to heat water or another fluid, and this heat is used to generate electricity, while PV systems convert light directly into electricity through photovoltaic cells.26

The CSP plant of Ain Beni Mathar is already operating and supplying electricity to the grid. This plant uses a cutting-edge design, combining a large array of 224 parabolic mirror collectors concentrating solar energy and boosting the steam output needed to produce electricity in this 470MW facility.39 In February 2016, the first phase of Ouarzazate Solar Power Station (OSPS) Noor 1 was linked to the national power grid. Noor 1 accounts of an initial capacity of 160 MW out of total planned capacity of 500 MW. By its completion, OSPS will be the world’s largest CSP plant and would ensure energetic needs of over one million households by 2018.45

Simultaneously, through the PROMASOL programme (Programme of the Moroccan Market for Solar Water Heaters (SWHs)) more than 440,000 m2 of thermal solar sensors were installed in 2012 and it is expected to achieve 1.7 million m2 by 2020. PROMASAL (launched originally under the PERG programme) will contribute to an annual energy production of 1190 GWh by 2020 and avoid the emission of 920,000 tCO2 per annum.

In 2008, the Mediterranean Solar Plan (MSP) was launched to strengthen Euro-Mediterranean cooperation in the field of solar energy. This plan defined the target of achieving 20 GW of new renewable energy production capacities and ensuring significant energy savings in the region by 2020. Within this plan, the Moroccan solar plan is viewed as a key project in developing the MSP.26

Another initiative called Desertec was launched by the Desertec Foundation and private-sector companies from North Africa and Europe in order to reinforce the development of solar and wind projects in MENA that could supply Europe with green energy (15% of Europe’s energy needs). Support mechanisms include investment and financing guidance, studies and pilot projects. The ultimate goal of Desertec is to install 125 GW of renewable electricity capacity by 2050 with a global budget of EUR 400 bn.26 Finally, in 2010, the MedGrid Initiative was launched with the aim of creating a trans-Mediterranean super-grid of high-voltage direct current (HDVC) cable, able to export 5 GW of energy from MENA to Europe by 2020. Within this scope, the existing Morocco-Spain submarine cable was considered as one of three possible corridors for achieving this plan.

Hydroelectric power

Morocco has been using hydroelectric power as a major renewable resource for several decades and the first hydropower stations were opened in 1929 (S.S. Maachou (20.9 MW), Taza Rass El Oued (0.64) and Sefrou (0.26 MW)). The potential of hydroelectric power is estimated at 3800 MW and the choice of hydroelectric power was for ensuring a large share of national electricity needs was due to the policy of dams back in the 1960s. Although the frequent drought periods have limited the share of hydroelectric power in national electricity generation, some recent installed hydropower stations (Wastewater Treatment Plant (WWTP) of Afourer (464 MW) and Tanafnit-El Borj (40 MW)) have contributed to increase electricity generation by 940 GWh and a total 1360 GWh were produced from hydro power in 26 hydro power stations in 2014.17

Consequently, the NES has introduced a development plan for hydro power in Morocco to reach 14% of total installed capacity in the country by 2020. The plan laid its focus upon WWTPs and micro-hydro power stations. To this end, three projects with a total capacity of 580 MW were launched (Mdez-El Menzel (170 MW) WWTP of Abdelmoumen (350 MW) and micro-hydro power stations (60 MW)).29

It is noteworthy to highlight the fact that dams or reservoirs (1087 MW) are the main hydroelectric power technology in Morocco followed by pumped storage (472 MW) and run-of-the-river (98 MW) technologies. Finally, in contrast to wind and solar resources, the share of hydro power in total installed capacity will decrease by 7 points between 2015 and 2020 in favor of other renewables Table 1.26

In% |

2009 |

2015 |

2020 |

Coal |

29% |

35% |

27% |

Oil |

27% |

19% |

10% |

Gas |

11% |

8% |

21% |

Hydropower |

29% |

21% |

14% |

Solar |

0% |

5% |

14% |

Wind power |

4% |

12% |

14% |

Table 1 Evolution of installed capacities of different resources

Geothermal energy

In 1968, the Ministry of Energy and Mines launched first studies for assessing the potential of geothermal resources in Morocco. However, these studies were not positively conclusive and the support of R & D activities in this field remains confined under the yearning of academic researchers.46 A study by Zarhloule et al.47 on geothermal potentialities of Morocco highlighted the promising potentialities of geothermal power in north-eastern Morocco. According to this study, one hole near Berkane, revealed an average geothermal gradient of more than 110°C/km at depths greater than 300 m.

Zarhloule pointed out in another study48,49 that the estimated installed capacity of geothermal energy in north-eastern Morocco is around 5 MWe. He noticed that the heat flux is increasing northeastward (80-140 mW/m2) in the eastern Rift, northeastern Morocco, Alboran Sea, southeastern Spain and northwestern Algeria. Zarhloule concluded that this potential high geothermal gradient could play a major role for developing programs aimed at the geothermal exploitation for electricity production. For the time being, geothermal use in Morocco is limited to bathing and swimming and no planned project for exploring this potential was established so far.

Biomass

The potential of biomass in Morocco is estimated at 950 MW (issued mainly from agriculture, forestry and municipal wastes) and a target of ensuring 200 MW by 2020 and 400 MW by 2030 was defined for developing the potential of bioelectricity in Morocco. In fact, forests account for 9 million hectares in Morocco, and about 5 million tons of domestic solid wastes are produced annually (energy potential estimated at 1.65 million MWh/year (AMEE)). The total solid bioenergy potential in Morocco is estimated at 12,568 GWh/year and an additional 13,055 GWh/year can be supplied from biogas and biofuel (ONEE). On the other hand, the major use of biomass in Morocco is limited to heating and cooking particularly in rural areas. For instance, 89% of used wood is consumed in rural households for domestic applications (compared to only 3% in urban households), while the remaining 8% is used in some public baths and bread ovens (ONEE).

Recently, many landfills started to produce biogas in-situ under the National Programme for Municipal Waste (PNDM). In Oujda (1 MW), the annual production of methane is equal to 311,000 m3 and the produced electricity is injected in the national power grid. Moreover, the landfill of Fes (1,128 kW) has ensured 30% of public lighting through biogas. A project for expanding the installed capacity to 5MW is underway and by its achievement, it will contribute to avoiding 1 million tCO2 in 10 years. Finally, an industrial oil manufacture has ensured 60% of its energetic needs through the combustion of olive wastes.

Finally, recent feasibility studies in five regions of the country have been launched in order to evaluate the potential of biomass for energy production. The result of a study conducted in the region of Souss-Massa-Draa estimates the global potential of the region at 2,794,758 MWh/year (190,563 toe/year). Moreover, it was shown that fermentable biomass (urban waste, waste from livestock farming and vegetable crops) could ensure 22% of the electricity needs in the region (AMEE).

To sum up, Table 2 summarizes the planned or in development projects for different renewable energy resources in Morocco. The achievement of these projects will create more than 13,300 direct jobs by 2020, while another 36,800 jobs were created from the area of energy efficiency. According to the Ministry of Energy, Mines, Water and Environment (MEMEE) the total amount of investments in renewables between 2016 and 2030 is estimated at USD 30 bn. This investment will increase the total installed capacity of renewables by another 10.000 MW in 2030.

Energy Type |

Projects |

Installed Capacity |

Solar |

Quarzazate |

500 WM |

Foum Al Ouad |

500 WM |

|

Sabkhat Tah |

500 WM |

|

Ain Beni Mathar |

400 MW |

|

Boujdour |

100 MW |

|

Wind |

Tarfaya |

300 MW |

Tiskrad |

300 MW |

|

Jbel Hdid |

200 MW |

|

Koudia Baida |

200 MW |

|

Taza |

150 MW |

|

Midelt |

150 MW |

|

Jbel Khalladi |

120 MW |

|

Tanger 2 |

100 MW |

|

Boujdour |

100 MW |

|

Hydropower |

WWTP of Abdelmoumen |

350 MW |

Mdez EL Menzel |

170 MW |

|

Other Small Projects |

60 MW |

|

Biomass |

Landfill of Fes |

5 MW |

Table 2 Planned or in-development projects for renewables in Morocco by 2020

Nuclear power

Although current nuclear activities in Morocco are limited to sectors of health, industry, agriculture and education, the country is strongly considering the exploitation of this alternative energy for future applications. In fact, the NES introduced nuclear technology in the energy mix of 2030. In a first step, the nuclear plan will comprise two units of about 1000 MW each. These units will be used for seawater desalination purpose.50

The first nuclear installation in Morocco was opened in 2003 under a partnership between Morocco and USA, and it is located in Maamora at the Center of Nuclear Studies. It covers an area of 25 hectares and employs about 200 people.11 This research center consists of a nuclear reactor with many associated laboratories for nuclear research and training, but also for medical diagnosis. In 2010, the National Committee on Consideration of Nuclear Energy and Desalination (CRED) was created to assess the regulatory frameworks, the institutional requirements, and the human and technical capital for implementing a Nuclear Power Program (NPP) within a long-term period.

To this end, the country has proven many strengths for developing a NPP including political stability, adherence to international commitment treaties and convention, adherence to nuclear safety and nuclear security regime, availability of uranium in phosphate mining (Morocco can produce an average 500 tons of Uranium per annum), and creation of research facilities in the field such as the National Centre for Nuclear Energy Sciences and Techniques (CNESTEN). According to previous feasibility studies, the site of Sidi Boulebra located on the Atlantic coast Figure 1211 was chosen for developing any future project for nuclear power.

This site could receive up to four nuclear units of 1000 MWe each, and it was selected based on the following characteristics:

Energy efficiency

In parallel with its strategy for developing renewable energy resources, Morocco laid a strong focus on the efficient use of these resources with the aim of saving up to 12% of consumed energy by 2020 (compared to 2011), and 25 - 30% in 2030. To achieve these targets, the National Programme for Energy Efficiency was launched in 2011 in order to provide important guidelines for enhancing energy efficiency in five principal sectors: households, industry, agriculture, transport and tertiary (hospitals, hotels, restaurants, schools and other public services). Within this scope, AMEE has finalized a study that comprises more than 122 measures for enhancing energy efficiency in different sectors.

Energy efficiency in households: In 2010, the energy consumption of households accounted for 17% of the total energy consumption in the country.2 Thus, several measures were taken by stakeholders in order to alleviate the energy intensity of this sector. Thermal regulation was adapted for new building in order to reduce heat and air conditioning needs in building by 39-64% for the residential sector, and by 32-72% for businesses.14 According to AMEE, the installation of internal and external thermal insulation of building allowed an annual energy saving of 26%. Furthermore, the installation of insulated glazing can ensure a decrease of 13% in heating and air-conditioning needs. Moreover, generalization of low-consumption lamps under the PNAP program and installing SWHs under the PROMASOL program were among the main measures to reduce the energy consumption of households. To this end, AMEE is conducting several feasibility studies in Morocco to evaluate the potential of energy efficiency technologies and demonstrate the operational aspects of the thermal regulation in buildings.41

Energy efficiency in industry: The energy consumption of industry accounted for 21.5% of the total energy consumption in the country in 2010 2. AMEE identified three important areas for reducing energy consumption in the industrial sectors. First, electricity consumption can be reduced by 15% if some important measures were taken including improving the power factor and the power purchase agreement, installing variable-frequency drive, and replacing standard equipment with high efficiency equipment. Second, a thermal energy saving up to 65% can be ensured if industries strive to

Finally, an energy saving potential of 10% can be guaranteed in the area of steam and compressed air cycles by installing an energy management system and using renewable energy for energy production.41 Another measure obliging industries with high energy consumption to carry out energy audits in order to assess the efficiency of their energy management systems and ensure the optimal use of energy in different areas.

Energy efficiency in agriculture: The agriculture sector (along with fisheries) represented about 14% of the total energy consumption in the country in 2010.2 In fact, this vital sector is considered very energy intensive due to major use of irrigation equipment, tractors and engines, dryers and farm buildings.41 Two programs have been developed within this scope in order to reduce energy consumption: the program for developing solar water pumping and the program for optimizing energy performances in farms. The latter program have been conducted in 10 farms as a demonstration project and resulted in saving 100 tCO2 with an average time of return on investment of 9 months. It is expected that AMEE will generalize this successful experience in other farms following a partnership with Crédit Agricole Maroc for sponsoring this program.

Energy efficiency in transport: The transport sector dominated the energy consumption in Morocco with almost 44% of the total energy consumption in 20102 and about 23% of GHG emissions in the country.41 Noticeable measures were introduced in this sector including scrap page schemes (replacement of old vehicles) for old trucks and taxis, the introduction of compulsory technical inspections every year and eco-driving training for the drivers of heavy vehicles. Other measures are in planning including the introduction of tax incentives to promote low fuel consumption vehicles, the introduction of emission limit standards, the dissemination of energy audits for commercial vehicles, as well as the implementation of information and awareness campaigns.41

Energy efficiency in tertiary: The tertiary sector accounted only of 4% of the total energy consumption in 2010,2 however it is expected that this value will rise in the few upcoming years in the light of the national tourism development plan (adding 200,000 beds by 2020). Moreover, the expansion of public services will contribute to a growing energy demand in this area. Energy efficiency measures in this sector include thermal regulations in building (hotels, hospitals, schools…etc), use of SWHs and establishing eco-cities (Zenata eco-city in the region of Casablanca).

Additional measures are summarized below:

It is obvious that the fulfillment of the mentioned plans will change the electricity sector completely in Morocco during the upcoming years and placing the country as the forefront of clean energy users worldwide. However, many challenges and barriers are still hindering the smooth deployment of these projects and must be addressed holistically by different stakeholders. The aim is to achieve the governmental targets and increase the attractiveness of this potential on a global scale. To this end, major challenges are categorized into five areas: political, technical, economic, social, and environmental barriers. The main obstacles of each category are provided below along with key recommendations to alleviate their impacts on the implementation of the NES.

Political challenges and recommendations

This category encloses institutional and regulatory aspects of the electricity sector in Morocco. Major obstacles include the lack of an integrated approach for alternative energy deployment in the country. Moreover, the Moroccan electricity sector is still highly monopolized by ONEE although to a less extent than before. This situation is not suitable for increasing the share and the competitiveness of alternatives compared to conventional technologies. Finally, the lack of information and data is still hindering the access of different social segments and utilities to this green knowledge, which is urgently required for answering different issues of renewables in Morocco.

To overcome these barriers, an inclusive approach - favoring partnership and cooperation - must be implemented in order to allow different stakeholders to take part in developing national policies for renewable and alternative energy. Furthermore, encouraging domestic and industrial IPPs to integrate the Moroccan electricity sector is capable of increasing the installed capacity (along with electricity generation) of renewables and security of supply (in contrast to monopolistic power generation). Finally, collecting and providing public access to relevant data and information on renewables will most likely accelerate the deployment of renewable and alternative energy in Morocco.

Technical challenges and recommendations

These obstacles relate mainly to the intermittent nature of renewables and security aspects of nuclear energy. This can affect energy security and widen the gap between supply and demand, which led to increasing energy imports. Moreover, the field of renewable and alternative energy is not mature yet in Morocco, and there is an urgent need for technology expertise and qualified personnel on a local scale.

In addition to the importance of developing other renewable technologies (namely biomass and geothermal), a need for a flexible regulating energy is urgently required in order to balance supply and demand, and decrease energy imports. CHP (Combined Heat and Power) stands as a suitable technology for Morocco due to its overall efficiency, which is high compared to separate heat and power generation. Moreover, CHP technologies are relatively cleaner in terms of CO2 emissions. It is noteworthy to mention the importance of increasing the installed capacity of renewables in different regions of Morocco in order to minimize the impact of their intermittency on security of supply. Simultaneously, energy storage stands as an important strategy for reducing the sector failures due to instability of renewables.

Additionally, promoting R & D projects can fill the gap in terms of local human potential in this area. These projects can be conducted through partnerships between Universities and power industries. In addition, technology transfer can play a major role within this scope, and Morocco could potentially benefit from successful experience of some leading nations in this domain.

Economic challenges and recommendations

These barriers are of great importance and they represent the main driving force behind the reluctant investment of capitals in the field of renewables. In fact, despite the advantages of renewables and their great potential in Morocco, the state is still facing complicated issues for attracting local and foreign investments in the area. This situation is due to the intermittent nature of renewables, their high construction and O & M (Operation and Maintenance) costs, their long pan of time concerning return on investment, and the lack of financial aids from the Moroccan government to develop renewable projects.

Morocco can use financial savings from cutting fuel subsidies to support local and foreign IPPs and R&D activities in the field of renewables. In addition, developing local businesses for installing and operating renewable projects can decrease their global costs and thus provide renewable electricity at an affordable price. Finally, different financial schemes must be implemented by the government in order to support the deployment of renewables. This include feed-in tariff for IPPs and taxes for conventional energy.

Social challenges and recommendations

The success of renewable and alternative energy deployment in Morocco relies among other reasons on social awareness and acceptance of these technologies in the energy mix. Unfortunately, the lack of educational programs on renewable and alternative energy is responsible for social lack of appreciation towards renewables and their enormous potential and opportunities. Moreover, the lack of best practices for energy efficiency is highly witnessed among different social layers in Morocco.

Raising the understanding of renewables and their potential can be ensured through strong governmental policies including educational programs, informational campaigns, and engagement of different social segments in the process of sustainable development based on participative democracy.

Environmental challenges and recommendations

Although renewables present the ideal option for Morocco in order to achieve a sustainable development of the electricity sector, they also have some environmental impacts mainly in the area of hydropower and biomass. Moreover, the prospective reliance on nuclear energy can generate adverse effects on the ecosystem if safety measures were not taken.

In fact, hydropower (particularly run-of-the-river technologies) is always linked to a massive disruption of the ecosystem resulting from the construction and the operation of hydropower plants near to some sensitive areas. Additionally, the intensive use of biomass (namely food crops) for generating electricity can lead to major impacts on the Moroccan agriculture and sylviculture sectors. Finally, previous nuclear fatalities in some countries are heating an international debate about nuclear safety and even pushing some countries to phase-out their nuclear plants in the upcoming few years.

Consequently, the environmental aspect of renewable and alternative energy has to be placed at the core of the NES in addition to the national plans for mitigating CO2 emissions.

Major measures to reduce the ecological footprint of renewable plants (mainly hydropower and biomass) include afforestation, micro- and WWTP hydropower palnts, and R & D activities. Furthermore, nuclear safety has to be reinforced through technological progress, regular monitoring, and personnel training.

This work provided an up-to-date dissemination of data regarding the present and future status of renewables in Morocco. The strong interest of stakeholders in exploring the potential of renewables is clearly demonstrated within the large package of projects and programmes during the last few years. However, the achievement of a successful transition of the electricity sector towards renewable and alternative energies has to deal with different challenges that are still obstructing the implementation of the NES. These barriers have political, technical, economic and social dimensions. Accordingly, it was suggested that Morocco can overcome these obstacles by implementing different measures across relevant sectors to facilitate the deployment of renewable and alternative energy in the country.

A balancing approach is the key to tackle the energy issue in the kingdom. In fact, Morocco cannot rely at the moment only on renewable sources since its major renewable potential comes from solar and wind which are not suitable to answer base load demand in contrast to other fuel types such as coal, hydro or nuclear power. Furthermore, the question of energy security must be taken into consideration while deciding on a flexible energy portfolio that ensures the four dimension of security of supply including: availability, acceptability, accessibility and affordability. In fact, the work of Chentouf and Allouch51 shows that Morocco has the lowest Energy Security Index (ESI) among the MedRing countries (-0.038) taking into account factors such as energy intensity, final energy consumption, energy dependency, gross domestic product per capita, carbon intensity and the share of renewable and nuclear energies. Hence, the redesigning of the energy sector in the country can helps the nation to shift this critical situation by lowering its dependency on imported fossil fuels while investing more in its local energy sources and decreasing its carbon intensity at the same time.

To this end, the role of academics is to play a major role in conducting R & D activities in this promising field and ensuring the promotion of a widespread understanding and acceptance of renewables in Morocco.

This research was supported by the National Center of Scientific and Technical Research in Morocco (CNRST) through the scholarship of excellence (Grant No. 22UAE2016).

There is no conflict of interest.

©2018 Chentouf, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.